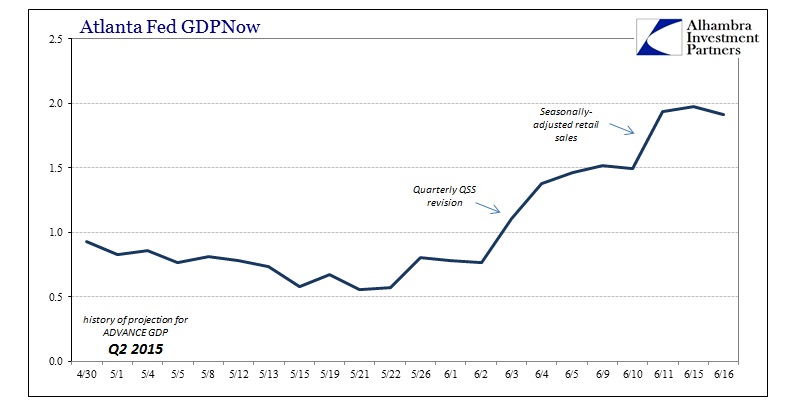

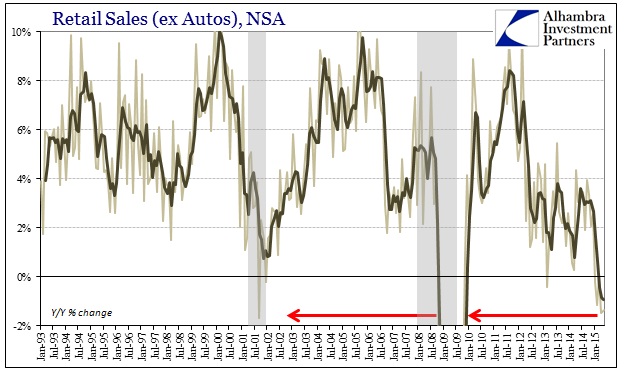

GDP estimates for Q2 2015 have been rising in June, largely due to updates on consumer and household spending. The first, the Quarterly Services Survey (QSS) showed a somewhat higher spending pattern for financial services (the largest component), which pushed Q2 GDP forecasts (according to the Atlanta Fed’s GDPNow tool) to +1.4%. Last week, the strictly seasonally-adjusted “surge” in retail sales contributed another half percent, taking estimates up to nearly 2%.

Based on those two data points alone, that 2% is thus highly suspect since the QSS is, to be charitable, inconsistent, and the seasonal adjustments for the retail sales figures turn the worst month of the entire “recovery” period into a huge, if isolated, boost. Unless there is an actual surge in actual retail sales, this time next month will see a seasonal subtraction.

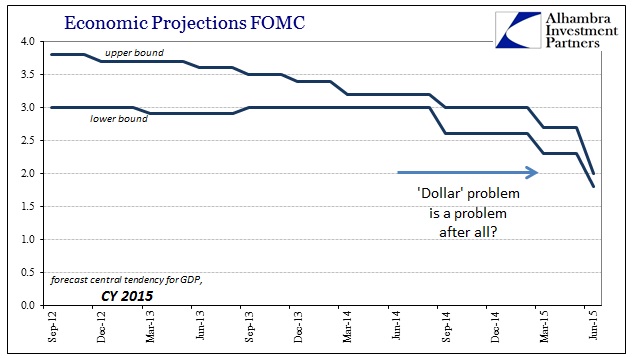

But even if Q2 remains on track for 2%, and Q1 is revised up to close to zero, that still leaves a huge slump for a half-year period way, way behind all projections. That was the true point of emphasis out of yesterday’s FOMC mess, namely that even the mainstream models see 2015 as largely written off – just like 2014 eventually came to be, and 2013, and so on.

