It’s certainly not quite the “butterfly effect” but the reality of the overall arrangements of the global economy is shockingly simple. The details, methods and interactions of the “dollar” can be incomprehensible at times, especially since there is no directly observable and thus plainly unambiguous data, but once the “big” moves entrench all that complexity recedes in importance (at least in terms of interpretation). While the father of modern chaos theory, Dr. Edward Lorenz, used seagulls originally as the primary narrative, it was Philip Meriless in 1972 who coined the phrase, “does the flap of a butterfly’s wings in Brazil set off a tornado in Texas?”

The current incarnation seems to be, “if the economy tanks in Texas does it set off massive protests in Brazil?” The lack of actual economic progress has been established throughout the “recovery”, but there is something extraordinary about the last seven months. While most Americans remain enthralled by the exclusivity of the credentialed economists and their unending devotion to “stimulus” as a religion, the rest of the world is reaching a boiling point.

Police estimated the crowd in Rio de Janeiro at 25,000. In the centre of São Paulo, ten times that number joined a rally on Avenida Paulista, according to the Datafolha polling agency. In the capital, Brasilia, 40,000 rallied in front of Congress. In both Belo Horizonte and Belem, about 20,000 people joined the anti-government demonstrations . Another 40,000 were reported on the streets in Ribeirão Preto in São Paulo state and 100,000 in Porto Alegre.

Altogether demonstrations took place in more than 60 cities, also including Recife, Salvador, Manaus and Fortaleza with the overall turnout likely to exceed 500,000. Local media and police reported a total of more than a million people, though their figures were based on a four-times higher estimates of the crowd in São Paulo.

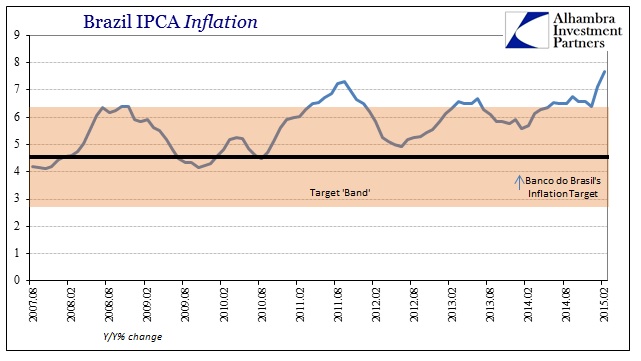

Nothing brings out active discontent quite like sharp political differences during economic decay. Brazil’s economy is already predicted (which likely means it will be worse) into recession for 2015, but at the same time “inflation” is now far above Banco do Brasil’s target “band” (the upper end is 6.5% and Brazil’s IPCA rate for February reached 7.7%!) and still going.

