I have been pointed toward an alternate explanation for what I described as Japan’s potential tipping point. Scott Sumner (and others) is arguing that the tremendous increase in importation of goods into Japan is a sign Abenomics is actually working. His reasons relate to the orthodox idea of a “demand shock”, ostensibly how he classifies the yen devaluation, triggering what amounts to a domestic wake-up call. With more activity inside Japan, it would seem consistent that Japanese would buy more from abroad.

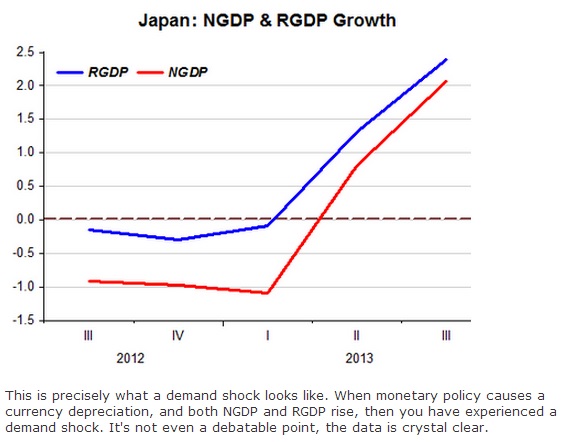

He presents the following in evidence:

What is crystal clear from that chart of Japanese GDP second derivatives is that there is great ambiguity about its reliability. Since RGDP lies continuously above NGDP, that shows the persistence of the negative inflation calculation, as if that were fully valid in a 30% yen devaluation environment. There are a great number of difficulties in expressing “deflation” (or negative “inflation”) in terms of GDP, but here we have a “shock” that is causing no shortages of paradigm shifts. In other words, GDP calculations look like they do but that is not necessarily consistent with what the Bank of Japan expects to accomplish.

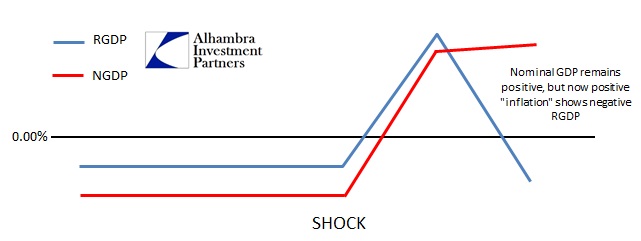

The next phase in GDP could just as easily (and I would argue is much more likely) look like this:

That would be particularly true given a state where such a massive and unfavorable trade imbalance has arrived. It would be further the case in an economic system where wages continue to be problematically left out of this “demand shock” (more on that in below) and where a massive tax increase is only months away. Perhaps that is why GDP underperformed such bright expectations in Q4, as inflation calculations embedded in GDP begin to “normalize” to the new post-shock calculations?

Setting all that aside, there is a larger issue here that gets back to yesterday’s main idea. Again, as Mr. Sumner characterized import growth:

Actually this is a good sign, as faster economic growth will often worsen a trade deficit. The US trade surplus shrank immediately after the sharp devaluation of 1933.

Recalling one of the slowest and longest “recoveries” in US history is not the proof he probably sought, but it does conform to the spreadsheet changes of various numbers. But we don’t have to go back eight decades to see this in action, we need only look at the US’ recent economic history.

Merging this sentiment with the Summers/Krugman hypothesis that the US economy “needs” asset bubbles, you can see where the appeal lies in that convoluted expression of tortured logic. An economic system can only maintain such a large and growing trade imbalance, at the same time the currency devalues, where the internal (or external, in the case of eurodollars, something not exclusive to dollars – there are euroyen markets too) creation of “money” far outpaces both. The asset bubbles and the trade deficit are symptoms of a larger instability, where financial replaces true wealth (productive capacity) in a temporary redress against what is really a nation growing poorer.

Perhaps this is illuminated most clearly by thinking of its opposite – the gold standard mechanisms. No such persistent trade imbalance would have been possible under the gold standard, or even convertibility of various gold exchange standards, because the outflow of gold would have halted, or at least seriously challenged, the internal system. Gold, representing accumulated real wealth, leaving in such a manner exposes the growing poverty of the system experiencing that outflow imbalance. Replacing it with fiat or credit production only masks that larger imbalance of widening paucity – which is eventually and inevitably revealed when the credit “cycle” busts, and with it all the assets improperly priced on acceptance of the illusion.