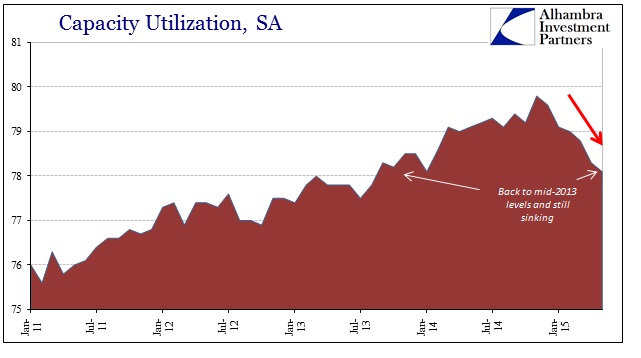

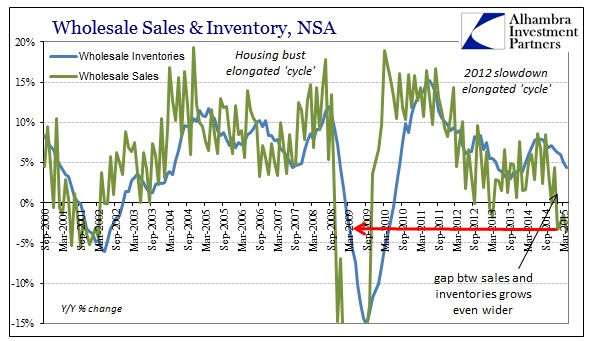

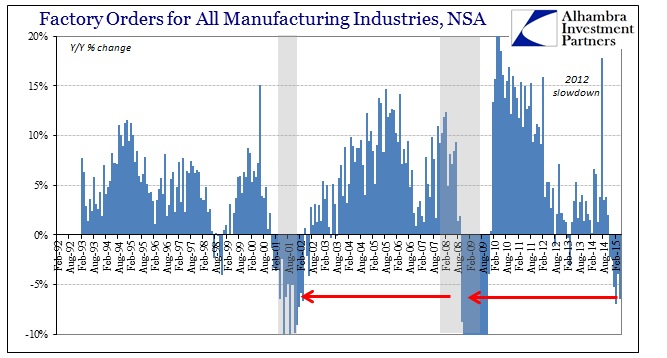

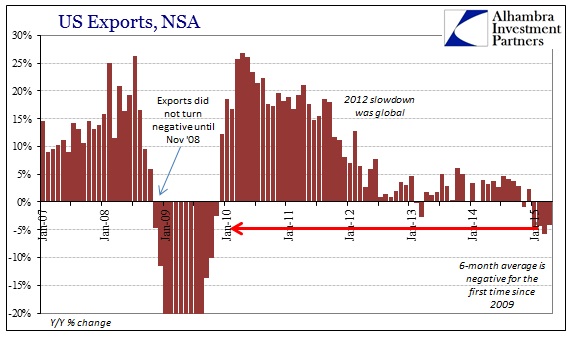

There is, however, overflowing evidence that 2015 is nothing like all the prior yearly disappointments. While GDP may, at this moment, appear to be similarly suspect as all the rest, GDP as an economic statistic is quite unhelpful in determining cyclical inflections. Where GDP may appear consistently tragic right now, more consistent calculation with the pace of contraction in broader economic measures would change that drastically.

GDP has always had a cycle problem, but one that was typically associated with the upturn. Again, this traces to trend-cycle variation, the subjective interpretation of BEA statisticians (like their BLS counterparts) that form the basis of “seasonal” adjustments. For most of the history of GDP, trend-cycle revisions were far, far greater upward after the trough. That suggested that, prior to the 1990 recession anyway, GDP was more helpful without needing revisions in determining the timing of any recession if not so much the recovery.

That seems to have changed with that 1990-91 cycle, which is unsurprising given that recoveries and recessions themselves have changed under interest rate targeting (more elongated cycles, far less of the “V” shaped events). That would tend to lead to the interpretation that GDP, which was developed under data sets that aren’t as much alike to current circumstances, suffers a form of recency bias that has yet to be corrected.

