After marveling at the speed at which the FOMC downgraded, once again, its over-optimism regarding 2014 growth, my good friend Fred Everett started to calculate exactly how daunting a task even hitting the lower end of the reduced range actually might be. It’s not just the misstep in Q1 that is the problem, it is the sometime tortuous nature of compounding when it goes in reverse. A decline in GDP is devastating, which Fred’s inquiry shows quite well; speaking very much about why negative quarters are always (until now, they would have us believe) absent from growth periods.

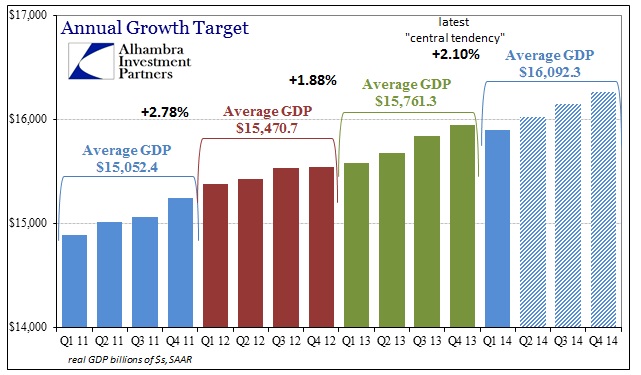

The manner of calculation, according to the BEA, is to start by averaging the four seasonally adjusted annual rates (SAAR) from each quarterly GDP figure.

The average of 2012’s four quarters works out to $15.47 trillion; $15.76 for 2013. Thus the annual growth is estimated to be an “unexpected” weak showing of 1.88% for 2013. To gain the new FOMC “central tendency” would require an average of $16.092 trillion for 2014.

To hit that target average would mean a quarterly growth rate of about 0.76%, or a 3.07% annual rate per quarter. That actually undershoots the target by about $7 billion, but it would yield a growth rate for 2014 of 2.05%, which would round up to the 2.1% target. In other words, the “easiest” path for the economy to achieve the new target is just a little less than 3.1% in each and every one of the next three quarters.

That would mean no room at all for another stumble. Further, that kind of growth has only happened on two occasions since the Great Recession: in 2010 and toward the end of 2011. There has been nothing like it recently as the economy has clearly downshifted. I know that weather remains the mainstream fixation, but this amounts to hope for some long delayed silver bullet.

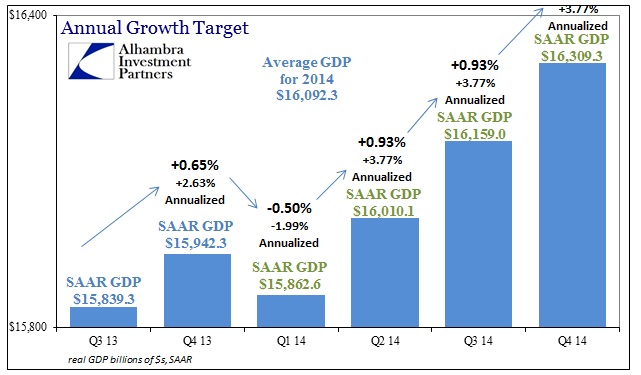

But that is not the worst of it, as there are estimates Q1 is going to be revised still lower to as much as a 2% decline (annual rate). Again, due to compounding, that would both be exceptionally rare outside recession and a tall task for this kind of economy to even reach that awfully low 2.05% standard.

If the Q1 decline does come in at around 2%, then the pace of growth just to get up to 2.05% jumps to 0.93% per quarter, or a 3.77% annual rate in each of the next three. The last time this artificial economy reached anything like that was 2005 in the “halcyon” days of the housing bubble.

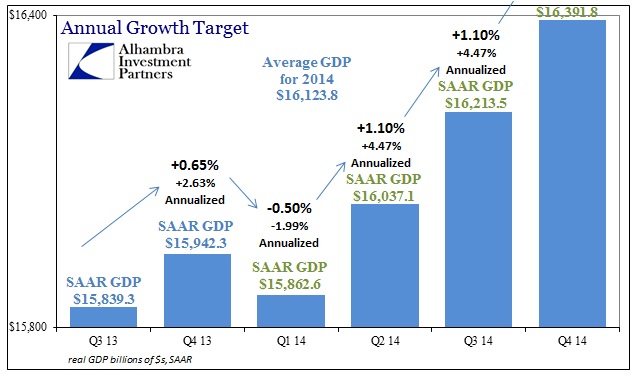

Since we are already down the rabbit hole, we might as well calculate hitting the upper limit of the “central tendency” since it is clearly included as part of this year’s expectation. Assuming that the economy has to both overcome the 2% hole in Q1 while actually hitting the upper end of the new “central tendency”, sort of defining the tallest order the Fed is “expecting”, is really nothing short of an exercise in fantasy.

To attain 2.3% growth for 2014 would mean just about 4.5% real GDP growth in each of the next three quarters – one of which is nearly finished and doesn’t seem to have even close to that kind of spring in its step. About the only time you see that kind of steady pace is in the presence of a true recovery. Does that mean the Fed’s models are looking for exactly that? Probably, but given the circumstances why would they suddenly be right this time? Even the one economic account that somewhat offers a positive trajectory, the Establishment Survey, falls well short of what would fairly be considered a full-on recovery.

No wonder the downgrade of the “central tendency” was so severe. Compounding after a negative quarter is a huge hole for the economy to dig out of. I just don’t see how this economy is set for near perfection just to hit that lowered target.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com