Slowly the optimism fades as last year’s spurt of activity is recognized for what it was: temporary. It is entirely common for such ebbs and flows to take place in inventory approaching recessions, as businesses themselves experience extremes in expectations in light of both hope and reality. Last year was, I must say, a bit unique in that spread between optimism and actual customer conditions, a divergence I think lies entirely in the psychology of QE. Businesses in large part base their ordering activity on mainstream economic forecasts; which in turn are derived from orthodox understanding; itself a religious believer of the “power” of monetary policy.

So as the hope of QE magic and mysticism turns against the reality of shoppers growing ever-poorer (itself a full part of QE), what’s left is really a cleanup of so much misallocation. The timing contains no wonder or mystery at all; the ties to the Christmas season are obvious and evident. Except, it seems, where orthodoxy again intrudes, instead conjuring ideas of correlations with winter temperatures and snowfall. That only makes sense if you refuse to remove yourself from the orthodox paradigm – the only way for economists to maintain the efficacy of monetary policy embedded at the core of their belief system is to search for alternate explanations, no matter how strange and illogical. If wasn’t snow, it was the government shutdown (all two weeks of it) or the menace of “cash on the sidelines.”

It may have snowed in a good deal of WalMart’s store locations, but that will not matter further down the supply chain as WalMart will indeed alter its orders for goods based not on weather but the reality it sees of its customer base (with 140 million weekly shoppers, that is quite a broad indication). That offers a much better explanation for both the persistence of 2008-like levels of activity in manufacturing, including durable goods, and the January results which are heading back toward the lowest end of that range.

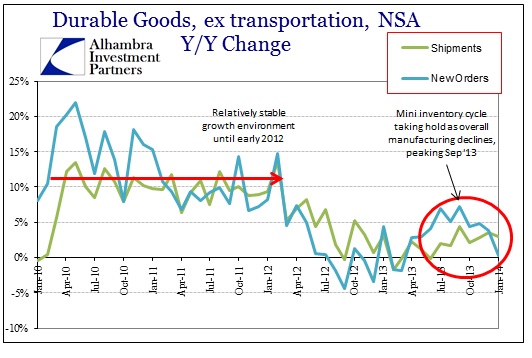

Where there had been some hope that new order levels in the middle of last year were portending a turnaround, the December and January results have to be especially disappointing. In terms of durable goods ex transportation, new orders were only slightly positive, and thus flat, with January 2013 (which was not a great month itself).

In capital goods, the level of new orders in January 2014 was almost 2% below January 2013. Shipments continue to be extremely weak, so no change in that trend despite the hope of previous months’ order activity. Now, with shipments remaining weak, we have the occurrence of reduced order rates to weigh on future expectations for activity.

Again, despite the appearance of a potential turnaround last year, that was only the case in orders and only in the narrow view of relative changes. In the more appropriate historical context, which offers a much more robust view of the cycles here, the current pace of manufacturing is not appreciably different than the Great Recession (apart from the ultimate collapse). That has been the case since the middle of 2012, and there is really nothing to suggest a different and more hopeful trajectory. Instead, with orders again falling, we may finally be at a point where even QE mysticism cannot penetrate.

The real problem here, apart from the suggested trajectory for the economy, is that regardless of recession semantics the economy falls further and further behind. Just like investments, there is a time value to economic growth, most visibly experienced in population and demographics. If we can’t even generate meagre levels of growth in anything meaningful, which would lead to actual employment and wage growth, then we have to conclude the economy is slowly decaying. That may seem somewhat better on the surface than the more typical sharp collapse of obvious recession, but this new form (seen in Europe beginning in 2011) of dysfunction may, in fact, be much worse over the long run – the specter of Japan.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com