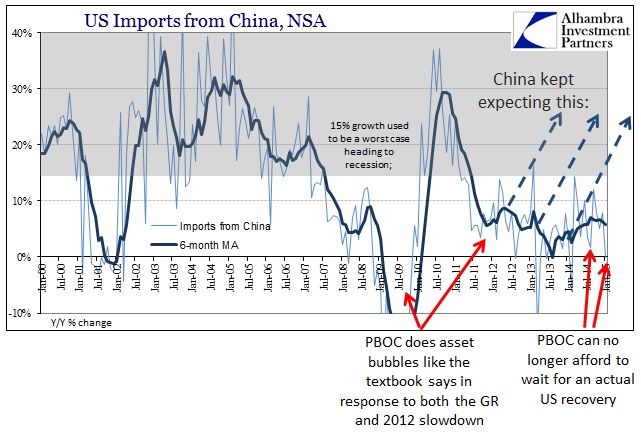

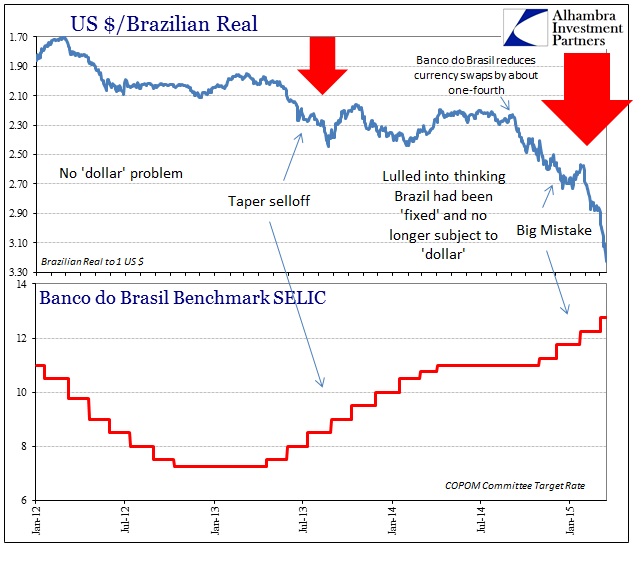

The immediate problem is the real. Banco do Brasil is “forced” to defend the currency with increasing interest rates at exactly the same time the international economy has “unexpectedly” stopped buying resources and goods from Brazil.

The central bank misread the conditions in the early and middle part of last year as if it had successfully broken the link to the “dollar.” Now, Brazil is overwhelmed by both surging inflation (properly defined) and recession taking hold of simultaneously of the external economy and domestic “demand.” With the real surging toward debasement, there isn’t much good that can from this situation no matter what they do from here on – the country is stuck within the rut provided by monetarism and its “dollar.”

That makes the Brazilian central bank the local financial transmission mechanism of the global “dollar” short acting out increasing volatility expectations. If it were just Brazil that would be bad enough, but there is every indication that the “dollar” is again (for the third leg in this single process dating back to June 2014; which is itself a continuation of the “dollar” disruption born the first time the word “taper” through dollar interest rate swaps into non-QE disharmony) creating havoc around the world.

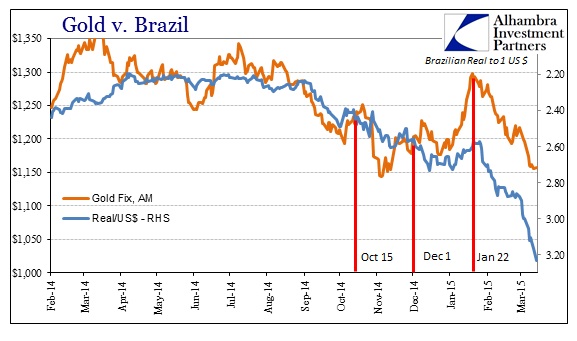

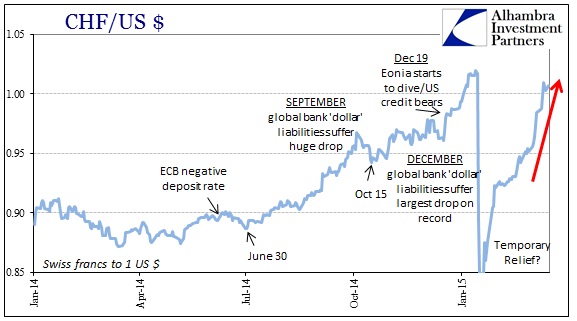

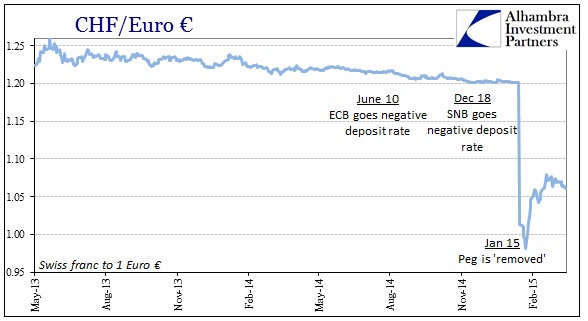

For one, the price of gold continues to depress back down toward cycle lows. Clearly, trading in gold that had been boosted by the January 15 liquidity problem is back to a correlation with the real. The Swiss franc, for its part, has sunk nearly back to the cross at which the Swiss National Bank abandoned the euro peg in the first place. Since it only took about two months to wither, you have to wonder what the SNB might be thinking about where it stands now (seemingly in a similar position and interpretation as Banco do Brasil before September 2014).

