By Andrew Hecht, via Seeking Alpha

Copper has been making lower highs and lower lows since 2011. The red metal peaked in 2011 at $4.6495 per pound. Since then it has been elevator down for the red metal. (click to enlarge) That elevator picked up some steam in January as the price of copper fell below long-term support at $2.72 and traded all the way down to just above the $2.40 level. That was the lowest level for the nonferrous metal since July 2009 — a multi-year low. Copper then proceeded to rebound.

That elevator picked up some steam in January as the price of copper fell below long-term support at $2.72 and traded all the way down to just above the $2.40 level. That was the lowest level for the nonferrous metal since July 2009 — a multi-year low. Copper then proceeded to rebound.

The recent rebound

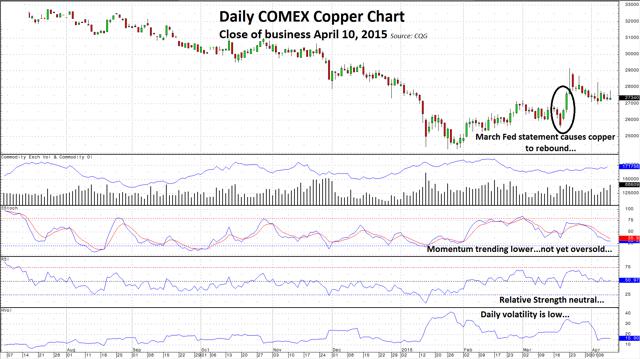

Copper remained comfortably below the broken support level after January at $2.72 per pound until late in March. Then the U.S. Federal Reserve Open Market Committee announced that they might not be raising short-term interest rates as soon as the market had expected and the price of copper popped higher. (click to enlarge) As the daily chart illustrates, in the wake of the Fed statement after their meeting in March, the price of copper once again traded above the $2.72 level. COMEX active month May futures actually built a head of steam and traded all the way up to highs of $2.9145 on March 23 on short covering before turning around. Since then, copper has retreated to the important $2.72 level once again, closing on Friday, April 10 just above at $2.7345 per pound.

As the daily chart illustrates, in the wake of the Fed statement after their meeting in March, the price of copper once again traded above the $2.72 level. COMEX active month May futures actually built a head of steam and traded all the way up to highs of $2.9145 on March 23 on short covering before turning around. Since then, copper has retreated to the important $2.72 level once again, closing on Friday, April 10 just above at $2.7345 per pound.

The move is running out of steam

As the daily chart highlights, recent action in the red metal has been less than positive. The price has moved back to that important level from which it broke down in January. The slow stochastic, a momentum indicator, continues to point to lower prices for copper. Meanwhile, relative strength is neutral, meaning the market can go either way at this point. With daily historical volatility very low at the 15% level, it is only matter of time before copper starts to move once again. When it does, the path is likely to be lower.

A stronger dollar is one reason it will fall

One of the chief reasons that the copper price popped up to above the $2.90 level in late March was that the Fed statement caused a correction in the U.S. dollar. The dollar index, which was trading above 100 prior to the March Fed meeting, corrected back down towards the 96 level and this gave copper the impetus to move higher.

The global pricing mechanism for most commodities is the U.S. dollar by virtue of the dollar’s position as the reserve currency of the world. Therefore, there is a solid inverse relationship between commodity prices and the greenback and copper is no exception.

After the downside correction in the dollar, it has once again begun to reassert itself as the strongest currency in the world these days, and that is not good news for commodity prices and the price of the red metal. (click to enlarge)

As the chart illustrates, the current state of the U.S. currency is bullish. The dollar is up over 26% since May 2014 and just under 10% so far in 2015. This could be an ominous sign for copper. If the copper price pierces the $2.72 level and begins to move lower once again, there is another issue waiting in the wings that could really get copper going on the downside.

Financing deals in China may force copper lower

China has been experiencing slower growth for the past year. In light of slower growth, the Chinese government introduced a policy of “new normal.” The government designed this policy to promote lower but stable growth for the nation. The Chinese have promised to provide stimulus to the economy and pump funds into domestic projects. At the same time, the Chinese are attempting to root out corruption in government and business in the country. There have recently been a number of high profile arrests. Meanwhile, when it comes to copper, China is on the demand side of the equation. As a growing nation that continues to build infrastructure, copper is an important metal for the Chinese. The turbocharged rally that took copper up to highs in 2011 was in many ways due to Chinese buying and stockpiling.

It is no secret in the world of nonferrous metals that there are huge stockpiles of copper in China today. These stockpiles not only serve as strategic inventory for the growing nation for years to come, but also as a financing tool. Interest rates in China remain above the levels around the world. As such, using copper as collateral for financing deals allows borrowers to access cheaper money abroad as they pledge the metal as a performance bond for the loan. However, a problem arises for the borrower if the value of the collateral falls below the total loan value. Therefore, if the price of copper begins to fall once again, it is likely that there will be some selling of this copper collateral as the loans may quickly exceed the value of the metal. This is a huge risk for the price of copper and what I believe will force the price lower later in 2015.

The target for the copper price

A confluence of events may soon force the copper market to the edge of a cliff once again. I believe that the dollar versus euro currency pair is heading to parity, which means that the dollar will become even stronger. In addition, last week’s release of the Federal Reserve minutes from their March meeting highlighted that there is no clear agreement among Fed governors about interest rate policy. One-third of the committee members favored a rate rise in June. Another third favors waiting until September and the third camp, the doves, favor waiting until 2016. This means that, if things remain the same, a compromise will likely result in a symbolic rate increase during the second half of 2015. Given that European interest rates will remain at current levels or lower until September 2016 at the earliest by virtue of quantitative easing, any rate rise in the U.S. is likely to power the dollar even higher. This is a big negative for the price of copper. If it starts to fall once again, the financing arrangements in China will come into play, which could bring even more selling to the market. Finally, major low cost copper producers around the world continue to sell metal into the market and increase output. Remember that lower energy prices have lower copper production costs for most producers. A lower production cost lowers the bar for selling in terms of nominal price. The lower prices go; these strong producers may decide to keep on selling to force high cost producers out of the game, thus increasing their own market share for the future. This has been the strategy in markets like iron ore. The Saudis are also attempting to use this strategy in the world crude oil market.

The bottom line is that I believe copper will fall once again in 2015 and a confluence of events will likely take the red metal down to the $2 level, which is my downside target for copper in 2015.

Copper Financing Deals Will Help The Red Metal Move Lower | Seeking Alpha.