Last week was pretty much a disaster, not just economically speaking, for a wide swath of the globe – from Japan’s ongoing “unexpected” collapse to Europe’s “unexpected” third go at contraction (without recovery) to a very dim and “unexpected” view of credit markets pretty much everywhere including the US. This week started out with more grimness, in places like China and Brazil. That half of the BRIC’s block has run into more questions this year despite what appears to be growing ease in currency and finance.

That is typically the hallmark of such ebbs and flows entering and moving deeper into crisis. A shock almost always precipitates counteractions that have some varying degrees of nominal success. Brazil took the “easy” way out last year by enticing Brazilian banks to do the dirty (and ultimately expensive) dollar work for them (due to the peculiarities of the Brazilian swap/central bank system). That has led to a rather stark dichotomy as the Brazilian economy, thought to be susceptible to economic difficulties due to currency pressures (“inflation” among them), has dropped to six months of contraction while the real instead gained (and then held those gains) against the dollar.

Like Europe and Japan, Brazil’s second quarter was much worse than anticipated. GDP was estimated at -0.6% after falling 0.2% in Q1. While the actual definition of recession is different in different places, two consecutive quarters of contraction does not necessarily automatically place the label “recession” on it. However, such an occurrence is universally an indication of something more serious than a minor inconvenience (just like a -2% GDP in a single quarter in the US indicates something very much amiss).

The problem for Brazil, sitting somewhat comfortably off the front pages with the real “captured” by seeming stability (or meaninglessness strikes again?), is that dollar swaps are now captured by rolling maturities in increasingly large amounts. That highlights this basic tension and the upside down world that global finance has manifested.

The current convention regarding currencies is that they are driven by trade flows, but the real and Brazilian economy could not be more dis-acquainted this year. Brazil’s turn at the headlines last year coincided with a weak economy, to be sure, but the sharp devaluation was not driven by that at all. Instead, the devaluation was in response to US$ tightening off the taper-driven bond market/eurodollar episode. In other words, it was all about finance rather than economics.

There are tremendous implications for that realization, including the fact that it speaks to the incomprehensible amount of leverage applied (and then episodically yanked back) everywhere. The US$ no longer is anything like the US$, especially via these eurodollar linkages, instead having become an agent of just such corruption of function. Some people refer to this as “hot money” but I think that qualifier leaves out too much to be useful. At least “hot money” has some linkage to economic function; this is pure financialism run amok globally.

Delinking a currency from an economy in this manner deploys all manner of price discrepancies that disable the efficient flow of resources (not just raw materials and marketable goods, but even financial resources). When Brazilian banks last year were desperate to maintain short-term dollar financing due to totally unrelated financial actions a hemisphere above them, that impacted not just banks but actual trade financing and economic flow. That surely played some role, though not the primary one, in heightening Brazil’s economic deficiencies heading into 2014.

The eurodollar standard was meant to replace the gold exchange standard, and did so largely because it operated seemingly as an efficient ledger system without the “hassle” of having gold on hand first to settle and clear trade needs and imbalances. The problem was, as with all things related to financialism, the “need for gold” placed a very real limitation on exactly those imbalances. In the short run, nobody likes to be unable to engage in trade due to lack of “money”, but that is the capitalistic way of efficiently allocating across oceans and geographies.

In the modern, orthodox conception of trade, all trade is everywhere good and proper – and if a country needs to borrow to engage then all the better. So the eurodollar system financialized away from strictly a ledger system of keeping track of who owes what into a debt-based system of “buy whatever you want.” In a gold system where imbalance is limited banks are nothing but bookkeepers, and thus fill a very limited role; in the eurodollar system where everyone borrows to settle trade in dollars they really don’t have access to, banks are ever-present, ubiquitous and thus take precedence over everything at the very apex of the pyramid where true capital and money once occupied.

The big corruption since 1985 has been the tone and usage of eurodollars away from trade and into what can only be described as speculative finance. The same banks that are making “dollars” available to Brazilian banks to finance real trade are also those that were lending via securitizations into trillions of subprime US mortgages, and then sovereign PIIGS. The wall between economy and financialism has been totally destroyed in the pursuit of debt and leverage for everything.

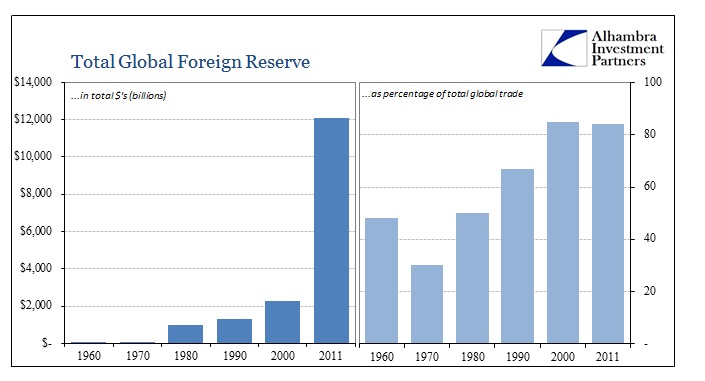

The entire premise of this “reserve” accumulation is (was) that nations could be insulated from currency problems by holding so many “reserves.” That might have been the case, and might now, if those “reserves” were actually piles of “dollars” sitting in a vault somewhere very much like gold bars used to be in London. But the dollar “reserve” system is not a physical accounting of “money”, as it should be, or even a hard copy ledger system of clearing limited and limiting imbalances. Instead, this eurodollar standard places a liability in attachment to every one of those “dollar” assets; and in most cases those liabilities are too short-term in nature as to be free from rollover risk and potential disruption.

In this world, everything needs to be financed, in “dollars”, all day every day, subject to tomorrow’s whims and whispers of change. What looks like to economists as “resilience” is instead the pathway for global “contagion.” Last year’s relatively benign rehearsal should have been much more of a wakeup call about such fragility; particularly since we are not all that far removed from the “real thing” of 2008 (which was centered in eurodollars in London, and much more global than perhaps people realize even today).

Global trade is every bit as financialized as the mortgage bubble was or the bond bubble is – and that is as backwards as it sounds. For countries like Brazil, the “good” news is that the contraction might have been worse if the financial disruption in eurodollars had continued. Instead, they get to “revel” in the very much linked observation that the global economy lurches once more toward the abyss in “shockingly” coordinated fashion. “Somehow” the world has been unable to recover past that last great crisis, instead only sowing the seeds for further fragility and spreading it out far and wide.

At least we can count on consistency, including that politicians are politicians no matter where they reside:

“I want to emphasize that even really organized countries are having problems getting better growth,” Finance Minister Guido Mantega told reporters.

He said gross domestic product data suffered because of unique, seasonally related statistical effects, and stressed the unemployment rate has been low and stable. As a result, he said he believed Brazil’s situation did not really constitute a recession.

The Polar Vortex of the Antarctic? I suppose that is a concept much easier to suffer on the retail level, even though it was summer there, than truly appreciating just how much eurodollar bastardization and leverage has destabilized and disabled basic planetary economic function.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com