Part of that stems from denial; the BEA doesn’t think it has a trend-cycle problem even though it admitted a major miss to the 1990 turn. In a paper published in 2003, for example, the BEA notes, despite huge revisions eventually to Q3 1990, that it believed there was nothing wrong with its projections at the peak:

The average revisions for current-dollar GDP around cyclical turning points are qualitatively similar those for real GDP. Again, the final estimates present a generally accurate picture around cyclical peaks, although there is a modest upward revision to current-dollar GDP increases in peak quarters. For the next quarters after peaks, the mean absolute revision is noticeably smaller than was observed for real GDP. Around cyclical troughs, however, there is a somewhat larger tendency toward upward mean revisions than was found for real GDP. The mean absolute revisions are also upward and somewhat larger than those for real GDP in trough and “next” quarters.

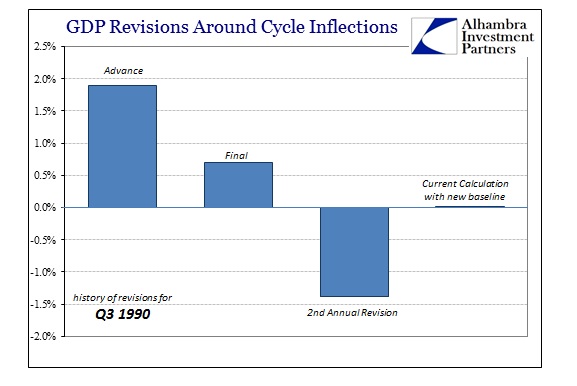

The reason for that is simple – they continue to lump all cycle peaks together as if the recession process in 2001 was the same as late 1973. In 1990, for instance, the subsequent downward revisions to Q3 were very much outsized, and were not much recognized until the 2nd annual revision nearly two years later.

Some observers have suggested that the “miss” in identifying the beginning of the 1990-91 recession led to significant policy errors. The beginning of the recession in 1990:III, following a peak in 1990:II, was not correctly identified until the second annual revision that was published in July 1992. Previously, 1990:III had been identified as the peak. The latest estimate shows that real GDP declined 0.7 percent in 1990:III; the current quarterly estimates showed increases ranging from 1.9 percent in the advance estimate to 0.7 percent in the final estimate. The final current quarterly estimate understated the rate of decline in 1990:IV by about 1 percentage point and overstated the rate of decline by a similar amount in 1991:I.

The advance estimate was almost +2%, which really wasn’t good in the context of late 1980’s growth, but was more than a little supportive given the geopolitical context and the timing of that release. That second annual revision showed that the 1990-91 recession started earlier and that Q3 1990 GDP was not +2% but rather -1.4% (it has been revised, in the new July 2014 baseline that incorporates the new GDP components, to the slightest possible positive number, +0.009801%). Where the public’s attention was on rapidly rising oil prices and the looming “ground war” in the Persian Gulf and Iraq, amidst heavy aerial bombardment and general war, in economic terms all seemed well in the autumn of 1990 – but only for a short period.

The advance estimate was almost +2%, which really wasn’t good in the context of late 1980’s growth, but was more than a little supportive given the geopolitical context and the timing of that release. That second annual revision showed that the 1990-91 recession started earlier and that Q3 1990 GDP was not +2% but rather -1.4% (it has been revised, in the new July 2014 baseline that incorporates the new GDP components, to the slightest possible positive number, +0.009801%). Where the public’s attention was on rapidly rising oil prices and the looming “ground war” in the Persian Gulf and Iraq, amidst heavy aerial bombardment and general war, in economic terms all seemed well in the autumn of 1990 – but only for a short period.

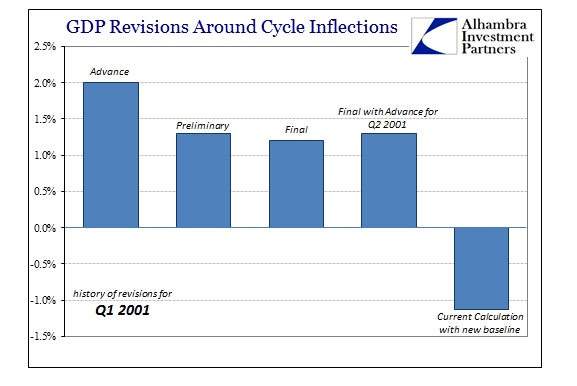

A decade later, the same pattern was repeated despite BEA assurances otherwise. In Q1 2001, less than a year after the bursting of the dot-com bubble, GDP was relatively reassuring once more that growth may have been weak but had not turned decisively in the negative direction.

