Despite the fact that the FDIC is largely charged with regulating small, community banks, it’s mixed-in deposit guarantee “insurance” brings the agency into contact with all manner of banks. This includes, of course, the largest firms that dominate in financial areas that have very little to do with banking in its most monetary form. The FDIC’s area of responsibility, in terms of primary regulatory authority, covers 4,177 institutions with about $2.6 trillion in total assets. That compares to the Office of Comptroller of the Currency (OCC) which is responsible for 1,554 institutions with $10.5 trillion in assets and the Federal Reserve with its 858 institutions carrying $2.2 trillion. Patchwork does not even begin to describe this.

On December 10, 2013, with very little public attention, the FDIC outlined its strategy for something called single-point-of-entry (SPOE). At issue was/is the new Dodd-Frank designation of strategically important financial institutions (SIFI’s), colloquially known as the TBTF’s. SPOE is meant to try to disperse some of the angst surrounding TBTF/SIFI by credibly (they hope) asserting some regulatory discipline in the case of failure. The idea, from the FDIC perspective, in hopeful combination with the other regulators with a hand in all this, is to place the holding company parent into receivership and recapitalize operating units in an orderly if exigent manner.

Following that plan, the FDIC more recently initiated a notice of proposed rule-making, by opening a request for comment period, that would require the largest thirty or so banks to increase both the robustness of their internal bookkeeping operations (which is a hint at the problems here in systemic terms of “market” knowledge) and the speed with which a review from the outside may practically occur. The purpose here is to reduce the effort and increase the efficiency associated with a failure, as the FDIC wants to be able to quickly assess what is actually going on where inside the actual Wall Street balance sheet, both separate from the SPOE above and in tandem with any deposit guarantee necessities.

FDIC Chairman Martin Gruenberg was quoted in late April as noting, “Timely access to insured deposits is critical to maintaining public confidence in the banking system.” Why?

At this point anyone not enveloped within the operations of the financial industry and its regulatory arm should be asking themselves why the hell are all these things just thrown in together. The ultimate vote of confidence for and from the public would be if their deposits had nothing to do with big banks at all, their derivatives and wholesale finance to begin with. There is absolutely no reason, in 2015, that your debit card or check-writing abilities with which you use to buy gas and pay for groceries (or shop online) has to be an unsettled matter of national importance because the largest banks, who only get larger and more complex, feel of themselves the need for that pedestal.

The FDIC itself says of its own mission,

Congress created the FDIC in the Banking Act of 1933 to maintain stability and public confidence in the nation’s banking system. The statute provided a federal government guarantee of deposits in U.S. depository institutions so that depositors’ funds, within certain limits, would be safe and available to them in the event of a financial institution failure.

