Along with the new Basel-y rules to be adopted for the banking system, there are other major changes that have remapped at least domestic finance since 2007. A big part of this pertains to the systemic liquidity capacity that I emphasize repeatedly, but in the sense that it is far more and different than just the “capital rules” that most commentary asserts as causation. There is another element to shriveled liquidity that relates most definitely to monetary policy itself, and it is in my estimation a far bigger factor than any Dodd-Frank changes to making wholesale credit inventories more “expensive.”

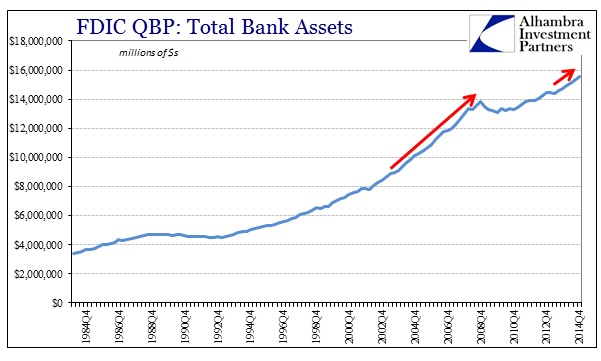

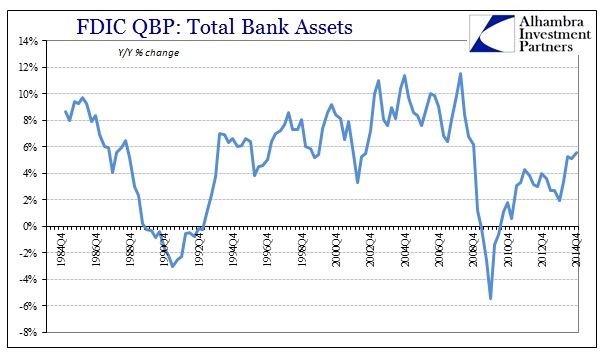

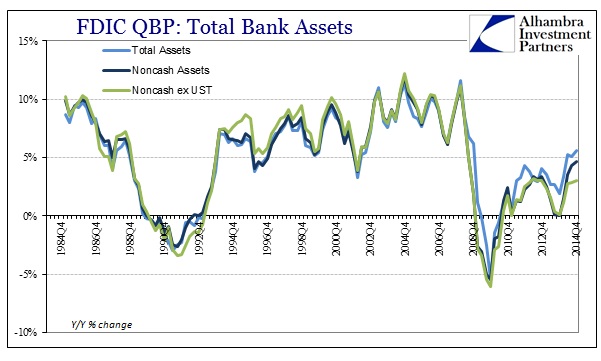

If you start with a view of domestic banking alone, the overall picture is almost like the overall economy. There is a definite upward slope, but one that has been “bent” at the panic. In the past few years, however, the slope starts to attain more resemblance to the prior bubble periods which is undoubtedly the point. Monetary authority and theory asserts, without question, that banking is a necessary component in economic sustenance, so trying to engineer a return to 2005 is part of the policy package. NOTE: all the data presented is taken from the FDIC’s Quarterly Banking Profile, which is made up of call reports from almost 8,000 institutions.

