By Tyler Durden at ZeroHedge

The G-20 Shanghai summit was a dud; China’s People’s Congress fizzled (even if it unleashed the biggest iron ore rally in history, however brief); and so – in a month full of expectations for major policy stimulus (which have so far been vastly disappointing), we approach the one event that is most actionable: the ECB’s March 10 meeting and press conference, where expectations are, just like back on December 3, so great – some expect up to a 20 bps rate cut to -0.5%, others expect QE to be increased from €60BN to €70BN per month, yet others believe that Draghi will either extend the TLTRO, expand the pool of eligible collateral or introduce tiering in the negative rates schedule like Japan; Credit Suisse believes the ECB will start buying corporate bonds – that the market’s pent up hope for stimulatory relief can only lead to disappointment, especially after a bear market rally as furious as this.

Indeed, some such as SocGen, admit as much: as Michala Marcussen says, “our view remains that monetary policy is near the limits of what it can achieve in isolation; structural reform and fiscal stimulus is required next.”

Bloomberg’s Richard Breslow was particularly poetic this morning when he wrote that “meddling with the monetary system had its day. The ECB, and the BOJ, among others, are increasingly looking like one trick ponies. Even if you agree it was a really good trick, at some point it losses all impact on the audience. And that is a real danger as the QE transmission mechanism can’t work if it fails to impress. From Davos to Shanghai we have been treated (tortured) with hearing central bankers talk longingly about fiscal policy. And then go off and ramp up monetary policy. The tact they employ in criticizing their governments is utterly the wrong tack.”

We wholeheartedly agree with this searing observation, because Breslow is 100% correct: even as they blame the fiscal authorities for not doing their job (and the Fed has been particularly vocal in bashing Congress), central bankers do everything in their power to prevent the “risk off” market selloff that could finally force the required fiscal change and awake governments from their stupor. We highlighted this paradox 5 years ago when the Fed was launching QE2 and nothing has changed since even though now both the BIS (whose directors ironically are the same central bankers its economists love to criticize each quarter), and the Davos billionaire set, both agree that central planning has not only gone on for too long, but has lead to unprecedented and adverse consequences.

And while there appears to be a disturbing, and 7 years late, break out of common sense among even the tenured “intellectual oligarchy”, one bank refuses to hand over control, and instead has released a note telling Mario Draghi in no uncertain terms, that it is “Time for the ECB to step it up.”

In the note by Robin Brooks, whose abysmal FX recommendations in past few months, and whose epic, and just as overoptimistic misread of the December ECB meeting left Goldman clients with billions in losses, have made many ask if he is the next incarnation of the inimitable Tom Stolper, he admits that “one year since the start of ECB QE, the program is in trouble.” What he means is that his recommendation for EURUSD parity, and even as low as 0.90 by the end of 2017, is in just as big trouble.

So, in order to avoid disappointing his former employer – recall that Draghi himself worked as Goldman when he was selling Greece those infamous currency swaps – once again, this is what Goldman’s FX strategist recommends the ECB should do.

But first, this is how Goldman suggests Draghi pitch his case to his ECB peers:

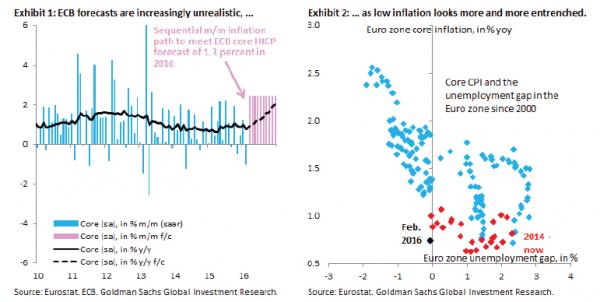

On perhaps the most important metric – inflation – we are almost back to where we started, with core near last year’s low of 0.6 percent. Looking through the lens of the inflation mandate, sequential (month-over-month) inflation needs to triple from its pace over the past year for the ECB to meet its already low forecast for core of 1.3 percent in 2016 (Exhibit 1). Put another way, our European economics team forecasts core at just 0.9 percent this year. There is therefore little doubt in our minds that the ECB is missing its mandate and – given the miss on core – that this is not just a story about lower oil prices. Instead, the Phillips curve in the Euro zone may have shifted down, which would explain why core has failed to pick up even as the unemployment gap has closed (Exhibit 2). The fact that this downshift originates in southern Europe, as we have shown, suggests that structural reforms are pushing wages and prices lower, giving a deflationary bias to the periphery, such that Euro zone inflation is now lower ceteris paribus. If this is true, low inflation is a more serious problem than the ECB believes and requires forceful action. In this FX Views, we lay out scenarios for EUR/$ for different outcomes on Thursday. Above all, after a year of mixed messages, the ECB needs to signal that it is serious about pursuing its inflation mandate, including via a stepped up pace of monthly QE purchases.

