By Tyler Durden at ZeroHedge

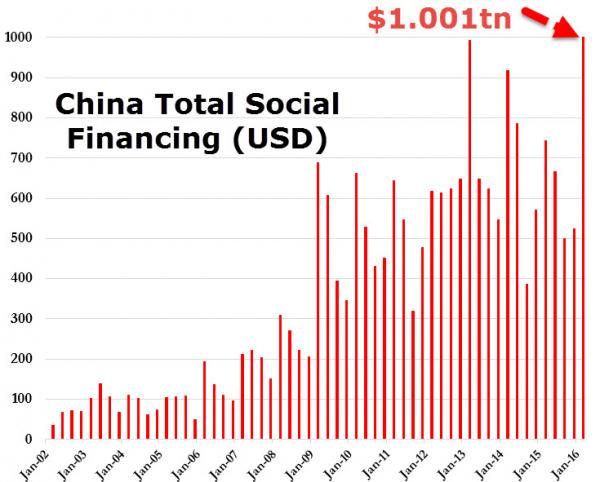

When it comes to China’s new credit creation, at least the country is not shy about exposing how much it is. To find the credit tsunami flooding China at any given moment, one just has to look up the latest monthly Total Social Financing number which include both new bank loans as well as some shadow banking loans. As we reported in April this amount had soared to a record $1 trillion for the first quarter …

… although as we followed up last month, it tumbled in April as suddenly Beijing slammed the brakes on uncontrolled credit expansion. It is unclear why, although the following chart may have had something to do with it: increasingly less of credit created is making its way into the broader economy.

No matter the reason for these sharp swings in credit creation, one thing that was taken for granted by all is that unlike China’s GDP, or most of its “hard” macroeconomic data, at least its credit creation metrics were somewhat reliable, and as such provided the best glimpse into Chinese economic inflection points.

That appears to no longer be the case.

In an analysis conducted by Goldman’s MK Tang, the strategist notes that a frequent inquiry from investors in recent months is how much credit has actually been extended to Chinese households and corporates. He explains that this arises from debates about the accuracy of the commonly used credit data (i.e., total social financing (TSF)) in light of an apparent rise in financial institutions’ (FI) shadow lending activity (as well as due to the ongoing municipal bond swap program).

Tang adds that while it is clear that banks’ investment assets and claims on other FIs have surged, it is unclear how much of that reflects opaque loans, and also how much such loans and off-balance sheet credit are not included in TSF. By the very nature of shadow lending, it is almost impossible to reach a conclusion on these issues based on FIs’ asset information.

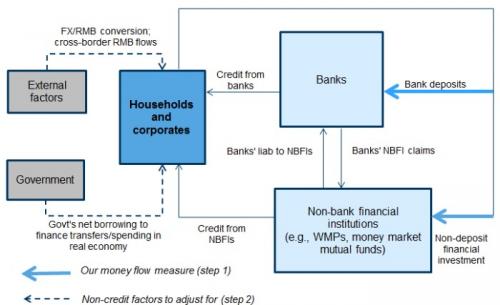

Goldman circumvents these data complications by instead focusing on the “money” concept, a mirror image to credit on FIs’ funding side. The idea is that money is created largely only when credit is extended—hence an effective gauge of “money” can give a good sense of the size of credit. We construct our own money flow measure, specifically following and quantifying the money flow from households/corporates.

Goldman finds something stunning: true credit creation in China was vastly greater than even the comprehensive Total Social Financing series. To wit: “a substantial amount of money was created last year, evidencing a very large supply of credit, to the tune of RMB 25tn (36% of 2015 GDP). This is about RMB 6tn (or 9pp of GDP) higher than implied by TSF data (even after adjusting for municipal bond swaps). Divergence from TSF has been particularly notable since Q2 last year after a major dovish shift in policy stance.”

As Goldman concludes, its finding suggests that the Chinese economy’s reliance on credit has deepened significantly, and adds that “our projection of China’s debt/GDP ratio for coming years has turned more unfavorable as a result.”

* * *

For those curious about the details, here’s more from Goldman:

How much credit has really been extended?Total social financing (TSF) statistics are supposed to be a comprehensive measure of this but their accuracy has been affected by recent events—in particular, the ongoing municipal bond swap program and an apparent rise in “opaque loans” and/or off-balance sheet lending by financial institutions (we will generally call such lending “shadow lending” in this report). Recent official comments suggesting scope for a more systematic compilation process for TSF also point to potential quality issues with the statistics.