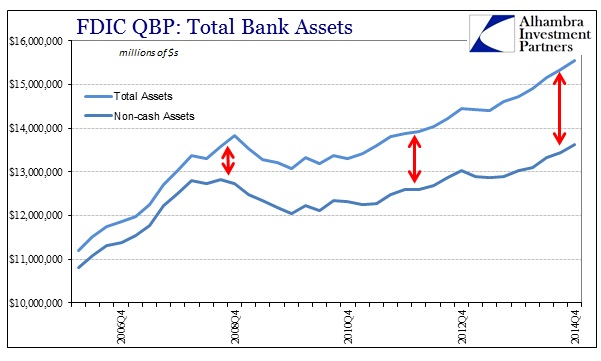

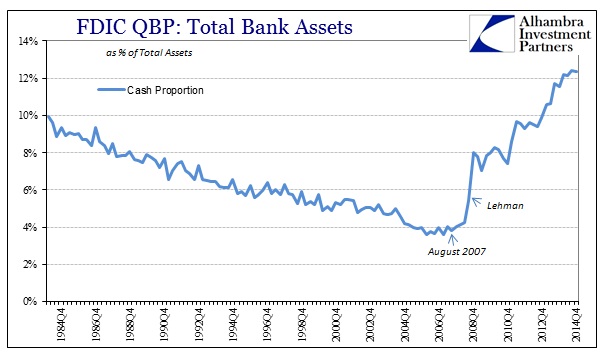

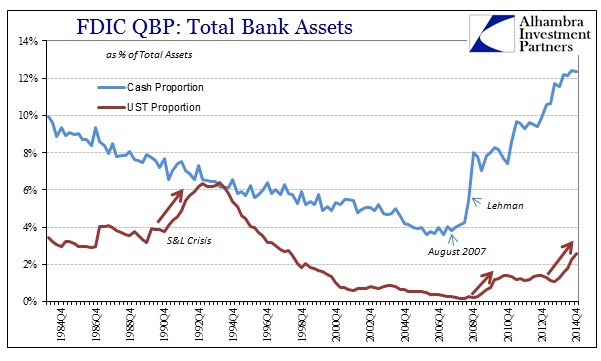

While the total run of assets looks to be more to the FOMC’s liking, there is an incongruity within the aggregate balance sheet that alters the trajectory quite severely. From 2008 onward, US banks have taken to holding an unimaginable amount of “cash.”

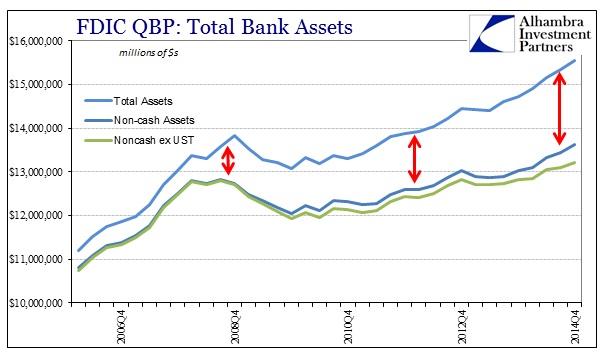

Further, to generate a picture of what Keynes mistakenly called the “liquidity preference”, banks are also buying up UST in equally amazing quantities.

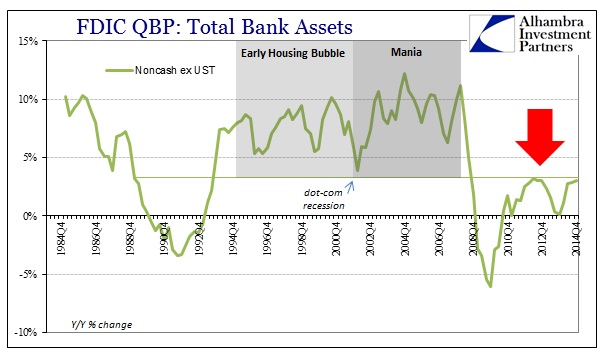

The net effect of these transformations is quite deceiving, as what looks like a banking system heading toward “normalcy” (if credit-driven bubbles could or should be called as such) is actually not.

When stripped of these “liquidity” instruments, the banking profile domestically is not all that different than during the crisis period. Growth in assets has returned, certainly, but at a level that is much, much closer to crisis (still) than bubble.

Is this a demand or supply issue? Judging by interest rates, it would seem to be almost mutual agreement among both demand and supply that a low level of credit growth (from banks; bond markets are another element to the big picture) is most appropriate, and thus not quite in agreement with the idea of an economy closer to being fully mended. We know about the demand side of the equation because there is no mystery as to where all the cash came from.

As if to prove yet again that bank “reserves” are nothing but policy byproducts, the level of cash in the domestic banking system has absolutely no bearing on the level of credit production. The best the FOMC can hope for is some backwards, convoluted psychology that sees banks less worried about wholesale liquidity because primary dealers and the largest banking entities are stuffed with inert and largely useless “cash.” If there were tremendous demand for credit, as should be the case with an economic “boom”, this “cash” would not be so idle.

