The foregone conclusions regarding currency devaluation in orthodox policy prescriptions are being turned inside out in Japan, where trade is behaving exactly contrary to all policy expectations. Getting from A to B sounds so tantalizingly easy and simple, but financial complexities (arising out of constant and persistent appeals to financialism itself) go beyond muddying the waters. The same holds true of the US version of QE, where the Fed, through the Open Market Desk, does not simply “purchase MBS”, there are production coupons and dollar rolls in the TBA market to consider.

Not to be left behind, the ECB is traveling down much the same road of intricacy. The stated policy goals, evinced under Mario Draghi more than anyone, took the form of simple steps; 1. Improve liquidity, leading to; 2. Reduction in interest rates, leading to; 3. Improved credit production, leading to; 4. Utopian economic recovery.

Go back to mid to late-2011, just as the euro crisis broke into the wide open and threatened a rerun of 2008. That was exactly the game plan as it was designed. The twin bill of the EFSF (or whatever acronym was going to fly the easiest) covering “capital” and the LTRO’s covering bank liquidity were supposed to directly contravene the credit damage that the orthodoxy posited as the primary economic culprit. Breaking the damn in the flow of interbank liquidity was the first step toward the assumed debt renaissance.

Complications, however, arose nearly immediately. The ECB couldn’t fix the PIIGS, so interest rates in the “periphery” continued to rise into the middle of 2012 despite an immense euro injection. Only Draghi’s eventual (and untested, as yet) promise to “do whatever it takes” arrested the interest rate defiling. So #1 never did lead to #2. And when #2 was actually achieved, throughout the end of 2012 and deep into 2013, it did nothing toward #3.

As I wrote just over a year ago on the same topic, that unleashed a bit of comic irony, “the ECB pushed banks into sovereigns but now complains that the banks are buying only sovereigns.” The calculus of bank credit apportionment is both utterly simple and not so simple – simple in that banks took Draghi’s guarantee and ran up the prices of PIIGS debt to unbelievable levels; not so simple as “bribing” banks to lend does not necessarily direct where and how they do so.

In this new age of European finance being “fixed” by the interest rate skew of Draghi’s promise, it has curiously gone without notice that lending into the financial system has continued to depress, rather heavily too. Lending to “other financial intermediaries” has suddenly tanked, beginning around July 2013 (coinciding “coincidentally” with dollar market taper interruptions). The peak in lending to MFI’s, on the other hand, dates back to June 2012, meaning the current downtrend started the month Draghi made his promise. In other words, it appears as if banks traded lending to each other to lending into sovereign debt – they do like “low risk” more than anything.

That would suggest a relative value proposition whereby the financial system was aided by the LTRO’s, and then “unaided” by the implicit support for sovereigns in close succession. The net result has been an “unexpected” decline in lending into the real economy.

Economic circumstances no doubt played a significant role in determining this credit crunch, but it is extremely difficult to ignore the timing of the acceleration of the loan retrenchment. Given the set of financial factors at that point, perhaps there was no choice in that the ECB was forced to put its emphasis on the most pressing issue of the period, which went from near bank panic to near currency panic. Even with that in mind, the trends evident above express nicely the texture of financial facets that never quite seem to make it into the planning stage of monetary policies.

I think it also highlights the limitations of central banking. There was never going to be a “cure” to the disease of the euro. No matter where the ECB decided to place primary emphasis it was bound to create problems elsewhere, the “whack-a-mole” process of constantly dealing with new and recurring problems. In that respect, the economy bore the brunt of finance-first policy (once again).

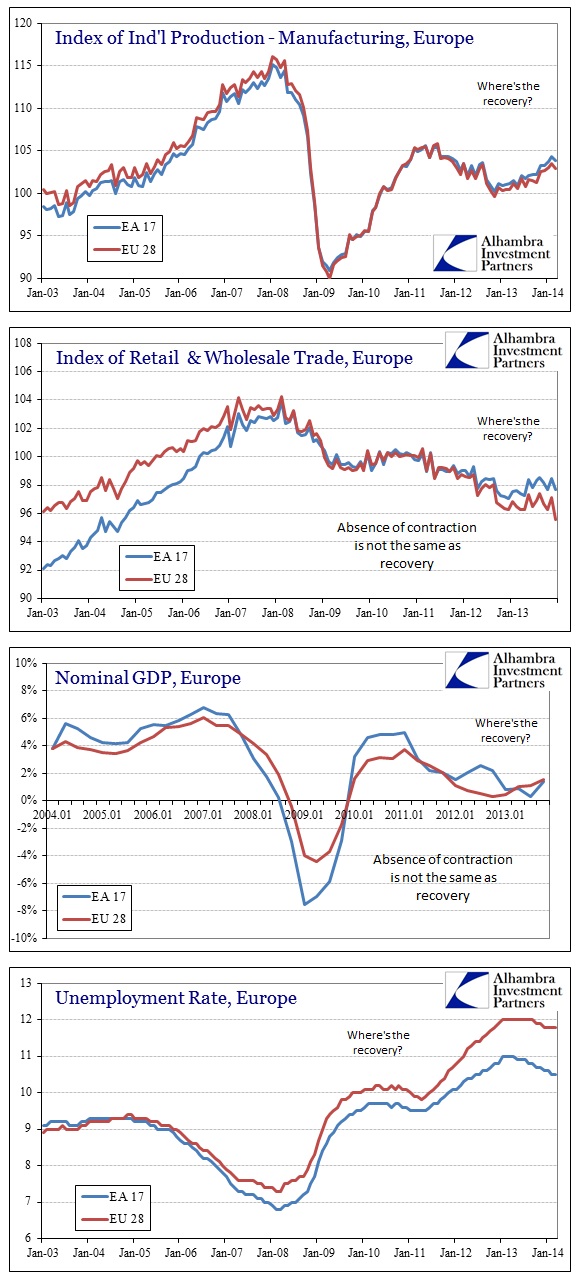

The net result is as it has been world-wide, an artificial period of seeming calm burying deeper the instability that remains stubbornly unsolved by monetarism. Commentary continues to proclaim recovery in Europe, as well as the US and Japan, but what exists is nothing like a recovery.

Now the European policy class is apparently back again to intervene in some more financial factors in perhaps new and exploratory ways, they are still using the same cover: #1 leads to #2, #3 and finally #4. At some point, you might expect someone to expose the great myth at the center of all of this – if there is a recovery then there should be no further need for intrusion. I think these rumors speak very plain about the worries in Europe right now, that since nothing has gone as designed there is the very real downside that the artificiality wears off and the continent takes a triple dip of some increasing damage.

I will have more on the financial side of the whispers and potential analysis in a later post.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com