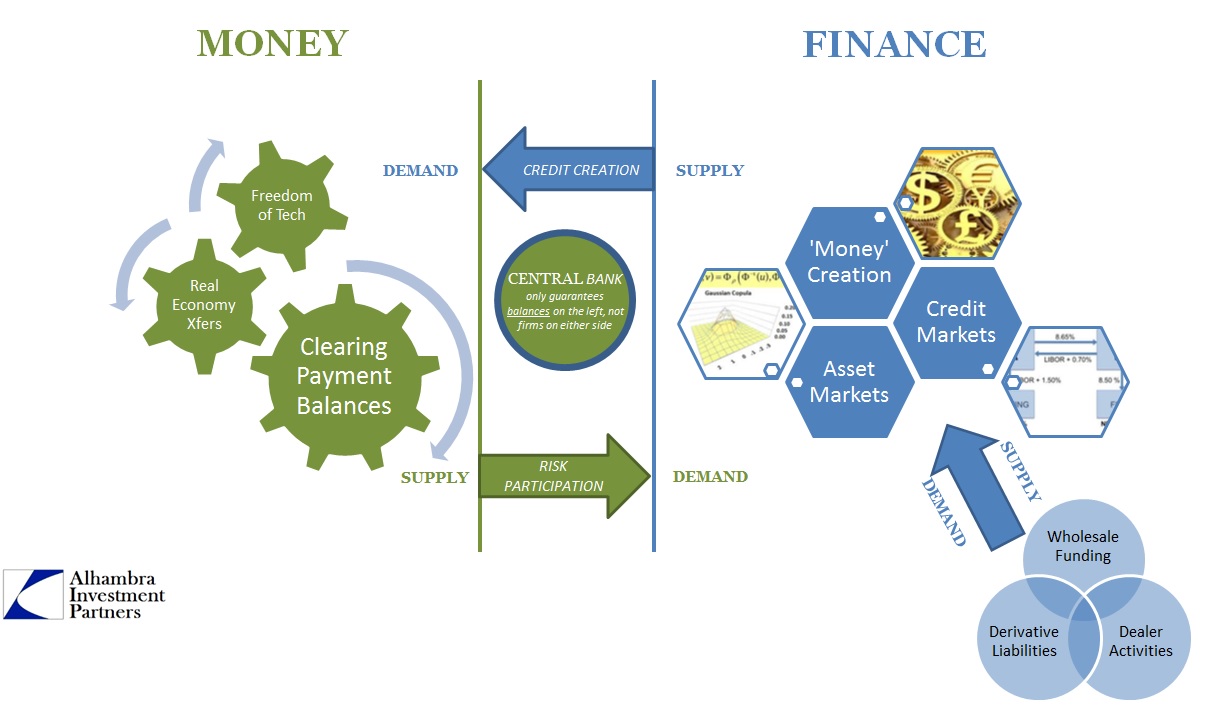

Nowhere does that logically and directly extend to the eurodollar system of global futures and interest rate swaps that set the tone and management of the wholesale financial system. You can make the case that credit and debt are systemically important without ever piercing the fact that that itself does not justify entangling money and payment processing; money is not debt, and money should be given priority over it. That is why the whole mess has become such a mess in the first place, because banks have used that deposit base, the payment end of money, to gain favor and especially shelter for their financial businesses.

In terms of payment technology, the prepaid system and the newer innovations that are just now becoming active make banking in the monetary sense obsolete – banks are expensive distractions. Banking, properly defined, is a matter of finance and there is no good reason to combine the two except as a means of power and influence. A monetary system that is defined independently of its financial system will always keep the balance of power shifted toward the people in decentralized form (even where the “wealthy” hold much of the money). Where finance has come to dominate money, the way is opened for the cartels and “too big to fail” especially as the interweaving of payments and money with finance is used as justification for all that centralization in the first place – “we” can’t let banks fail because money would fail, and thus we must submit to central planning for our own good.

By ensnaring the deposit and payment functions, banks make the argument that because deposits are legally and morally primary in function, that standing must transfer to all finance because they are housed together. In the past, there was some operational sense to the arrangement but increasingly that distinction is returning as technology opens up the possibility of separating money from banking once again.

In many ways, this already happened in 2008. There was no general panic among depositors during the Panic of 2008; that was entirely contained within the wholesale banking system. Sure, the FDIC ended up taking down more than 500 failed institutions, but that had nothing to do with endangerment from or for the payment system. It was, again, the financial side of those banks (MBS mostly) that contained the rot.

Somehow, this fact has been bastardized and turned upside down – instead of reading that the payment system functioned well as designed (and the FDIC deserves credit here) which would suggest functional separation from finance, the Fed, primarily, turned that into justification for making all wholesale finance depository finance. There are no more investment banks, as the last of them, that survived failure and near-failure, converted to depository institutions to become statutorily covered by “liquidity” methodology that was never intended for wholesale to begin with! That statutory difference is, admittedly, something of technological evolution but you cannot also dismiss that there is acknowledgement of very important functional diversity as well.

In October 2006, the FDIC published a paper on its (the authors, who claim the usual “views do not necessarily reflect official policy and standards”) estimations for resolving failure for a “large U.S. commercial bank.”

While the FDIC regularly handles small bank failures, its experience with large banks is more limited and dated. Of the ten largest failures in the history of the FDIC, the most recent one was over ten years ago. It has been over twenty years since the collapse of the largest bank handled by the FDIC. Much has changed since these failures. Since then, the largest U.S. banks have gotten substantially larger and more complex, and the rules under which the FDIC must operate have become considerably more restrictive.