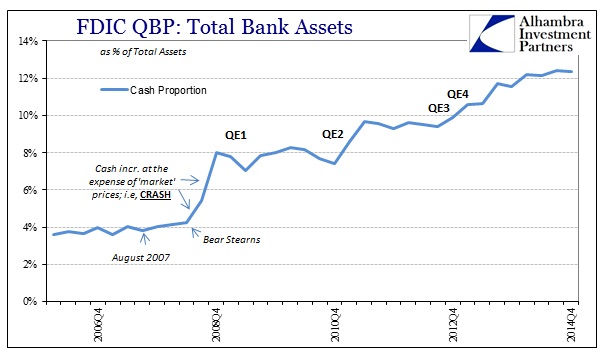

From a policy perspective as it relates to the panic, however, QE1 at least makes some sense as it relates to the basic and primal Federal Reserve mission of “currency elasticity.” The huge rise in cash starting with August 2007 and amplifying after Bear failed was taken directly from asset prices – the dreaded firesales that typically accompany such illiquidity. QE1 was the first attempt (along with other programs aimed, quite belatedly as you can see, at collateral and eurodollars) to address or arrest what would be called a run if it were done via individuals rather than banks. But the increase in cash balances thereafter, particularly starting with QE2, were repeated attempts to cajole banking into helping stir an economic revival via “portfolio effects” and thus inflation expectations. Other than stock prices, nothing much happened except the rising cash balances.

This seems like another very good problem to have, as a world stuffed with “reserves” that are though on par with good liquidity is one in which there is very little assumed danger (a fact disproven by history, but that is ignored under orthodoxy). Yet, for that conventional theory, it does not agree with actual banking conditions. Again, banks have been attached to low-risk profiles and have done very little toward taking on “risk” that monetarists are dead-set in forcing of them.

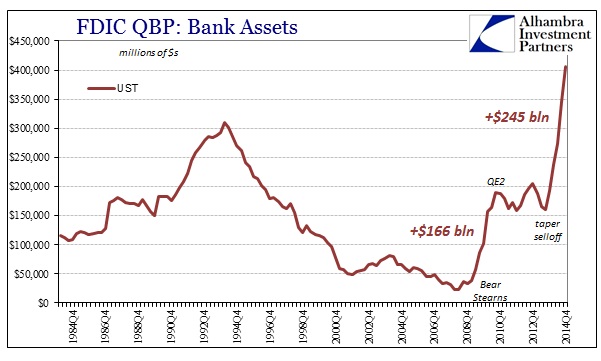

Most recently, banks have been on a UST buying spree the size of which we have not seen since the darkest days of panic. Rather than suggest normalizing behavior, domestic banks are acting quite pessimistically (in opposition to what they say externally about “markets” and the economy).

The timing of all of this only adds to the confirmation of behavior, as the domestic banking system has added $245 billion in UST assets since the dramatic taper selloff of mid-2013. Since the start of the buying in the quarterly data dates to the beginning of Q4 2013, that makes a lot sense given what we know we don’t know about November 20, 2013. That this buying trend is now far greater than even that which came directly after Bear Stearns failed suggests again liquidity concerns on the part of domestic banks wholly in conflict with the idea of healing – banks are battening the hatches.

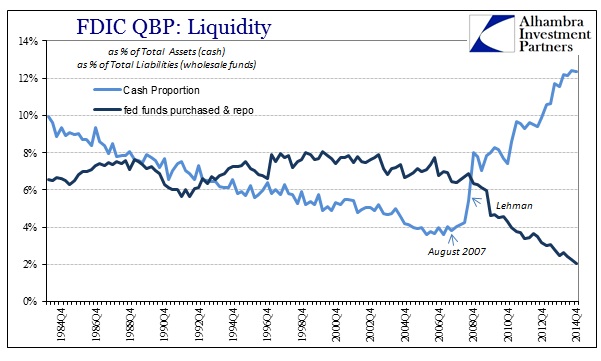

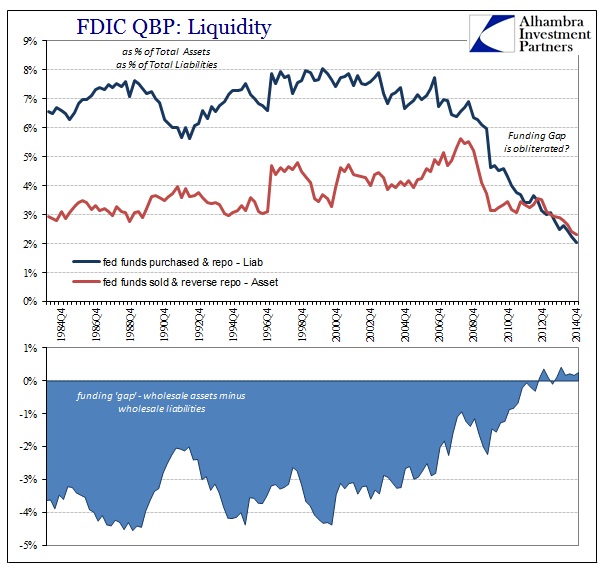

While the wholesale system certainly shares much of the blame for what happened seven years ago, it does provide “necessary” (for as long as the wholesale system predominates, and that has not changed post-crisis at all) liquidity for maintaining order; relatively speaking given recent history. However, there is a definite inverse relationship between banks’ uses of wholesale finance and QE-driven levels of cash.