Ever since the rumors of government disdain for loss of the peg, the franc has seemingly re-attained stability with the euro – which was the true problem in the first place. As with Brazil, the Swiss may only have a choice about which form of economic suicide to commit.

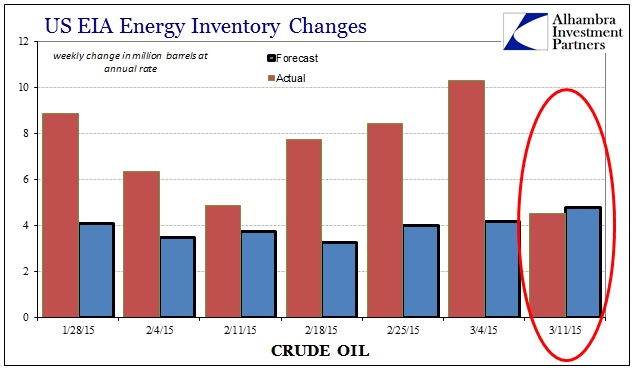

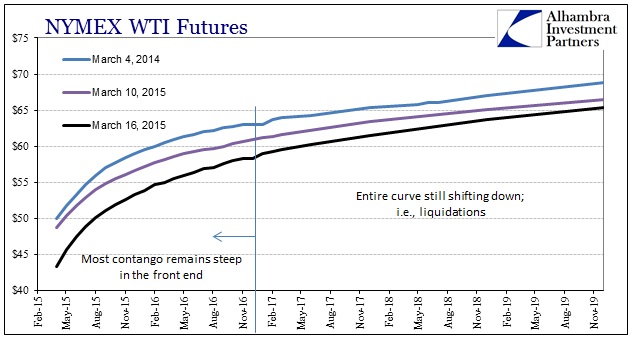

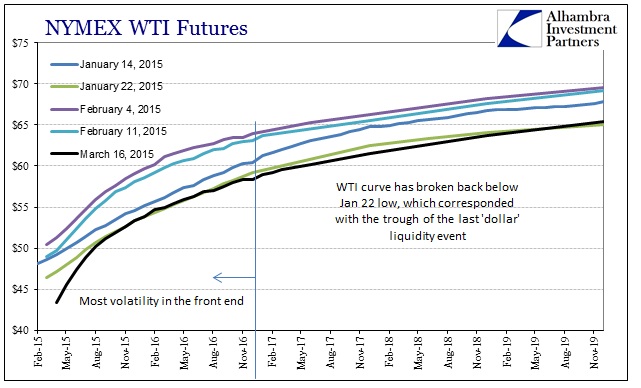

Even with those more direct currency comparisons, it is perhaps crude oil trading that is of the purest sense of “dollar” finance in the middle of March. Last week should have been the most favorable price trend for WTI as crude inventories in the US actually rose less than expected for the first time in months.

Rather than rising even slightly in exhalation over potential easing off extremes, crude continued to get crushed in March, increasingly resembling further “dollar” liquidations – a commodity’s financial transmission effect of the real economic outlook.

As usual, there were no surprises on the supply side only the growing realization that this price collapse may not yet have run its course, and thus storage capacity is increasingly in doubt. However, since contango did not rise all that much, as the entire curve shifted downward, that would suggest more economic fundamental doubts (“dollar”) than pure commodity relations. By way of comparison, the WTI curve is now back at about the same as January 22, the very bottom of the last liquidity event.

Lower lows and more widespread disruption would seem to indicate that indeed the next leg is in full swing, and that there is no solution yet in sight. Global “dollar” finance appears to be still quite pessimistic and now further beyond certain depressive indications from the last time around. That would seem to suggest this overall financial disruption is still not yet even near its clearing level.