On August 31, 2008, Germany’s Commerzbank announced that it was purchasing ailing rival Dresdner Bank from Allianz SE. As usual, however, the deal wasn’t described in those terms as nothing ever is so honest in public. Then-Allianz CEO Michael Diekmann said at the time of the announcement:

As a strong bank, the new company can safeguard jobs in the long term. With a stake of nearly 30 percent Allianz will be the largest shareholder of the new bank and will gain access to a powerful distribution network for its insurance products. The move will also secure the further success of its bancassurance strategy.

Just four months later, Commerzbank was becoming partially nationalized due to the “strong bank.” By taking in €10 billion from SOFFIN, Germany’s bank bailout vehicle, at the outset of 2009 the merger could proceed. Without the “capital”, Commerzbank would have walked and left Dresdner (and Allianz) likely to be wholly nationalized (because failure is not an option anymore). As one “insider” was quoted as saying, “the government just couldn’t afford to let this deal fail.”

For its part, Commerzbank spent years recovering from not just Dresdner but its own wholesale realities. The total rescue would total about €18 billion before it was all over, and that was a heavy burden on the bank. Thus, it wasn’t until November last year that the bank could finally pay a dividend again, a significant milestone on the firm’s road to recovery. The huge positive step by paying out the announced dividend earlier this year was not just a favorable impression on the bank’s fortunes but also those of Germany and its long road from “necessary” nationalizations.

As has become typical of global banking, however, it wouldn’t last long, as yesterday the bank announced a massive restructuring that intends to displace about 9,000 jobs, 20% of its total workforce. And, in what can only be a massive blow, new CEO Martin Zielke apparently intends to ask the board for permission to once again suspend the dividend.

“Something” must have drastically changed this year where everything was supposed to be so much better. Instead, even the media has taken to blaming what was once universally described as “stimulus”: NIRP. As Bloomberg reports today, “Zielke, 53, has been under pressure to reverse a slump in earnings that forced him to scale back full-year profit goals, hurt by negative interest rates and volatile markets.”

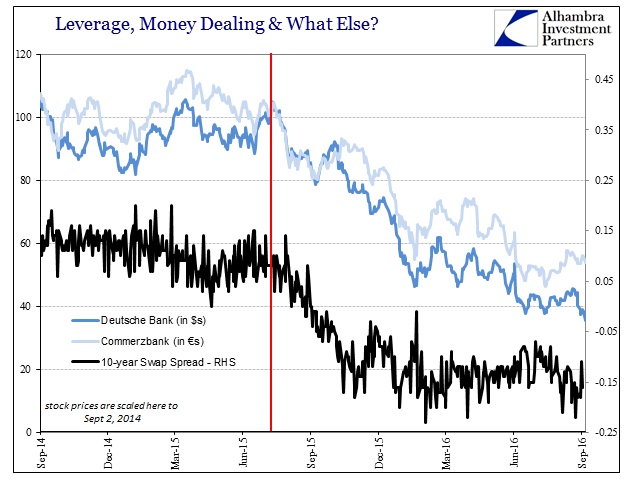

While adding negative interest rates to the negative side of the banking ledger is actually progress, the real story, as usual, is what is left mostly unsaid: “volatile markets.” The bank’s stock price looks suspiciously like that of its bigger German cousin, Deutsche Bank. When Commerzbank announced that it was restarting its dividend at the beginning of last November, the share price was €10.69; Friday, before the announcement of renewed reorganization, the stock had closed at €6.307.

There is much more than NIRP going on in Germany and elsewhere, as there are clearly risks and conditions that aren’t being reported in the mainstream. As a bank, you don’t go from establishing a hugely positive trend by restoring the dividend only to take it away just a short time later (potentially) without a significant financial change in between. It goes without saying that any kind of shift that would lead to such an abrupt and damaging turnaround had to have been hugely negative.

There is, again, far too much similarity between DB and Commerzbank in terms of their share price histories. It suggests that there is not something wrong each with Deutsche and its rival, rather there is a singular “something” being shared by both. Further, by virtue of both banks’ efforts now to restructure, DB’s curiously having been announced almost simultaneously with Commerzbank’s dividend restoration, we can surmise that this “something” became a common burden of at least German banking sometime in 2016.

Obviously, this negative pressure is not limited to German financial conditions nor NIRP which had been instituted all the way back in June 2014. Thus, we are left with “volatile markets” that clearly plagued the one German giant before corralling the other. I believe that describes quite plainly the two halves of 2015 – where the “rising dollar” was first a problem in more localized fashion, no less of a material disruption just isolated into pockets (like Switzerland). The second half of last year was more uniform in its action and intensity, taking place all over the world and almost all at once. DB was one of those figuring into the 1st part whereas Commerzbank was not.

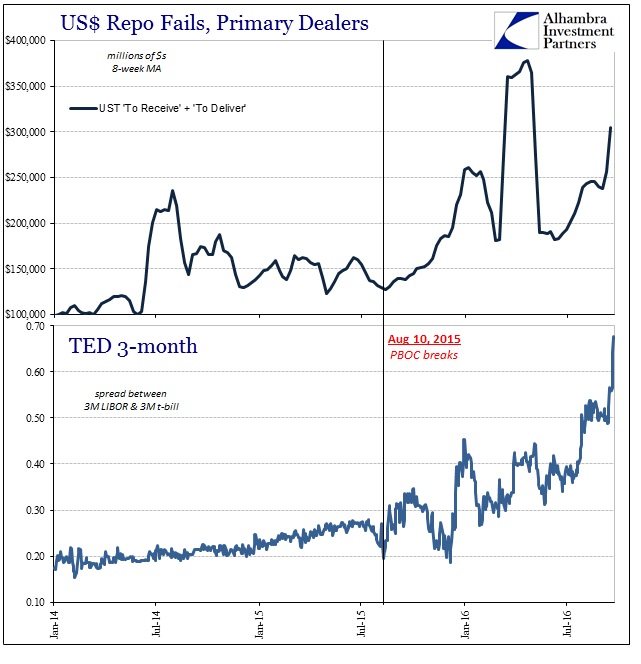

After the “volatile markets” of the second part, there was no escape for anyone in more systemic fashion, a fate to which even Commerzbank’s once cemented recovery has since succumbed to. In other words, “global turmoil” or “volatile conditions” is not actually limited to just the specific liquidation episodes of August 2015 and January/February 2016. There is much, much more going on here than is being reported.

What I wrote specifically for China in kind applies to Commerzbank:

Such drastic changes and blown expectations immediately call our attention to the “dollar.” Why has the PBOC sacrificed its post-August 2015 liquidity regime to stick CNY at around 6.68 to 6.685 – not even 6.70 anymore? The fact that Chinese money markets are now such a huge and obvious mess can only mean that whatever it is about the “dollar” that caused this shift has been judged as the greater of these two “evils.”

How else do we explain the bank’s drastic step of possibly ending their dividend not long after restarting it? “Something” changed alright, and it is showing up in more and more places this summer and now early autumn.