Or else? And here is where it gets good, because Goldman basically lays out, point for point, what Draghi should do on Thursday if he wants to remain in his cephalopod master’s good graces:

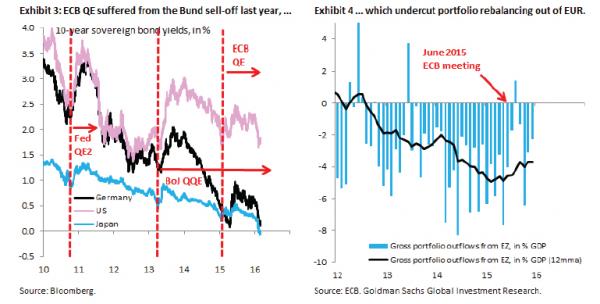

There is little doubt in our minds that the ECB wants to surprise this week, not just because of the inflation picture, but also because it disappointed in December, inadvertently tightening financial conditions materially. The question is whether it will choose to do that on the deposit rate and/or sovereign bond buying. From the perspective of EUR/$, we think it is helpful to go back to first principles. The main goal of any QE program is to encourage a portfolio shift from the safe haven asset – Bunds in the Euro zone – to risky assets, including foreign currencies. The sharp Bund sell-off a year ago, not to mention the volatility since then (Exhibit 3), have impaired the functioning of ECB QE, as can be seen from the pull-back in residents’ portfolio outflows following President Draghi’s comment that “markets should get used to periods of higher volatility” at the June press conference (Exhibit 4). Our first preference is therefore for the ECB to simply stabilize Bund yields at a relatively low level, similar to what the BoJ has done since the start of QQE. This is the most powerful option for Euro down and would require the Bundesbank to adjust the maturity of its Bund purchases to market conditions. A shift from Bunds to more periphery debt, for example by relaxing the capital key, is next up in our list of preferred measures, where our rule of thumb is that an EUR 100 bn surprise is worth one big figure downside in EUR/$. Another cut in the deposit rate is our least preferred option, because we see the effect from negative interest rates as relatively limited. We think a 10 bps surprise is worth two big figures downside in EUR/$. Given how much is priced and the negative perception of tiering, this is the least powerful option.

Goldman has spoken and it demands more QE. NIRP is its least favorite option.

In the next paragraph, the vocal “urges” of what the ECB should do continue, and here we find that according to Goldman, that major Bund selloff of last April, was precisely at the behest of the ECB as we suggested, and as many accused us of the usual tinfoilhattery. We were right.

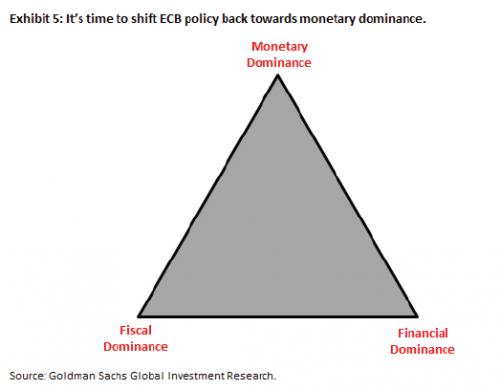

Any QE program has distributional consequences, by penalizing savers at the expense of debtors. At the ECB, the interests of savers (and the financial sector that serves them) are represented by the Bundesbank, perhaps the single most important constituency within the central bank. As we showed last year, the Bund sell-off in April/May coincided with the Bundesbank reducing the maturity of its purchases (when to anchor yields it should have done the opposite), so that – in our minds – the sell-off was partly a policy decision. We see this as a form of “financial dominance,” with savers impeding forceful QE, a concept our European team discussed in early 2014. Meanwhile, shifting purchases towards periphery debt is less powerful for Euro downside, especially if it coincides with a steeper and more volatile Bund curve, because it more closely resembles a quasi-fiscal operation, helping the periphery sustain large debt burdens, aka “fiscal dominance.” Finally, the debate over tiering, which aims to shield banks from the adverse fall-out of negative interest rates, is just another example of “financial dominance.” The fact that monetary policy is subject to lobbying from different vested interests is of course nothing new. But in the case of the ECB, this is coming at the expense of “monetary dominance,” meaning that policy is not quick and forceful enough to boost inflation back to the mandate (Exhibit 5). Ultimately, we think monetary dominance will reassert itself, given that the ECB has only inflation as its target. That is the underlying reason why we continue to hold to our 0.95 forecast for EUR/$ in 12 months.