Ironically, in the very next sentence, the authors express the usual recency bias that accompanied the whole of the crisis trajectory, “Therefore, the FDIC should be proactive in planning for a possible large bank failure— even if none are expected in the near term.” Less than a year later the eurodollar market broke irrevocably, leading directly to the first of many failures and systemic chokepoints or dangers. And none of those had much if anything to do with the American payment system of deposits and “money” (as it is understood in the 21st century conventions).

It is also poignant that the second objective presented in this paper as an FDIC “mandate” is to “preserve market discipline.”

When markets are working well, bank creditors monitor banks and either demand higher interest rates or exit banks that are too risky; stockholders prefer to invest in high-performing banks and penalize weak bank managers. Thus creditors and stockholders provide bank managers an incentive to avoid excessive risk and to fix problems promptly as they arise. If the FDIC were to avoid systemic risk by “bailing out” the creditors and stockholders of a failed bank, then the creditors and stockholders of other large banks may be less inclined to monitor and discipline bank management.

It is exactly this point that gives us TBTF/SIFI’s and also the modality of how that arose and continues to exist. In other words, because the largest banks lump themselves, and have regulators include them, as a whole banking system featuring both payment and finance the entire system is afforded special status when only one of those functions, the former, deserves it. As it was, because these banks were afforded that deposit “privilege” actual pricing of their activities was ill-mannered, which totally circumvented any ideas about imposed discipline. Stock prices, in particular, but also credit, rewarded unconstrained risk exactly because of this regulatory favor. And that perversion extends to issues surrounding complexity, too.

When Bear Stearns failed, and even Lehman, Wachovia and WaMu, nobody much cared outside of investors because they recognized that there was minimal danger to payment balances everywhere. That provides good reason for separation not closer entanglement; there is no reason to blindly save institutions that have no true monetary function, and thus systemic moral hazard dies with it.

Unfortunately, this is not even close to the dominant view, though that isn’t really surprising. Bureaucracies don’t volunteer to give up power, and banks are not going to be signing up to remove themselves from society’s rightful monetary pedestal. Beyond just this unnecessary knot of regulatory overkill and redundancy (and, most especially, misunderstanding and inflexibility), the future status of even monetary innovation is being waged this time by another regulatory operation of the state leviathan, the CFPB.

While the trend is still small at this moment, presenting this opportunity and what seems to me a window of urgency on the part of bureaucrats, it is the underbanked that are largely being targeted for the manner in which they secure and access, voluntarily in most cases, these “alternate” forms of payment mechanics. We are not just talking about payday loans, but also and especially prepaid debit cards. These pieces of plastic function in almost every manner like a bank account or debit card without the necessity of ever setting foot inside a bank. They are linked through the major electronic networks, such as VISA and MC, and even feature automatic payroll “deposit”, so there really is total functional equivalence.

And that seems to be the problem. Under the guise of “protecting the poor”, the government is out to assail these providers under the legion of the Dodd-Frank monstrosity, the aptly named (for 21st century Orwell-ianism) Consumer Financial Protection Bureau (CFPB). The prepaid card industry sprang out in the regulatory black space where banks don’t roam, and now there will be a battle for banking regulations to correct that freedom.

There is, at this moment, the opportunity to redraw these distinctions to their proper format; to remove finance from money and all the unnecessary danger and complications that have created the worst incentives for actual economic function. Unfortunately, government agencies are instead pressing further to redefine everything as finance. Even what little space has been gained in the past decade or so by organic technology and innovation is now under scrutiny for no good reason other than control and power. As long as money is part of finance banks will be at the apex of the pyramid even though modern society is trending toward decentralization in almost everything else.

I have no illusions about the pliability of mainstream attitudes being sufficient to head off this tightening of the regulatory noose. Orthodox economics, and so mainstream politics, endorses this view in total ideological lockstop where credit and money are not just inseparable but treated, unbelievably, as one and the same. Instead, the purpose is to prepare when for when actual reform is far more realistic; as in after the next one which, as the last one, will be conclusively traced back to these same repeated mistakes and deficiencies. Free the monetary system, free the recovery. Banks are supposed to be background tools not our entire purpose; economic performance flows from that simple idea.