The first data issue, i.e., municipal bond swap program, is relatively easy to address. It is mostly related to the different treatment of LGFV debt and municipal bonds in TSF statistics.[2] We have been adjusting for this factor by adding the municipal bond issuance for the swap program to the reported TSF to arrive at our measure of adjusted TSF, although the adjustment is not precise given uncertainty about the exact usage of the proceeds from the municipal bond swap issuance.

But the second issue, i.e., shadow lending by financial institutions, presents a much greater data challenge. In listed banks’ balance sheets, investment assets have been rising rapidly. Media reports (e.g., here and here) and disclosures by individual banks indicate that banks have embedded some of their loans to corporates in these assets, driven by regulatory arbitrage (our Banks research team has discussed these developments in recent notes).[3] In part reflecting this phenomenon, macro monetary data published by the PBOC has also clearly shown that the banking sector’s “claims on non-bank financial institutions (NBFIs)” (and also banks’ “equity and other investment”) have been rising rapidly in the last several quarters (for the PBOC data on these items, see this and this).

These observations have raised questions and triggered debates, often revolving around the following issues:

- How large is the system-wide size of “opaque loans” or, put another way, how much of banks’ NBFI claims is a result of opaque loans? In our view, it is not likely that all NBFI claims are opaque loans; they may be related to “financial round-tripping”—i.e., banks lend money to NBFIs (e.g., investment funds) that invest in financial markets and this money just circulates in the financial system and eventually comes back to banks without being “leaked” to the real economy. The “round-tripping” idea is indeed consistent with the corresponding very rapid increase in banks’ liabilities to NBFIs (Exhibit 1). It also dovetails with banks’ increasing tendency to allocate part of their capital to outside asset managers for financial investment in the secondary market (in what is called “entrusted investment” from banks), with the intention of boosting investment returns.

- Besides the “opaque loans” held on banks’ balance sheet as part of investment assets, how much additional credit is extended off banks’ balance sheets?

- To what extent is shadow lending (i.e., the on-balance sheet opaque loans plus off-balance sheet credit) already captured in TSF data?

These issues lead to the ultimate macro question of how much credit has in fact been extended to the economy. It is naturally almost impossible to conclude by looking at the asset composition of FIs, as by design it is hard to tell what assets represent opaque loans and (to a lesser degree) how much off balance sheet exposure there is. Increasing interconnectedness amongst FIs via various evolving “channel” set ups certainly makes the task no easier.

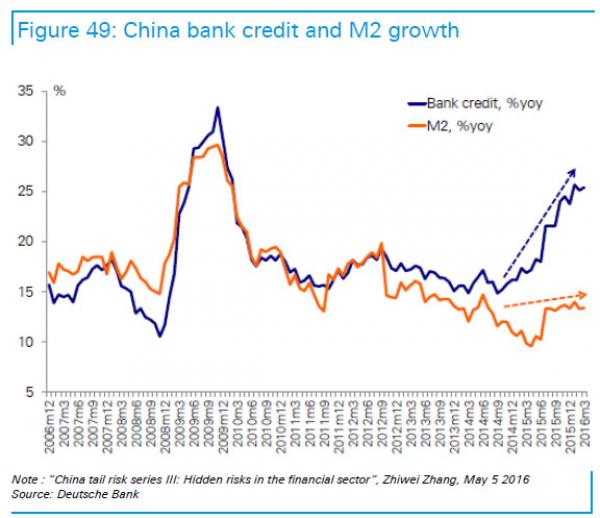

As the second chart from the top shows, M2 has become disconnected from loan creation in China. This has important consequences:

We adopt another line of attack at the question: Namely, we look at the mirror image of credit (which is on FIs’ asset side) and focus on “money”, a metric related to FIs’ funding side. The basic idea is that credit generation is effectively a money creation process. Without credit creation, the amount of money would normally be unchanged no matter what happens in the real economy and vice versa (see Box 1 for more discussion on the general credit-money relationship).[5] With this linkage extended, it is possible to come to a reasonable estimate of the true pace credit flow (at least from banks) to the real economy by looking at growth of broad money, or M2, as we did a couple of years ago.There is a problem though with this simple proxy, i.e., China has been becoming much less banks-centric. M2, which is essentially banks’ deposits, is no longer broad enough to reflect all key funding elements as the financial system diversifies. In fact, recognition of the growing diversity of the financial system already led the PBOC to expand the coverage of M2 in late 2011 to also include NBFI deposits (vs. only household and corporate deposits previously), partly intended to account for the increasing importance of WMPs at that time. But even with that expansion, M2 does not sufficiently capture FIs’ funding sources nowadays for two related reasons: i) banks have been drawing a significant amount of funding from non-deposit sources such as money market mutual funds’ purchase of NCDs, which is not included in the current measure of M2 (Exhibit 2); and ii) NBFIs (e.g., investment funds, insurance asset managers) have been rising in popularity amongst households/corporates as saving and investment intermediaries, and their financial activity may not be fully reflected on banks’ balance sheet (i.e., conducted off banks’ balance sheet).