Q1’s advance estimate, released on April 27, 2001, was again +2%. The next two revisions marked GDP for the quarter down, but only slightly so that by the time the advance estimate for Q2 2001 was released on July 27, 2001, right in the middle of what became the dot-com recession, Q1 GDP was revised up again to +1.3%. The current view, as with the annual revisions made immediately thereafter, is for around -1.13% and thus a similar miss in terms of magnitude as the start of the 1990-91 recession.

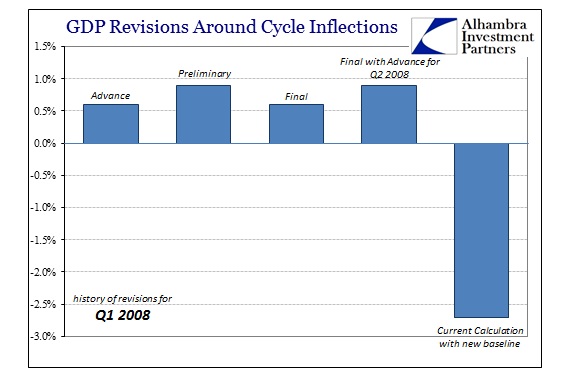

The worst case, which totally supersedes the 2003 paper on cycle revisions, is, of course, the Great Recession. If the lack of trend-cycle accuracy was bad in 1990, causing policy and public confusion, the errors at the outset of the Great Recession were catastrophic given the eventual result. The first advance release came out on April 30, 2008, to some great relief since it showed weakness but a positive number; +0.6%. Recall that this was the quarter in which the Fed had several “emergency” operations, including an intermeeting rate cut of 50 bps, and the failure of several funds and smaller financial firms before the big one in Bear Stearns. Despite all that irregularity and growing fear and cutbacks, the BEA’s trend-cycle subjectivity was a welcome reprieve with its advance number.

That only grew worse with the “preliminary” update, which somehow revised Q1 GDP upward to +0.9%! That revised figure was released on May 30, 2008, and you know that upward revision contributed to Ben Bernanke telling a banker’s conference in Massachusetts on June 10, 2008, that the “risk of a substantial downturn had ‘diminished over the past month or so.” The then-Fed chair was taken at his word, expert and all, by how many people, investors, and most of all economists in the media. Though he was certainly referring to the FOMC’s mistaken premises about financial factors, especially OIS (ignoring eurodollars more specifically), but it would be pure coincidence if that upward revision, amounting to no small relief, did not contribute mightily to that dreadfully mistaken view.

While the final revision dropped Q1 estimates back to +0.6%, the advance release for Q2 on July 31, 2008, had moved that back up to nearly 1% while also offering even greater (and catastrophically faulty) reassurance on the economic front with a bounce to +1.9%; all the while the GSE’s were already in progress to collapse and the financial system was in full reckoning of the second phase of the panic. The actual contraction in Q1 has moved around quite a bit in the years since, but at the current calculation of -2.7% actually understates the damage done as it was not purely of the recession forming, but in how that actually fooled so many people, up to and including the FOMC, into believing it wasn’t.

The BEA, indeed all of the current suite of economic accounts, has always had a trend-cycle problem but one that is far greater in the different character of the economic cycles under central bank activism (Greenspan’s tenure, which began in 1987, and forward). Recessions do not appear as they once did (neither do recoveries, but that is a separate and exhaustive issue only tangential to this line of inquiry) but GDP still acts as if they do. That needs to be factored while incorporating, of necessity, instead a broad and corroborative view of the whole economy.