Prior to August 2007, the domestic banking system (concentrated mostly in the largest 20 or so banks) was deriving about 7% of total liabilities from federal funds and repos. That is an enormous proportion dedicated to a means which is ultra-short term and, as it turned out, not as robust as thought. As of the last QPB, that proportion is down to just 2%. From the perspective of QE, there is an obvious and inverse relationship between bank “cash” and wholesale liabilities. And it is not difficult to figure out why, as the biggest banks with enormous “piles” of useless “reserves” don’t need “market” cash for their liability structure.

In other words, QE has acted as I have suggested for years, namely that the Fed is not enacting currency elasticity, or its “lender of last resort” status, but rather acting as the “market of last resort” to which all prices are provided a “floor” – allowing a return to more “market”-driven wholesale finance might endanger asset price levels, and thus blow the whole and still artificial system apart once more. While that may seem to be another wonderful byproduct of so much monetarism, it is, in fact, a withering of robustness in wholesale finance.

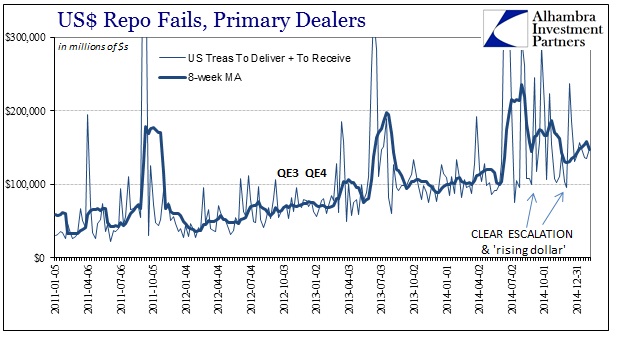

Like a muscle that goes unused, the domestic side of the wholesale system has clearly atrophied. That includes not just the “demand” for federal funds and repo, but clearly the supply as well. With a smaller and less robust domestic liquidity system at work, you can start to appreciate very well why banks post-November 20, 2013, might want to seriously change and improve their liquidity profiles – the wholesale system is no longer reliable for even the slightest stress.

That would seem to be the experience of 2014, especially starting mid-June onward. The effects of QE have been to “crowd out” actual market sources of liquidity, which only further complicates the issue of “flow” since QE’s exertion of indolent bank “reserves” does not lead to robust circulation. The Fed and orthodox economists decry and detest hoarding especially of money, but QE is the largest proponent of hoarding ever conceived – so much so that it has led directly to the severe decay of domestic liquidity, and the “harmful” (from the Fed’s perspective of trying to engineer another massive bubble) downstream impacts upon bank preferences.

It should be noted that this only describes the domestic side of the banking “dollar” system, as what takes place in the eurodollar end is and can be entirely different. However, from what we see of eurodollar disorder, especially of the constant and severe currency problems from Russia to China to Brazil and even Switzerland, liquidity constraints upon eurodollar function is evidently just as impaired. And, as noted previously, there is more than a little element of QE to that as well.

The bottom line is that most commentary seems to believe regulations are behind these changes when in fact banks themselves are recognizing the holes in monetary theory particularly as they relate to how academic models never fit out in the complexity of practical application. There was always a downside to implementation of QE’s, even recognized flippantly by authorities, but the intent was the resulting robust economy was more than enough to make up for it. The decay in systemic “dollar” liquidity of the wholesale model (which would be a good thing if it was accompanied by a radical alteration of banking models, something that clearly did not occur) is just such a downside, totally unexpected by monetary theory. Now banks are forced to react to both the lack of actual economic progress and a sorely diminished liquidity capacity to support the whole centralized pricing regime.

With all that in mind, banks that are hugely flattening the yield curve make perfect and prudent sense.