Before the financial disconformities of 2013 can be allowed to rest in the annals of financial history, I think there is still one more piece that needs to be analyzed in the context of where we are now. Convention about liquidity disruptions is again leading back to Dodd-Frank and Basel, rightly so, but that isn’t enough to fully capture the decayed state of systemic liquidity in 2014. As I said yesterday on this topic, that includes the one-way trade that was “induced” by QE3 in September 2012, as clearly shown by the dramatic compression in swap spreads.

An interest rate swap is relatively straight-forward by itself and can thus provide, at times, relatively straight-forward analysis. To “take fixed” simply means that you pay a floating rate in exchange for receiving a fixed rate payment from some counterparty. Since this is a private transaction but benchmarked to the relevant UST rate, an interest rate swap “should” trade (it is quoted at the fixed rate payment) at a premium to the UST rate because there is risk involved. In fact, that was such a durable and iron-clad convention that it was once believed impossible to ever see a negative swap spread – that wouldn’t make any sense in this convention since the US gov’t is always viewed to be “risk free.”

The derivatives world was turned upside down during the crisis period and aftermath when, in fact, swap spreads (especially the 30-year but including, intermittently, the 10-year and even up to the 7-year) “somehow” turned negative. During the worst of the panic, there were even stories about how some computer trading systems didn’t even allow for a negative spread input because nobody apparently thought it could ever happen. Beyond that, there was massive confusion about what it all “meant”; did the financial market believe that the US gov’t was now more risky, especially given the more than $1 trillion deficits that were becoming common? Was this an indication of bank balance sheet capacity post-panic and the lack of arbitrage capacity?

That second implication was closer to what has happened, but not fully explanatory. The context of ZIRP and the role of QE in it are informative about the “ability” to penetrate a negative swap spread.

If you are a large counterparty of sufficient size and you are positively, absolutely sure that interest rates are going to fall and stay there, you are going to be overly aggressive (especially given how this all plays out in terms of balance sheet mechanics) in “taking fixed”, and why not? That is a winning trade that rewards not just in payment disparities, but in terms of contract value and, perhaps more importantly, collateral flow.

In some senses, this was very (scarily) similar to the credit default swap craze in the middle 2000’s, as financial institutions, like AIG, saw CDS as the same kind of no-brainer trade since it was such an imbalance in favor of writing protection and receiving payments. Like “end of the world insurance”, nobody ever thought they would have to pay out – and they never really did!

Despite conventional wisdom about the panic period, all that “toxic waste” of subprime mortgage assets generated far less actual losses on a cash-flow basis than most people would be aware. In fact, of the “toxic waste” the Fed pulled out of AIG in September 2008 and sunk into its Maiden Lane “hedge funds”, there were zero cash losses; none. AIG was not brought down because it suddenly had to pay out CDS, but rather the prices of the CDS contracts (moved by ratings downgrades and “market” mechanics of hedging and pricing illiquidity in a self-feeding spiral – nervous “investors” hedged via CDS, reducing prices, which forced ratings downgrades requiring collateral and making investors “need” to hedge more, reducing prices, etc.) required AIG to post collateral it had little of, and then none of. It is never losses that create dead banks, only the lack of collateral to maintain even “good” positions that are being priced the “wrong way” (see Orange County, CA, 1994).

Interest rate swaps are similar, especially in that they are collateralized and marked-to-market daily (CDS were not collateralized and marked daily, but counterparty collateral was triggered by certain thresholds, like ratings downgrades). For those large institutions that were seeing QE as a durable depressant on interest rates, “taking fixed” and paying floating meant not just being on the “right” side of the trade but positive in terms of contract values rising and collateral flowing in.

The other side, mostly insurance companies and credit-based hedge funds, were simply hedging their long positions. They were not necessarily making a statement on interest rates at all, but merely expressing hedging notations on their own positions. So for them to “lose” on the fixed side wasn’t really a consideration (you expect to “lose” on hedges when your actual positions are doing well since a hedge is supposed to be an opposite direction offset). Because of this disparity in incentives and reasoning, an imbalance is not all that unexpected. In that sense, the swap spread is like Black Friday sales, as dealers were cutting the price of interest rate “protection” to increase their volume.

When QE3 was announced, the 10-year swap spread almost immediately went to 0% and then negative intermittently. The 5-year spread followed lower, and it was clear then that what I have described took off – namely an abundance of dealers willing to pay floating and an abundance of hedgers willing to pay fixed. For the hedgers, this was great in that their hedging costs would be reduced, allowing them greater net returns on whatever they were hedging, or the ability to take on additional long positions or “risk” per unit of hedge offset (exactly as the Fed intended; this is the operational end of orthodox “portfolio effects”).

As long as this status quo can be maintained, it is a financial panacea as “everyone wins.” You know what they say about things that are too good to be true, the inevitable intrusion of reality brings it all crashing down again.

