Following up on my earlier observations about a reduced trajectory, getting away from the thick trees of quarterly statistic movements and revision for the forest of patterns and paths, viewing the subcomponents of GDP as standalone accounts rather than contributors highlights exactly that problem. Whether you view the economy through real final sales (both of domestic product and to domestic purchasers) or the flow of goods to consumers, the bend in 2012 remains stubbornly in place. That also applies to capex, despite what looked like a much greater contribution to GDP in the second estimate for Q2.

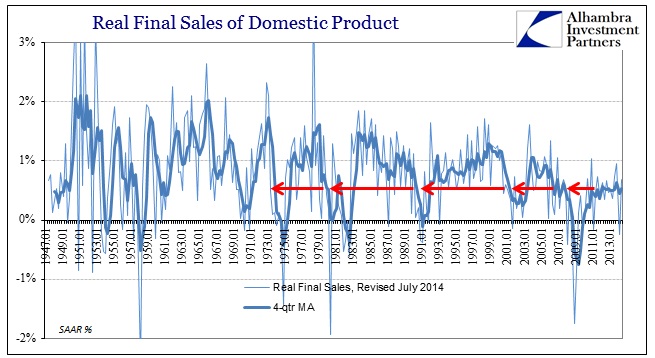

Somehow, post-revisions, real final sales have staked out a steadiness never before witnessed. While that may seem like a positive feature it is decidedly not. That would be the case if the growth rate was twice the current level (and really almost triple), but final sales are stuck at what usually is reserved for the onset of recession. That gives weight to the theory that the economy has remained depressed almost consistently since 2010 (under QE) absent any actual recovery (aside from the burst in late 2009/early 2010 before QE2 rudely intruded).

The wider perspective of whole GDP less inventory actually shows the exact same “stability” and disappointment.

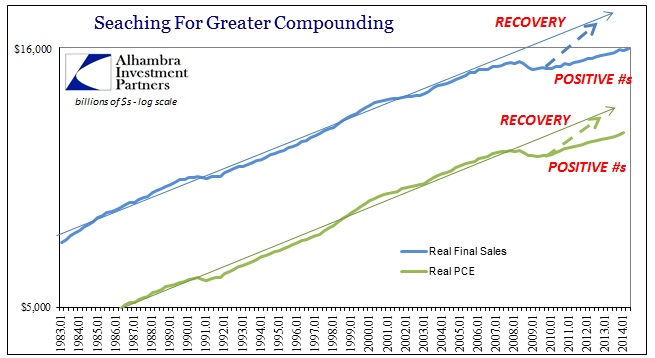

What gets lost upon focusing in on growth rates is, again, the bend in trajectory. What we are witnessing is dangerous asymmetry, as the depths of contraction are never fully healed by the “growth” assumed thereafter. That seems to now account for two “cycles” running, with the latest being far, far worse and much more durably ingrained than the dot-com runaround.

The longer growth remains depressed, the worse this actually gets as compounding works instead violently against us. It would be concerning enough if that was limited to a certain segment or even two, but it is so broad-based that it suggests serious deficits in basic function.

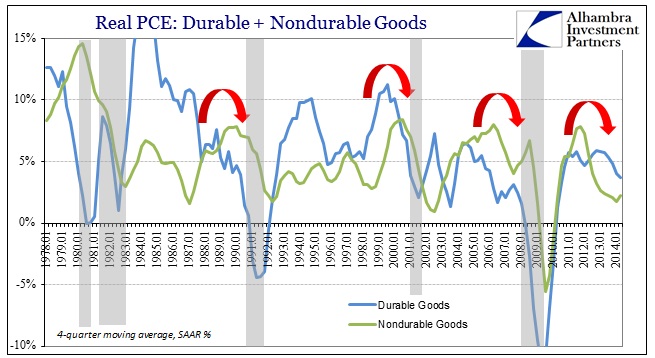

Growth rates in consumer spending on goods are highly depressed from where they should” be, leaving the PCE trajectory bending lower and lower. The first asymmetry after the collapse in 2009 was unfortunately reinforced by a second in 2012.

Again, growth rates are as low as what we usually see at or near recession, prolonging the absence from a healthy course. And that actually includes the overwrought frenzy of auto sales brought about by the booming subprime trade through leases for anyone.

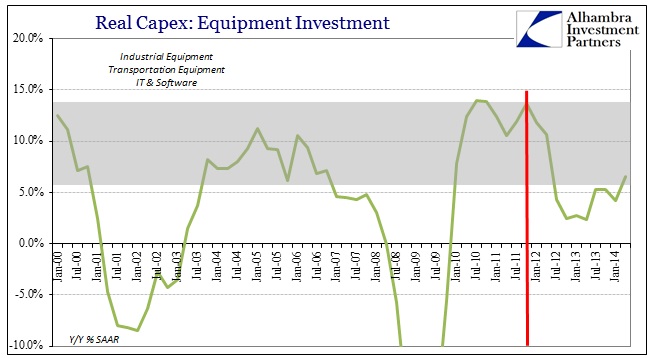

The same is apparent in capital spending, as equipment investment suddenly decelerated also in 2012.

Somewhat alarmingly, industrial equipment spending, as well as that for transportation equipment, has not seen much of a return. Furthermore, echoing the foundational problem of the eroding productive base, these kinds of investment are not much changed from even 1999.

The net result is an economic course that might be “better” more recently but not even close to enough to make up for all these deficiencies. That is not a cost-free proposition, as lost growth under these circumstances is itself a damaging condition. This is more than just idle labor losing skill or becoming un-hirable, the system itself is forced to re-orient to whatever marginal changes are actually taking place – good and bad. That would include, as we well know, financialism to a disappointingly high degree.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com