On the other hand, though, including all elements of FIs’ funding side would not be ideal either, in our view, as that would overstate the pace of money created from lending to households/corporates, because of possible “financial round-tripping” (as discussed above) and double counting.

Therefore, to deduce the size of credit flow to households/corporates, we construct our own measure of adjusted “money”, which is intended to be broad enough to capture increasing financial diversification but targeted enough to cover only funding that comes from and is owned by households/corporates.

Goldman then proceeds to explain how it comes up with its own, adjusted, version of a comprehensive debt creation number in China, aka following the money trail. This process, while complex, can be summarized as follows:

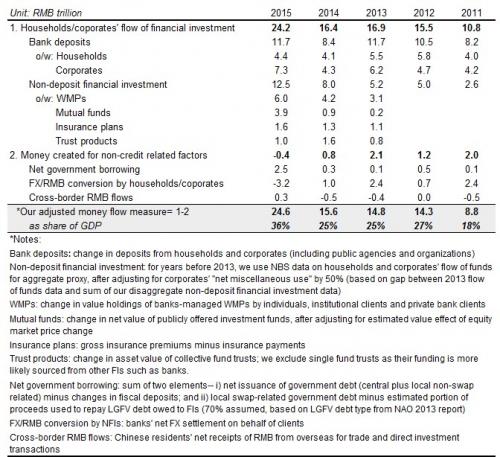

And quantitatively boils down to the following:

This is how Goldman explains the variation:

The broad trend of our measure seems clear, showing a significant jump in 2012 vs. 2011 and another, even bigger, jump last year vs. 2014. In comparison, M2 increased by only about RMB 16tn last year—a main reason for the difference is that a lot of “money” going into non-deposit financial channels is not included in M2. But in trying to follow the money flow more systematically as in our exercise, it seems clear that there was a lot of money created and circulating around amongst households and corporates relative to what the TSF shows, and this evidences that a very large relative amount of credit (as a % of GDP) was extended last year.How does our measure compare with the TSF data? To allow apples-to-apples comparison, we need a couple of additional adjustments:

- We take out the FX loan portion of TSF (to match our RMB money concept), and also adjust that for the municipal bond swap program since mid 2015 as we discussed in the opening section

- We add entrusted loans that are included in TSF to our adjusted money flow measure (as the money flow measure does not capture company-to-company lending

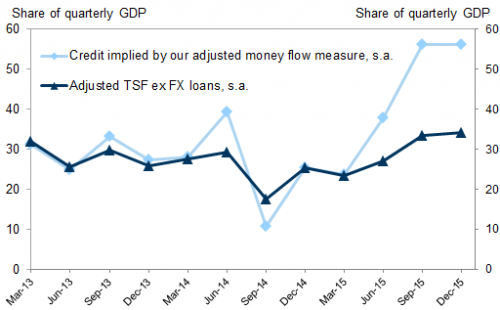

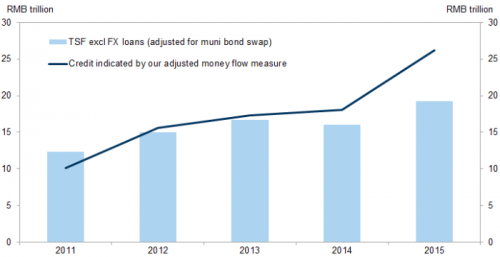

Credit flow to households/corporates as indicated by our measure is not entirely aligned with what is implied by TSF data, but the two metrics are fairly close in 2011-2014 (Exhibit 5). However, there is a large gap of some RMB 6-7tn for 2015, suggesting that TSF data (even after adjusting for the municipal bond swap) misses a significant chunk of credit extended to households/corporates last year.

