On this side of the “dollar” world, credit markets have all but written Janet Yellen into irrelevance. Despite her pleas (because of?) last week, there isn’t any part of money dealing or fixed income that is taking her “certainty” about recovery and “inflation” as even a partial setting. So lost is the FOMC, that everywhere you turn these markets are moving opposite.

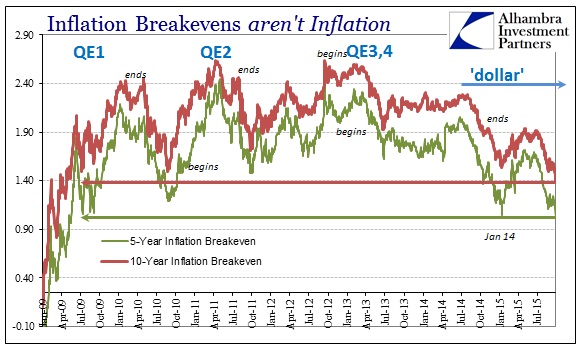

Where that has to sting the most is “inflation expectations.” Proving to be far more than just crude prices (which have largely been stable since August, at least in the view of not crashing again), breakevens are now at lows last seen in the dark days of 2009, surpassing that first “wave” earlier this year. Trading in the past few days has seen TIPS hedging interest drop sharply, which can only count as credit markets giving up on the recovery narrative in full – once (to January 14) might be “transitory”, but twice eight months later and at new lows is goodnight Yellen.

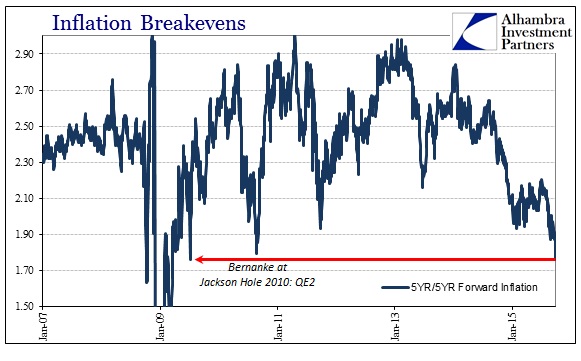

What really drives home that point is that the same new low has been visited in the FOMC’s “preferred” measure of forward inflation expectations, the 5-year/5-year forward rate. That measure (through yesterday’s liquidation) has dropped more than 10 bps just since Thursday’s close – when Yellen was last seen meekly projecting her “professional forecasters” of long-term expectations anchoring. This can only be interpreted as a direct market rebuke.

