The fact that initial unemployment claims keep making record lows does not mean what Wall Street and its Big Media PR flacks want you to think it means.

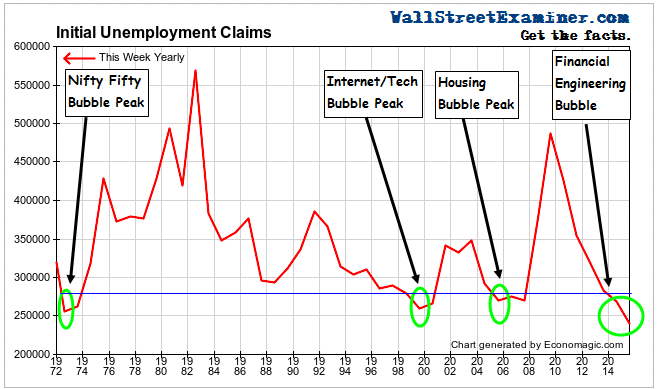

First time claims for unemployment compensation continued their string of record lows for the same week of the year. The actual number, not subject to any seasonal hocus pocus was 263,427. That was just 1,858 claims per million employed workers last week. That compares with 2,270 per million in the same week of 2006 just as the housing bubble was on the brink of deflating, and 2,294 in that week of 1999 as the internet/tech bubble was peaking.

The Department of Labor (DoL) reports the unmanipulated numbers that state unemployment offices actually count and report each week. This week it said, “The advance number of actual initial claims under state programs, unadjusted, totaled 263,427 in the week ending November 14, a decrease of 27,633 (or -9.5 percent) from the previous week. The seasonal factors had expected a decrease of 22,113 (or -7.6 percent) from the previous week. There were 286,115 initial claims in the comparable week in 2014. ”

Click here to view chart if viewing in email

We use actual data, as opposed to the seasonally manipulated headline numbers which Big Media shovels out for mass consumption. To see from the actual numbers if there’s any evidence of trend change we must look at how the current week compares with the comparable week in prior years.

The actual change for the current week versus the prior week was a decline in claims of -27,633. The 10 year average for actual data for that week was a decrease of -22,688. The same week last year saw a decrease of -23,233.

Week to week changes are noisy. The trend is what matters. Since 2010 the annual change rate each week has mostly fluctuated between -5% and -15%. Last week was within that range with a year to year drop of -7.9%.

A persistent shift to a year to year increase in claims would be a sign that the US economy is headed for recession. That has yet to happen.

The stock market is a key. When it weakens, employers normally take their cues from that. The Fed knows that businesspeople watch the stock market and often base hiring and firing decisions on its direction. A weakening market would not only make the Fed even more cautious about attempting the charade of raising rates, it would at some point possibly even put QE back on the table.

In spite of all the evidence from Japan, Europe, and the US that QE stimulates only financially engineered bubbleization and not real economic growth, central bankers continue to believe the economic mythology that it does. So the Fed has been cowering in reluctance to shrink its balance sheet and return to any semblance of a “normal” monetary policy.

In the meantime, the Fed has enabled and encouraged financial speculators and corporate executives to carry out a massive skimming operation which impoverishes an ever increasing portion of US households. Likewise, businesses have acted out a low-pay job hoarding bubble in response to the signals from the Fed QE-driven stock market bubble that has only recently stopped bubbling.

Click here to view chart if viewing in email

Employers saw the housing bubble beginning to deflate in 2006 and reacted accordingly, starting to lay people off that year. Stock traders were the last to get the news as the Fed kept growing its System Open Market Account (SOMA) at the then “normal” growth rate of 5% through mid 2007, when it stopped, before shrinking the SOMA late in 2007 and 2008.

The Fed stopped growing the SOMA last October. Since then stock prices have leveled out. But employers continue to hoard their low paid workers.

The longer this goes on, the closer we come to the next “adjustment.” It won’t be pretty.

I chart and analyze the real time Federal Withholding Tax data in the weekly Wall Street Examiner Pro Trader- Federal Revenues report. It has been an excellent predictor of final revised non farm payrolls and GDP.

Addendum (Reposted from earlier reports)

In the Tale of Two Economies, massive gains accruing to the investor/speculator/corporate mafiosi class skew the headline economic numbers positive while the bulk of the American people experience no gains. QE and ZIRP have caused Ben Bernanke’s trickle to pool at the top with the banker/speculator/investor/corporate looter crowd. Meanwhile, the vast majority of American families have seen their household income stagnate for more than a decade as QE and ZIRP create perverse economic incentives that work to their detriment. The ever increasing economic drag which that creates will eventually result in negative top line numbers, but we aren’t there yet.

Record low claims are the patina of policy success that Wall Street and the dangerous, corrupt media empires that spread its propaganda use to anesthetize and hypnotize the public. The data hides the basic truth that most Americans are not doing well economically. These record claims represent a bubble that was born out of and is joined at the hip with the financial engineering bubble that has been metastasizing in the US economy for a generation.

We can thank central bank policy for the economic divide it has wrought and for the long term adjustment that lies ahead. The stock market faces the problem of reduced long term profitability that will ultimately result if most Americans can’t afford to buy the products and services that corporate America produces.

If you are new to these reports, here is a review of the key historical antecedents of the extreme readings on initial claims from a post, August 13, 2015.

Historical Initial Claims and Bubbles

Click here to view chart if viewing in email

“In recent weeks, Big Media and others have noted the fact that claims were recently lower than the record low of 1973. What they failed to mention was that that low came well after the Dow reached an all time high in January of that year. The devastating 1973-74 bear market, which cut the value of stocks by 50%, was in its early stages. This was an early example of employers being late to the funeral.

“Similar employer hoarding of workers has been associated with bubbles in the more recent past and has led to massive retrenchment, usually within 18 months or so. In the housing bubble, employer hoarding behavior continued well beyond the peak of that bubble in 2005-06.

“It’s worth noting that there was an institutional stock market bubble in 1972-73. It was the Nifty Fifty bubble, where the biggest best known stocks kept soaring while everything else in the market went nowhere. A bubble does not require mass public participation. Institutional bubbles are just as insidious, even more so.

“The current string of record lows in claims is now 6 months beyond the point at which other major bubbles have begun to deflate. Based on the fact that previous records were attained at and for some time after the peaks of massive bubbles, by that standard, the current financial engineering, central bank bubble finance bubble, which is very much a big money, institutional bubble, may be the bubble to end all bubbles!

The post Here’s Why You Should Be Very Worried About These Bullish Claims was originally published at The Wall Street Examiner. Follow the money!