Our money flow measure points to much larger credit extended in 2015 than implied by TSF

We next extend our money flow measure to quarterly frequency—we can only go back to 2013 when relevant information is available quarterly and can allow the quarterly series to be consistent with the annual one. The quarterly comparison shows that credit indicated by our measure and adjusted TSF began to diverge meaningfully in Q2 2015 and continued to widen in Q3-Q4 2015 (Exhibit 6). It is probably not a coincidence that the divergence happened amid a clear dovish shift in monetary policy stance (7-day repo interest rate fell about 200bps between Q1 ’15 and Q2 ’15; Exhibit 7), the general accommodative stance in Beijing following the major growth slowdown in early 2015, and policymakers’ encouragement for more financial diversification and innovation to relieve corporate financing constraints.

Credit indicated by our measure started to diverge notably from adjusted TSF since Q2 2015…

What about in 2016?

It is not feasible to construct our adjusted money flow measure for Q1 ’16 yet given data limitations, but judging from the continued ytd increase in banks’ “equity and other investment” assets (which has been statistically correlated with the gap between our implied credit measure and adjusted TSF), it seems that as sizable as adjusted TSF was in Q1 (at about RMB 7.5tn), it might still understate the underlying credit flow to the real economy. In recent weeks, the regulator has announced some prudential tightening to discourage shadow lending activity, but how aggressively the regulator will implement the rules and the how effective the tightening will be remain to be seen.

Goldman’s conclusion, which probably does not need much explanation because it is simple enough: China’s debt is far greater than anyone expected, is the following:

An uncomfortable trend that has gotten more discomfortingThe results of our analysis have a few implications for our macro outlook:

- In terms of short-term growth, our implied credit metric suggests that credit impulse to growth may be greater than that based on adjusted TSF, although the difference in magnitude may not be very significant.

- For monetary policy, given that lower wholesale interest rates tend to give rise to more shadow lending, to the extent that the authorities intend to contain the latter, the scope for a meaningful fall in 7-day repo interest rate seems more limited in coming months unless growth sharply slows, in our view.

- More worryingly, our implied credit metric indicates that the trend of China’s leverage has probably deteriorated faster than we previously thought, even though we had already expected the ratio to continue rising in the next few years. Compared to our previous estimates, the experience in 2015 suggests that the economy’s dependence on credit has deepened significantly and that it likely needs sizeable flow of credit on a persistent basis to maintain a stable level of growth. The chart below shows how much more unfavorable our baseline debt/GDP projection is now after incorporating our implied credit metric for 2015 vs. what it was based on data only until 2014.

- Such a scale of deterioration certainly increases our concerns about China’s underlying credit problems and sustainability risk. The possibility that there is such a large amount of shadow lending going on in the system that is not captured in official statistics also points to regulatory gap, and underscores the lack of visibility on where potential financial stress points may lie and how a possible contagion may play out.

Surge in shadow lending implies faster growth in debt-to-GDP ratio

In other words, not only was China lying about everything else, it was also fabricating its broadest credit creation aggregate, with the underlying “new credit” number turning out to be far greater than anyone had expected (or believed). And for someone as traditionally conservative and Goldman to warn that “that the trend of China’s leverage has probably deteriorated “, that “that the economy’s dependence on credit has deepened significantly and that it likely needs sizeable flow of credit on a persistent basis to maintain a stable level of growth” and that “such a scale of deterioration certainly increases our concerns about China’s underlying credit problems and sustainability risk“, must mean that China’s economy is about to fall off a cliff.

Because once the rest of Wall Street catches up to Goldman’s most striking observation that “the possibility that there is such a large amount of shadow lending going on in the system that is not captured in official statistics also points to regulatory gap, and underscores the lack of visibility on where potential financial stress points may lie and how a possible contagion may play out”, then all those concerns about Chinese credit (and FX, and economic, and bubble) contagion will promptly return front and center to the global arena.

* * *

One final point: in recent days it almost seems that Goldman has been doing all in its power to precipitate a mini Chinese meltdown, whether short or long-term (recall “Goldman Unveils The FX Doom Loop: Turns “Outright Negative” On Yuan Due To “Weak Link“” from Thursday night).

To be sure, the narrative over the past 6 months from everyone, has been “how stable” China has been. Well, Goldman just broke away from that very fragile game theoretical equilibrium in which everyone was desperately lying to preserve asset prices, by actually telling the truth and precipitating what will be the next crash.

Why, we don’t know. However, with China now the fulcrum in any local or global central bank decision, and also the underlying catalyst for any marketwide risk-off bout, we do know that what Goldman “discovers” and warns about, soon everyone else on Wall Street will do too, until it becomes common knowledge and risk assets reprice correspondingly. Trade accordingly.

Source: Goldman Finds that China’s Debt is Far Greater Than Anyone Thought – ZeroHedge