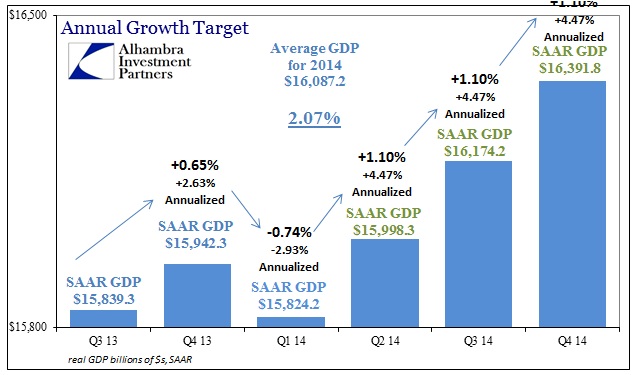

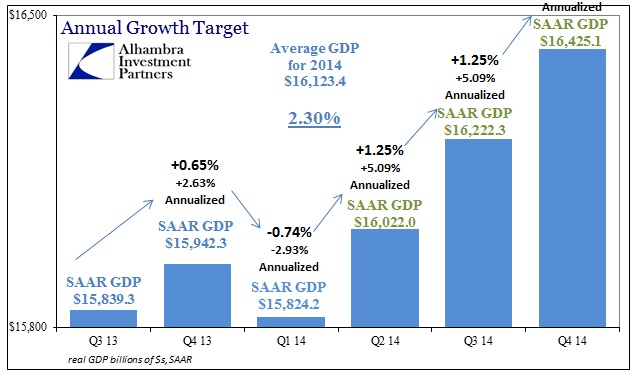

In light of the enlightening of the full-scale of the first quarter’s disaster, it seems fitting to calculate the FOMC’s growth target with this new information. The current “central tendency” is estimated between 2.1% and 2.3% for calendar year 2014. Given these revised figures, the target for average real GDP of $16.084 trillion, just to get to 2.05%, is inordinately more difficult.

Again, compounding is a huge boost when everything is growing, but the opposite occurred which amounts to an enormous setback beyond simple optics.

Just to reach 2.05% (thus gaining the “benefit” of rounding) means 4.5% growth in every quarter for the remainder of the year. That’s a 1983-84 type recovery appearing out of nowhere, with absolutely no sign that is even possible at this moment.

To emphasize that further, to gain the topline of the “central tendency” is to be beyond fantasy.

Let’s just say that 5.1% for the remaining nine months is very much out of the question. Given that the 2.05% is likely out of the question too, that means more downward revisions to the “central tendency” are coming.

That raises the issue of the idea of “central tendency” in the first place. The FOMC’s economists run simulations of various permutations (Bayesian too) of economic factors and come up with a statistical scatter of where the models think the economy will be in the quarters ahead. The greatest cluster of those simulations, or those inside the “Bell curve” (to oversimplify), are assumed to be the “central tendency” as the name implies. If your models always assume that monetary policy attains a positive multiplier, then the very incidence of monetary policy “stimulus” will lead to an upward bias in the “central tendency.” It really is that simple as to why economists can’t seem to get a good grasp on reality (and thus appeal to mother nature to save their math).

Since the “central tendency” of the simulations assume as they do the monetary efficacy, they will not “see” recession. It is axiomatically incompatible for ferbus and the rest to forecast a “central tendency” of recession while monetary policy is so “accommodative.” That simply means that the Fed’s models are unrealistic to a very high degree – which has been confirmed over and over and over again.

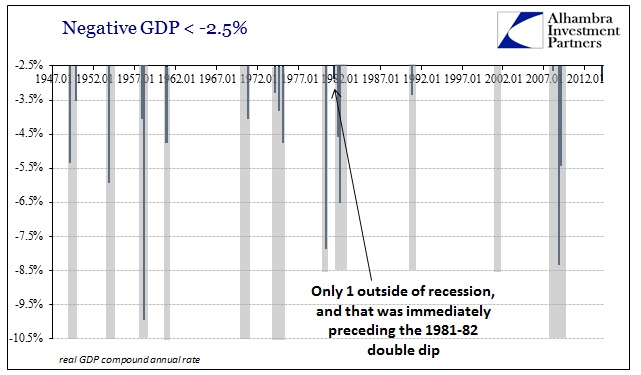

There have only been 18 prior quarters with -2.5% or worse real GDP (compound annual rate) in the postwar era. That puts this latest estimate in some “elite” company.

As you can guess, every one of those highly negative quarters occurs during recession (except one – the 2nd quarter of 1981 came in at -2.9% but was just outside the official NBER recession date of July 1981; so where it was not officially part of the recession, it did both immediately precede one and immediately follow another).

The first quarter of 2014 is worse than anything seen during the 2001 recession – which the worst contraction then was -1.2% in the third quarter of 2001. In raw GDP terms, that would make the first three months of 2014 worse than the whole of the 2001 recession.

So where does that leave us now? The economy is either in recession, or it has passed into something entirely different that has never been seen before. As I have said on numerous occasions, you can’t discount the possibility of the latter, but the former is made all the more compelling by everything from the pattern since the middle of 2012 to corroboration by so many other data points that are also showing levels concurrent only to contraction.

Maybe Occam’s razor is most appropriate, in that it seems far more likely that a slowing economy with a high degree of “slack” and drag is falling off than Polar vortices knocked an unusually strong 1983-type recovery off track only temporarily. And it’s not like this kind of recession blindness is atypical.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com