The headline number for the NAR’s existing home sales report increased 0.7% in November to of 5.61 million. That’s an annualized figure based on the seasonally manipulated (SA) monthly rate. Whatever error is included in the monthly number is magnified by 12. The SA number sometimes represents the actual trend more or less accurately, and sometimes it doesn’t. It’s impossible to know at the time of the initial release whether the number is a fair portrayal of reality.

Therefore we look at the actual counts for the month and compare them to the same month in previous years, to see how well or poorly last month did.

We also need to be cognizant of the fact that these are not “home sales.” “Existing Home Sales” represent the final settlements of sales that were done a month or two before when the contract was signed. The NAR reports that number in a release called “Pending Home Sales.”

As a former Realtor, I would simply call Pending Home Sales, “contracts.” They represent the meeting of the minds of buyer and seller. To those of us who are or were in the industry, a property is “sold” when it goes under contract. No doubt sellers and buyers feel the same way. The sold sign goes up, the property is taken off the market, and the price has been established. Although there’s always some nervousness about making it to closing, sold is sold.

On average about 95% of sales contracts close. However that can vary when financial conditions change, particularly if mortgage rates rise sharply, as they did in November. Some sales fall out when buyers who did not lock their mortgage rate no longer qualify. The mortgage isn’t approved and the mortgage contingency clause isn’t met. The sale falls through.

Conversely, buyers who have locked their rate may rush to close before the rate lock expires. Other buyers who gambled and didn’t lock their rate will accelerate their closing date so as to avoid any additional rate increase. This borrows closings from future months.

I suspect that happened in November as rates soared. Most media reports featured the fact that the rate of closings was at the highest rate in more than a decade. The media presented the November data with a rosy hue as always whenever they have a lazy excuse for doing so. That’s much easier than doing any real journalism.

However, to its credit the Wall Street Journal did point out that rising mortgage rates and rising sales would put a “crimp” in future sales. I think it will be much worse than a “crimp” as mortgage rates and sales prices rise to create a double whammy on the maximum mortgage payment that buyers can afford. If sellers do not immediately adjust their asking prices lower, sales are likely to collapse. And we all know that sellers are tenacious about trying to get their price, until it’s too late and the market has already dried up. Then prices fall with a vengeance.

The actual sales count for November was 415,000 units, down 30,000 from October. That was much better than November 2015, which saw a drop of 93,000. That was an outlier due to a regulatory change regarding mortgages. This November was also helped by having an extra business calendar day for closings to take place.

The average November decline for the past 10 years was 45,000, but the numbers were all over the place due to the crash in the early part of the period, and then government attempts at manipulating the market through home purchase tax credits. Under the circumstances this November was a middle of the road performance, better than the last 3 years, but worse than 2009-2012.

The year to year gain of 18% versus November 2015 is completely misleading due to the sharp drop in November last year. Fact is, however, that this November’s total sales were the strongest since 2006, at the tail end of the bubble. It is sharply higher than any November since the crash bottomed in 2010. I think that there’s a very good reason for that, and it isn’t bullish. This was the last hurrah for buyers who had taken advantage of mortgage rates at or near the bottom of the market.

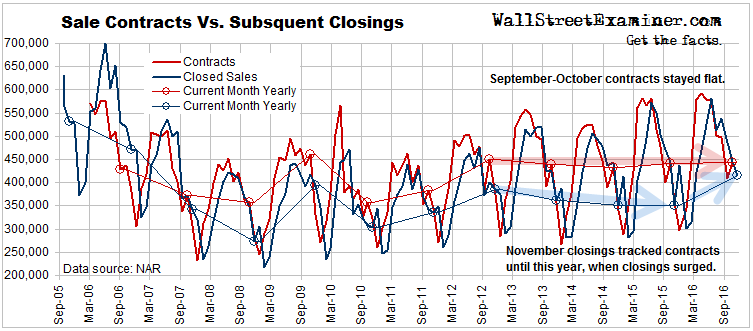

Unlike sale closings, the number of contracts in a month isn’t affected by the calendar or other anomalies. Buyers and sellers sign contracts 7 days a week, and realtors enter them into their MLS databases every day. We saw no sign of an increase in sales contracts in September-October. So what caused the sharp increase in closings in November?

The trend of contracts signed in October has been completely flat since 2012. Look also at the peak buying season in April-June. It was not materially higher than it was in 2015, in spite of mortgage rates falling from around 4% in the peak selling season in 2015 to around 3.5% this year. None of the data shows an increase in demand that would account for the November spike in closings. The data on contracts proves that sales have been flat.

From 2012 to 2014, the ratio of closings to contracts actually weakened slightly. That trend leveled out in 2015. Then suddenly last month the normal gap between these two lines narrowed sharply as closings surged. This anomaly was obviously not caused by an increase in demand.

What does account for it is the spike in mortgage rates that came in the second half of November. That triggered a panic. After the election of the Trumpinator, buyers concluded, probably correctly, that rates were not going to come back down.

Many of them had not locked their mortgage rates. Those who could still qualify, rushed to close before rates could rise any further. Many others had locked their rates, but faced a deadline in which they needed to close in order to keep that rate. These people may have also accelerated their closings.

If I’m correct we will see the impact of the higher mortgage rates in the November data on sales contracts (called “Pending Home Sales” by the NAR). That data will be published on Wednesday, December 28. Contracts should be weaker than normal for a December, and should be softer year to year. Then a month from now, in late January, we’ll get the data on December closings. This number should be downright awful, reflecting the number of closings that the current panic stole from what would normally have been December closings. That data should herald the end of the current episode of Zombie Housing Bubbles.