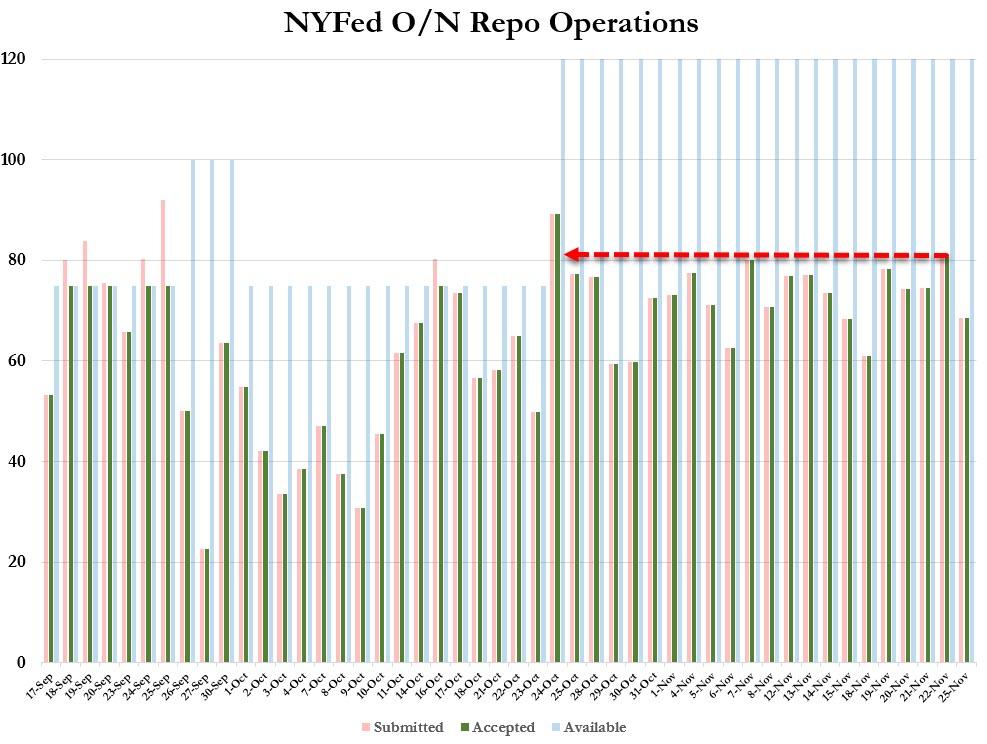

Traders were keenly looking ahead to the result from today’s 42-day repo as this was the Fed’s first liquidity-injection providing dealers with funding to carry them over into next year, as the operation was the first to mature in 2020 or January 6 to be precise. And, as many had feared, year-end liquidity fears remain front and center as the $25 billion operation proved to be roughly half the required size to satisfy all liquidity demands.

https://www.zerohedge.com/markets/feds-42-day-repo-2x-oversubscribed-scramble-year-end-liquidity