Goldman’s conclusion is that “the ECB needs to surprise this week, not because of markets, but because – given the trend in core inflation – the existing policy mix is behind the curve.” Translation: the ECB has to surprise because of markets. Brooks continues:

Given the political economy within the ECB and what is now priced in money markets, we think the biggest margin for surprise will be to step up monthly purchases and signal that “scarcity” is not a constraint [ZH: even though it clearly is] including via shifting away from the capital key. Our rule of thumb is that an EUR 100 bn surprise on sovereign bond buying translates into one big figure down in EUR/$. Most important, beyond specific measures, we believe it is time for the ECB to step it up and reassert “monetary dominance” over all other interests.

Which is how Goldman lays down its ultimatum to a central banker whom it itself spawned. Then again, Draghi already defied Goldman once in December. Would he dare to do it twice? For one thing, Robin Brooks career at Goldman would certainly be over if he were to once again lead Goldman’s muppets into the ECB slaughter. Another 3-4 big figure search in the EURUSD, and Goldman wouldn’t have to fire Brooks: his former clients may just take matters into their own vigilante hands.

And therein lies the rub, because implied threats or not, according to MarketNews, the possibility of an ECB disappointment is all too real. This is what MNI reported last week:

The European Central Bank is likely to add a further deposit rate cut to its fight against low inflation and tepid growth in the currency area next week, but multiple conversations with a variety of Eurosystem sources indicate little or no consensus yet for action beyond a ‘plain vanilla’ rate move. While market expectations of a comprehensive easing package from the Governing Council are on the rise, policymakers from the world’s biggest economies warned last week at the G20 meeting in Shanghai that monetary efforts alone cannot address the issues of confidence and demand that are currently stifling growth.

Oops. If true, and going back to Breslow’s point, that would mean that Draghi will disappoint on purpose, precisely to stimulate a fiscal intervention and to keep the monetary toolkit at bay. If so, Goldman is in for a huge disappointment.

Against that backdrop, conversations with several senior Eurosystem sources indicate that while most are open to moves that can ignite growth and inflation without creating further risks to the region’s financial stability, there remains a great deal of uncertainty with respect to the viability of specific policy options and much will depend on both the Executive Board’s proposals and the new staff macroeconomic forecasts to be presented at the meeting.

The quotes confirm as much:

“I don’t think that monetary policy has reached its limits, but it’s a question of whether it marginally adds to the efficiency of what we’re doing with the instruments we have,” said one senior Eurosystem source. “There is a pretty much unlimited arsenal of instruments we can use. But the question I see and always ask myself is whether we are hitting the right buttons.”

To be sure, nobody doubts the ECB can do more, the question is whether it should do more:

Multiple conversations with Eurosystem sources revealed some concern with respect to the limits of monetary policy, although a large majority agreed there were still plenty of options for the Governing Council, even as they lamented the lack of fiscal support from Eurozone governments.“Monetary policy isn’t paralyzed, but it’s not the only game in town,” said a second senior Eurosystem source. “Within our limits and competencies, I think we do have influence, and we have proven efficient in terms of reducing long-term interest rates, improving credit conditions and stabilizing inflation expectations.”

“The huge handicap I’m seeing now is the European political environment; Europe is going through one of its major crises, I’m afraid, with even Schengen on the table.” The first source agreed.

And herein lies the rub: even the ECB realizes that the time for passing the buck to Frankfurt is over.

“I had hoped the ‘Juncker Plan’ would be there already, but it’s not yet,” the source said, referring to the E315 billion European Fund for Strategic Investments championed by Commission President Jean-Claude Juncker. “And every month that the Plan is not there, we are missing opportunities to have an impact from it. I have no idea what the European Commission is doing about that.”The same source also indicated a certain degree of remorse with respect to market expectations and the burden being placed on central bankers – largely as a result of the Bank’s previous activism.

“There is a refugee crisis; what could the ECB do? There is climate change; oh, the ECB needs to do something. I have the hiccups; oh, the ECB should do something … it’s crazy,” the source said. “I find this completely ridiculous and irresponsible. But we got ourselves into this.“

Yes, an ECB source said that, and he or she is right: you got yourselves into this, and there is only one way to get out – by demonstrating that you will no longer operate at the markets’ every whim and allow Brussels to punt at a time when they have to make decisions. To do that you will have to disappoint not only the market, but the banks that is confident it owns your boss.

Will the ECB finally have the guts to say no to Goldman? We doubt it, but just in case, we are going long the EURUSD if only for symbolic support value…

Source: Goldman Gives Draghi An Ultimatum, But the ECB May be Finally Ready to Snap – ZeroHedge