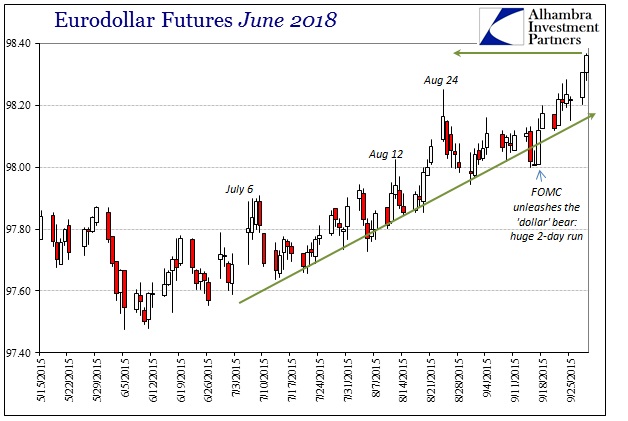

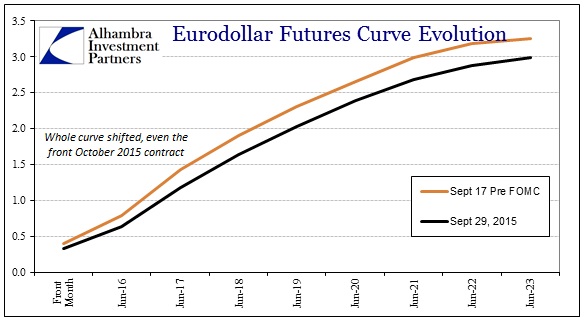

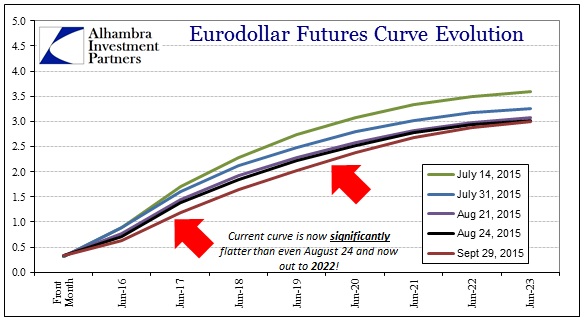

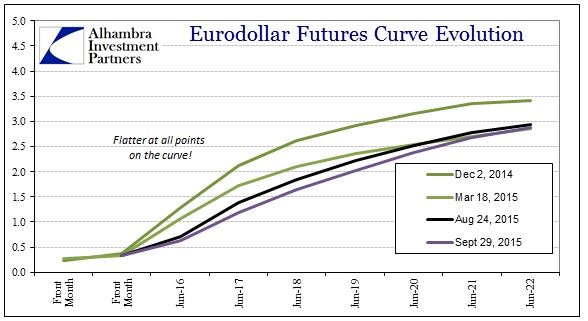

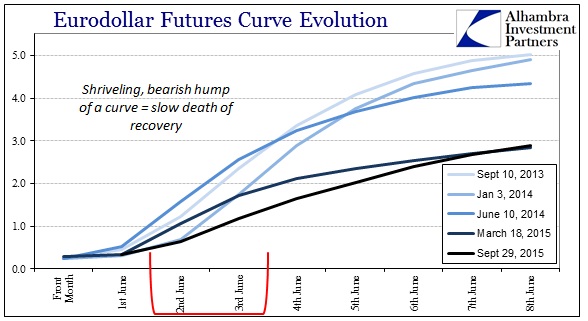

As I noted at the outset, that “inflation” view is not so much oil prices as it is “dollar.” Funding markets, including the Asian “dollar” again, have grown especially bearish in the past week, really dating back to September 17 when the FOMC basically confirmed what money markets have been suggesting in this latest “dollar” wave. The eurodollar market, in particular, is flushing in a manner that looks very much like another run (or the continuation of the previous to August 24; separated only by a short intermission rather than any kind of retracing perceptions).

The June 2018 maturity for eurodollar futures is a benchmark for me since it lies outside “expected” (for whatever that is worth) policy interference. In that maturity space we see how money markets are projecting the perceived effects of current policy against the economic and financial fundamentals in what “should” be a Fed-free time period. This has been growing steadily ugly since the “dollar” broke out last year, but since July it has been incredible. Again, inflation breakevens and forward rates seem to be following this view of money markets almost exclusively rather than purely crude oil. If so, it would be an end to the recovery as far as this credit view, meaning the “dollar” no longer pointing to potential economic downside.

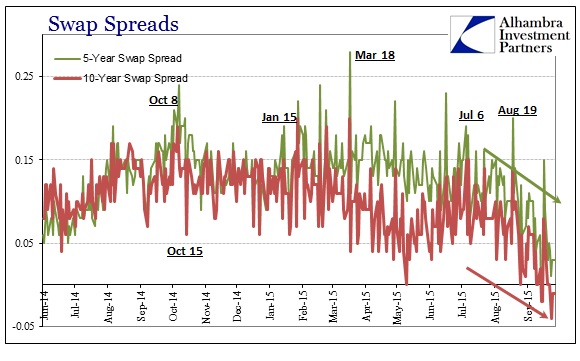

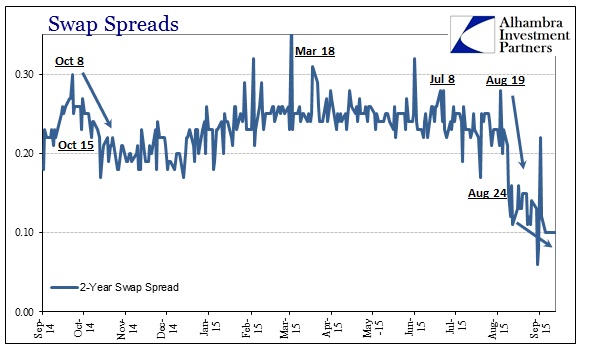

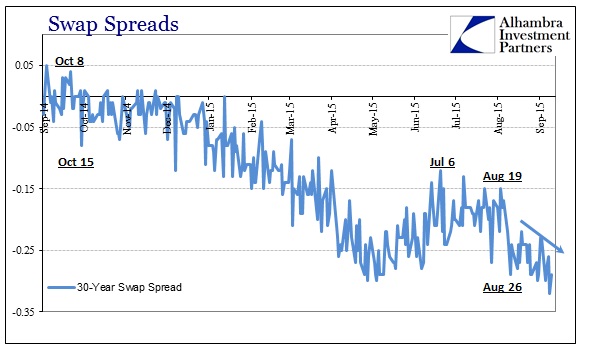

Since swap spreads are really just an extension of the money market view through eurodollar futures, those collapsing spreads (negative in far too many places) are just more confirmation of the bank-driven nature of the decay here. Like yuan liquidity in Hong Kong, all of these factors are tied together as the “dollar”; no central bank stands a chance against these waves and runs. This is far bigger than any one institution no matter how sterling their prior reputation (see: PBOC).

A financialized global economy will thus take its cues from the financial arena. Commodity prices and money markets are transmitting the downside of all that (again) into real channels of real economic activity. In many ways, this is exactly what orthodox monetary economics expects of “tighter” monetary conditions. The problem with their view is and has been they have little understanding as to what constitutes that wholesale “supply” to begin with (which is why bank “reserves” have had so little actual bearing on anything other than financial rationalizations, and even those are proving temporary).

As usual, central banks are stuck as if mainstream interpretations of late 2014 still apply, arguing against that first warning in the first place almost a year later (we are fast approaching the anniversary of October 15). That may suggest another reason why credit markets are following funding markets now, since central bankers appear content to demonstrate why they are always behind the curve (at best). Market perceptions that before may have been at least partially relying on the possibility of the Fed getting its act together about reality rather than rational expectations management of the fantasy are no longer so receptive to those promises (or the possibility of the fantasy). This shift may also further suggest acceptance of what I believe is the real state of financial affairs, aware or not, the Fed is powerless – talk is all there ever truly was.

In the short and intermediate terms, it is a distressing (though wholly unsurprising) sign to see these markets now focus on the “dollar” to the complete exclusion of Yellen and the FOMC. That would suggest an elevated alarm beyond what was in play even in the period leading to the August fireworks. There are two implications of that amplification, namely that the “transitory” idea is at least dying and how that relates to economic expectations in this latter “dollar” episode. In other words, if the first “dollar” wave suggested the outlines of potential global recession (a warning), this second is starting to examine and determine its depth (a confirmation) as if the FOMC doesn’t matter at all.