The Wall Street Journal gave the National Association of Realtors’ (NAR) existing home sales report a slightly negative tilt on Tuesday. The headline and subhead looked like this.

U.S. Existing Home Sales Fell 2.8% in December

Limited inventories and higher mortgage rates could hold back the market in 2017

The tinge of negativity is a bit surprising given that Dow Jones is a sister unit of NewsCorp’s Realtor.com and NewsAmerica Marketing, whose slogan is “Your marketing objectives are our business.” Tuesday’s report even went so far as to reveal “News Corp, owner of The Wall Street Journal, also operates Realtor.com under license from the National Association of Realtors.” That’s a step forward for them. Past disclaimers only informed readers that News Corp was also the owner of Move, Inc. which they said performed marketing services for the NAR. So the more recent disclaimer is a big improvement. On the other hand, in this week’s report, the disclaimer was buried in the last line of the article. That’s a step back.

At least the current report seemed more balanced and insightful than we have become accustomed to from the WSJ. The paper reported that:

U.S. home sales slid in December, a sign that rising prices and higher mortgage rates are taking a bite out of the housing market.

Purchases of previously owned homes, which account for the vast majority of U.S. sales, declined 2.8% from November to a seasonally adjusted annual rate of 5.49 million last month, the National Association of Realtors said Tuesday.

Their analysis noted that strong sales in 2016 as a whole were unlikely to be sustained.

The monthly decline capped the strongest year for housing since the peak of the real-estate boom a decade ago, and suggests it might be difficult to sustain the momentum in 2017.

As with virtually all economic data releases, both private and from the government, the NAR report features seasonally adjusted (SA) annualized data. SA data usually under or overstates the strength of the trend in the initial monthly release, and often misrepresents it entirely. So I rely on actual data that is not statistically massaged to artificially smooth seasonal patterns. It is much easier to see the state of the trend on a chart of actual data than it is to look at a mystical SA chart that may or may not represent the actual current state of the trend.

Before we get into the data I should remind you that “Existing Home Sales” is a misnomer. The data actually shows the number of sales that went to final closing (aka “settlement”), during the month. The sale usually took place 1 to 2 months earlier, sometimes even 90 days. The sold sign goes up after the meeting of the minds between buyer and seller, that is, the signing of the contract for the sale.

The data on the actual number of contracts for the month is reported under the term “pending home sales” about 5 days after the “existing home sales” report. Closed sales are normally a few less than pending home sales because a small percentage of sales fail to close. Realtors refer to those as sales that “fell through.” That failure rate is an interesting measure of the state of the market.

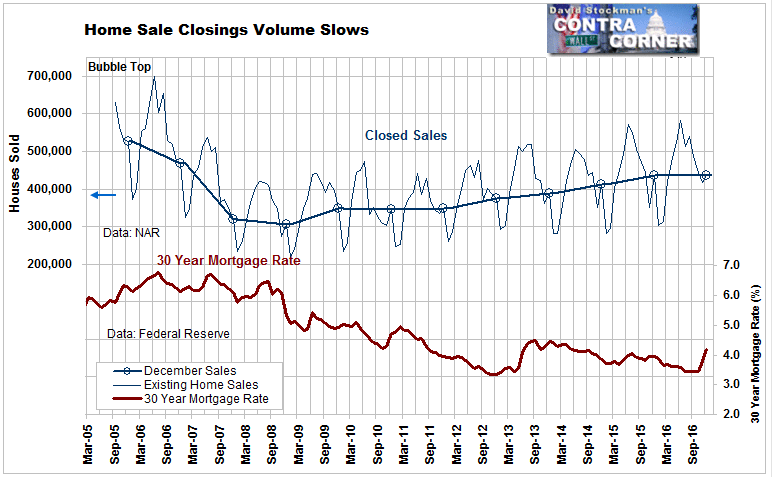

For December the actual number of closed sales of existing homes was 437,000. That was an increase of 19,000 units from November. These are mostly sales contracts that took place in October. December closings normally do increase from November.

The gain of 19,000 in December was pretty atrocious. December 2015 saw a gain of 85,000. December 2014 was up by 62,000. And December 2013 was up by 25,000. The average gain during the recovery from the housing crash was 36,000. Only once during the recovery was December worse. That was in 2012 when closings fell by 11,000.

On an annual basis December sales rose just 0.2% from December 2015. That’s a statistically insignificant gain. However, there were some changes in closing documentation rules that accelerated some sales to November that would have closed in December. Over the fourth quarter as a whole sales rose by 6.5% versus the fourth quarter of 2015.

That may sound bullish, but as a former real estate broker, mortgage broker, and commercial real estate appraiser, I don’t think it is. Instead, the sudden sharp rise in mortgage rates in Q4, accelerating out of a smaller increase in Q3, was the more likely motivator. Some buyers rushed to lock in low rates and close before rate locks expired. Others who had elected not to lock their rates also rushed to close before rising rates raised their monthly payment any further.

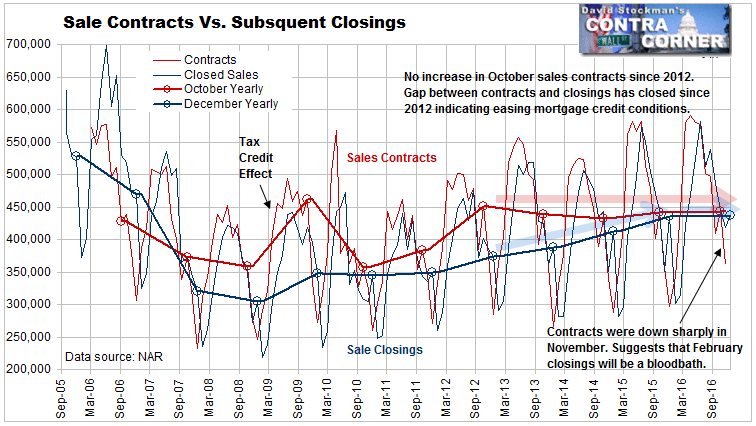

Another troubling aspect in the data is the fact that the number of October contracts has been flat since 2012. Steadily falling and record low mortgage rates have not stimulated more sales. However, the number of closings 2 months later has continued to rise. The gap between prior contracts and subsequent closings has narrowed to almost nothing. How can we explain the fact that sales closings have been rising when contracts have been flat?

The fact that far fewer sales contracts are falling through indicates radical easing in mortgage credit conditions. Underwriting standards have loosened dramatically. The credit quality of the buyer/borrowers in the incremental closed sales is inferior to the quality of credits in the early years of the recovery.

So it has required record low mortgage rates and easier credit conditions to keep the number of sales contracts in their current flat state. If mortgage rates continue to rise underwriting standards are also likely to tighten. This will be a double whammy for housing market standards. The sharp drop in November contracts already portends very weak numbers in the closed sales for January and February.

The next release of monthly contract data will be next Monday. Further deterioration in that number will be a strong sign that the housing party is over. Meanwhile, I’ll also take a look at how recent fundamental factors have created massive housing inflation in an upcoming report. It’s an unsustainable trend that bodes ill for the future of the housing industry and for the state of the financial system. I think that it will present a great short selling opportunity for housing related stocks and ETFs, and ultimately for the broad market.

Lee Adler first reported in 2002 that Fed actions were driving US stock prices. He has tracked and reported on that relationship for his subscribers ever since. Try Lee’s groundbreaking reports on the Fed and the Monetary forces that drive market trends for 3 months risk free, with a full money back guarantee. Be in the know. Subscribe now, risk free!