US businesses want to hire millions of workers. The problem is that nobody wants the jobs that those businesses are offering. They don’t pay enough to entice potential hires off their parents’ sofas. So the jobs listings grow.

If you’ve been around [The Wall Street Examiner] for more than a minute, you know well that we dispense with the silly, oft revised, abstract impressionism of seasonally adjusted data. If done properly, actual unadjusted data is easy to analyze and far more reliable. Not seasonally adjusted, actual job openings rose by 680,000 at the end of January to 5.05 million. The December-January change is usually strongly positive. The 10 year average for January is an increase of 542,000 jobs. As Januarys go, the month to month gain of 680,000 jobs was the highest since January 2007, just before employers figured out that the economy was plunging. The current gain is 27.4% higher than the level of January 2014 which is also an enormous gain.

The chart doesn’t lie. It’s easy to see that the increase in job openings is accelerating.

But exactly where is the big growth in those job openings? Except for government jobs, which contrary to popular belief are a tiny portion of the labor force, most of the job openings are in the low pay sectors. 62% of the job openings were in sectors which pay the lowest wages in the US economy.

Professional and Business Services includes high paying jobs but about 40% of the jobs in that sector are very low wage jobs (see Note below). If we include just those jobs, then approximately half the total job openings are in very low wage jobs, the kind that would hardly support a family let alone allow for discretionary spending. This is far from a normal distribution.

Low wages are likely why the ratio of new hires to job openings in January continued the trend of all time record lows since the JOLTS survey began in 2000 (see Note 2 below).

The 5.05 million job openings were the record for January in terms of total job openings.

But more interestingly, for the last 2 months the number of openings per million of US population has been right at the levels reached at the top of the housing bubble, in fact well after the air had already started to hiss out. Stocks topped out a year after the top of the housing bubble and employers follow the stock market. The stock market was sanguine and wrong about the state of things. Employers were the last to get the news. Perhaps it’s the same story today, 9 months after the collapse of the US oil and gas bubble and production boom.

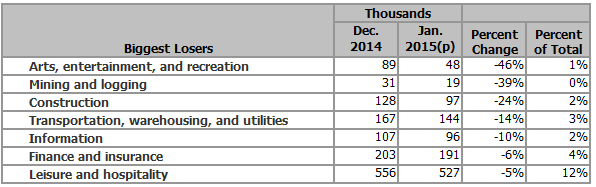

Clearly, employers in that oil and gas extraction sector and related sectors have gotten the news. Job postings in Mining and Logging, which includes the Oil and Gas sectors, were down a whopping 39% year to year. That was second only to Arts, Entertainment, and Recreation. The culture vulture sectors are always the first to suffer cuts when things start to go south. This is a canary in the coal mine.

Here’s a list of the biggest losers.

Clearly there are some surprises there. Core economic sectors like transport and warehousing, construction, and information took big hits. But the bloom also appears to be off the rose in the Finance sector, which had for so long been the prime beneficiary of ZIRP and QE. That’s not a good sign. Finally, those who serve upper income consumers in the leisure and hospitality industry, another low pay sector that had been booming, saw job openings turn south. These are all indications that the bloom is off the berg.

NOTE:

The Professional and Business (PB) Services Category is divided into several sub categories. The biggest ones are Professional and Technical (PT) services and Administrative/Waste (A&W) services. Each accounts for about 45% of the total. Corporate management accounts for the rest. 93% of the workers in A&W were production and nonsupervisory. The average weekly pay for that group was $569.60 in December. So 40% of all PB workers are low wage.

The average weekly pay for production and non-supervisory workers in the PT group was $1167.84, up about 3.5%. The takeaway there is that about 45% of the jobs in the overall PB sector are paid well above the average wage.

Where are most of the jobs? There were 300,000 net hires in the PT category over the past year and an increase of 360,000 in A&W.Most of the job openings therefore appear to have been in the low wage categories.

There were some good job openings in the JOLTS numbers, but most were low pay jobs that few workers want to take. There’s also a suggestion in the low rate of hires that business can’t find workers with the skills needed to fill the higher paying jobs.

NOTE 2: This ratio is usually greater than 1.0 because job openings are counted as of the end of the month, while hires are counted as accumulated on a daily basis for the month as a whole.