In the case of Japan and Sumner’s conjecture, it is actually much worse than that. As a national system marginally dedicated to export activity, the huge importation of now-offshored components and energy represents an even greater challenge to self-sufficiency, a more insidious version of productive poverty. With production costs increasingly tied (negatively) to currency pressures, the system can only appeal to more currency devaluation in the hopes of offsetting such currency costs with volume expansion. Thus the entire affair is now fully captured by currency edicts alone.

Aside from all of that, there is a more basic objection to Sumner’s interpretation of the import imbalance – namely congruity. The sheer scale of the increase in imported goods is not consistent with any other measures of domestic Japanese activity that might justify it all. I suppose you could advance the theory that Japanese retail and supply chains are gathering goods ahead of the tax increase, but that too would be directly contradictory to the stated goal of an actual uptick in economic activity. I highly doubt the Abe administration hoped the tax increase would spur productive activity overseas, putting foreigners to work making goods that used to be manufactured and fabricated inside Japan, with Japanese workers.

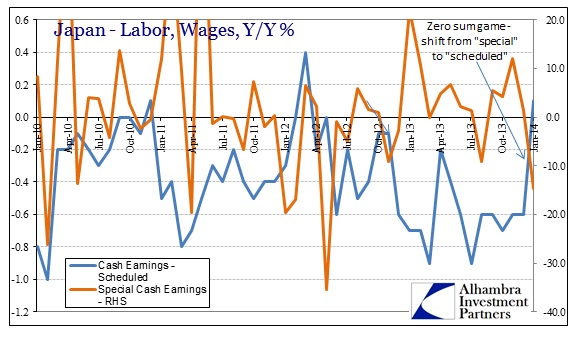

To that end, much was made about January’s increase in scheduled wages – the first yearly increase since March 2012 (at +0.1%). That should not have been surprising given the political attention to yearly wage negotiations. Companies have been made to “promise” some relief, in light of that yen illusion on profitability, to workers. Thus, they “shared” with them the smallest increase possible, at least so far.

However, in addition to being so very far below the now-inflating price structure (which Abenomics actively courts), that increase in “scheduled” wages has come at the obvious expense of cash bonuses. It has been cash bonuses that have kept household incomes from dropping precipitously throughout this adjustment period. In January, “special cash wages” fell 14.6%, meaning overall cash earnings actually declined for the first time in two months despite the uptick in “sharing.”

What continues to be expressed here and elsewhere, all over the world where orthodoxy dominates, is a devotion to numbers without a higher dedication to actual function. Sumner argues that the GDP figures show Abenomics is “working” and therefore subsumes the import imbalances. But that does not really make sense outside of stretching analogies to fit the cause, and instead betrays the arrogance behind the whole project. An economy is not its GDP, though we might assume one correlates with the other (at times). It is a far more complex system that does not suffer so much intrusion, and when such occurs it malforms toward the intrusion rather than healthy progress. Worse, in almost every case, the malformation is actually destructive over the longer run (like asset bubbles and trade imbalances), meaning it conforms to the cliché of “short-term gain, long-term pain.”

It is, as the US has experienced since 1995, a system growing poorer despite a positive number in both inflation figures and GDP. That is the tradeoff economists desire and seek – any kind of short-term activity is believed to be good. There is no consideration for the longer-term, and far more important, traits of sustainability and profitability (beyond cronyism; organic profitability is the life-blood of a real economy, rather than illusions of it). The Bank of Japan, like the Fed, seeks only activity for the sake of activity. If it moves GDP positive, no matter the downstream impacts, it is judged as a success. But a true recovery and sustainable economy is unambiguous on its face; there is no argument about its existence because it is evident in every facet.

It very much reminds me of schools that teach their students “to the test” rather than instilling a deeper understanding and allowing that to come out through testing. It’s a cheat; a short-cut of similar deception. The students pass the tests but are no better for it. Actually they are in a worse position because they get passed “up” in grade levels knowing only how to take a test. Like asset prices, that all comes crashing down at some point when that student’s intellectual poverty is eventually exposed, thus revealing the institutional rot that was once believed to be consistent with progress.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com