by Julie Verhage at Bloomberg

The plunge in Chinese equities has grabbed all the attention in recent weeks, but a team at Barclays suggests we should be watching something else.

Analysts led by Ajay Rajadhyaksha say that Chinese real estate is the sector to focus on,not Chinese stocks. Here’s their reasoning:

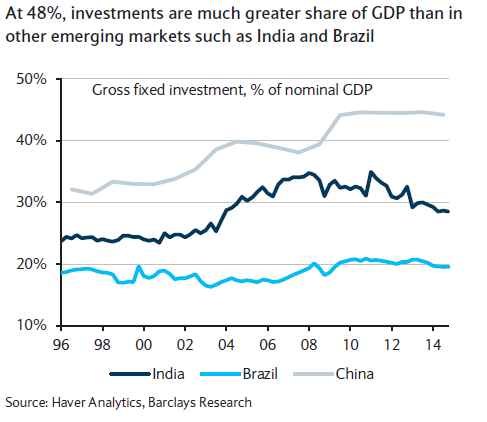

Over the years, much attention has focused on the massive share that investment commands in China’s growth. At 48%, it is much greater than the investment/GDP ratio in other emerging markets such as India and Brazil, as well as developed economies such as the US. What is perhaps less known is that real estate accounts for most of this increase. A quick glance at Chinese statistics shows that investment as a share of GDP has grown from the mid-thirties to 48% since 2000. In that period, real estate has gone from below 4% of GDP to around 15%.

The chart below shows how the growth in real estate in China compared to other emerging economies. You’ll notice that it’s significantly higher.

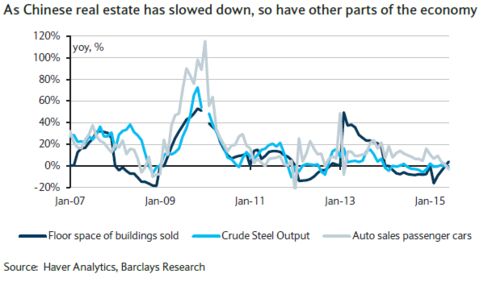

As the analysts anticipate a “sustained slowdown” in the real estate sector in the coming years, the next chart worries them. It shows the correlation of real estate and other parts of the economy such as auto sales or, say, steel output. (Real estate directly and indirectly accounts for 50 percent of all steel used, according to Barclays.)

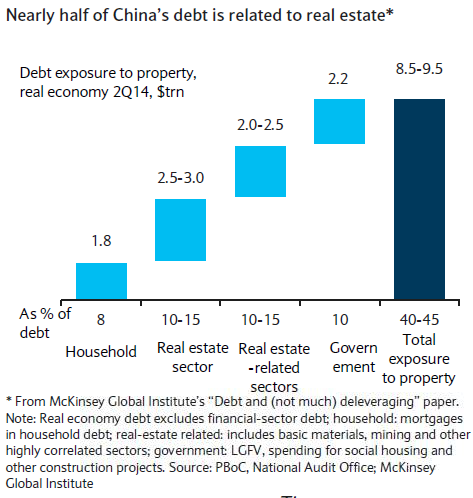

Meanwhile, the Barclays team cites a recent report from McKinsey estimating that nearly half of China’s debt is related to real estate.

The influence of real estate on both China’s economy and its debt means that real estate bears close watching.

Here’s the team’s conclusion:

We are aware that there are several pressing topics that we do not tackle in this report, including the outlook for the shadow banking sector, the size of bad loans on bank books and state-owned enterprise reform. We have discussed these issues in the past, and plan to do so again in the future. The outlook for the real estate sector remains the most important and the medium term path seems clear – a continued, multi-year slowdown of very significant proportions but not an imminent collapse. The Chinese economy remains on a glide path to slower but more sustainable growth over the next several years, though if we are right, the slope down might be a little steeper than many investors expect.