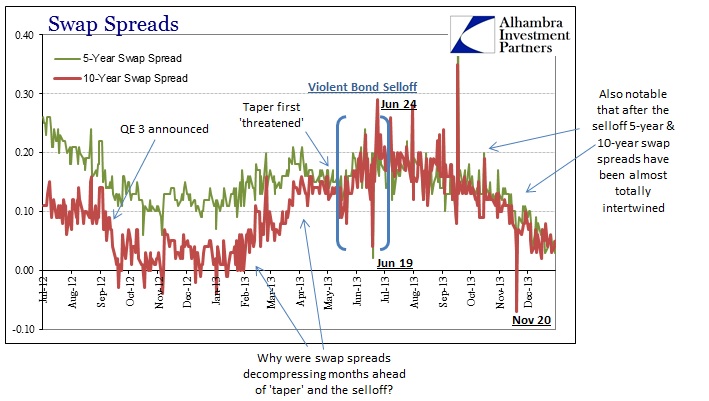

In the chart immediately above, showing the track of swap spreads after QE3, it is supremely odd to see spreads decompressing well ahead of the actual taper drama itself. The word “taper” was not entered into the financial lexicon until May 2013, and the violent credit selloff did not hit until later May, with the worst from June 16 or 17 until the blowoff on June 24. Now credit markets are supposed to be discounting mechanisms, and certainly in a manner far more attuned than bubble stocks, but the change here was one of policy.

Was the impending taper “leaked” to the big banks months ahead? That is a possibility, certainly, as the inner-workings of the FOMC have been shared with the inner circle of Wall Street/London behemoths before (notably leading up to the panic in 2008). There was also the very visible work of Jeremy Stein who had suddenly taken to warning about “reach for yield.” So it is possible that the crowded dealers on the floating side began to lighten their enthusiasm in a sudden bout of prudence based on anecdotal discomfort.

I don’t want to discount that part of it as I think that all played at least a role in this sudden shift in swaps. However, QE, especially QE4, ran into operational difficulties almost immediately upon its start. This is one reason why I separate the QE’s in late 2012 in defiance of convention, as QE3 was MBS and QE4 was UST – they were initiated months apart in different markets and, most importantly as I will try to define here, to different effects.

QE in the UST market is wholly different than how QE works in MBS. The latter is an indirect impact on something called production coupons, essentially increasing the profit spread of engaging in wholesale mortgages bounced off to GSE’s inside the TBA market. The former, QE in UST, “buys” individual bonds and notes (not t-bills anymore, which was an important precursor development from April 2011) most especially in the on-the-run space (OTR), which is the most liquid and tradable portion.

So the first stage of QE4 buying in OTR was January 2013, but by February there were already irregularities in OTR’s as “specialness” became something of a widespread signal of shortage. I have covered this topic many times before, so I won’t rehash the details again here, but the results were simply that QE was taking too much liquid collateral from repo markets to the point of at least minor disruption by February 2013; again, almost right from the start.

We know the Fed was aware of this problem because they shifted their entire POMO schedule out of OTR securities. I wrote about this a few months afterward, detailing this operational change using a spreadsheet actually provided to me by Ben Bernanke’s office (through the office of a member of Congress who was interested in querying Ben Bernanke about why repo was suddenly disrupted, and credit markets not functioning).

In other words, repo dysfunction tied directly to QE’s notorious tendency to strip out collateral created open disorder. Now to those participants in interest rate swaps, especially the dealers sitting heavily imbalanced on paying floating based on the idea that QE was forever, this was a stunning and potentially very upsetting development (though it should not have been based on April 2011; maybe dealers thought the Fed had learned an OTR lesson about interfering in OTR t-bills, which was what Operation Twist was all about). Dealers are well aware of internal plumbing considerations and likely would have connected the dots about QE – if it was going to be a disruption to liquidity it wasn’t going to be around forever as previously thought, or even all that much longer.

That is why, I believe, swap spreads started moving months ahead of anything else, including the eurodollar curve. In fact, other than swap spreads and repo specials there wasn’t much else to indicate what was coming, one of the most violent credit selloffs in recent history. Furthermore, that selloff was extremely odd given the asymmetry of it, as it was seemingly set off by only the threat of tapering QE?

In terms of systemic liquidity capacity, interest rate swaps and dealer capacity are intricately tied together so that if dealers did indeed read the repo market as an “oh s–t” moment, there was little derivative capacity to absorb the intended derisking. That meant by the time taper was first talked about openly in early May 2013, dealers were both already on edge about that possibility, which was then confirmed, and drained systemically of their capacity to absorb the now far broader changes in credit market stances. In short, the erosion in capacity to easily maintain pricing had already dwindled prior to the actual event; and all tracing back to “portfolio effects” in places nobody pays attention to.

The rest of 2013, as bank after bank was drilled in its FICC “revenue”, played out almost as a clowder of jilted lovers. Their response was very revealing about how all this relates to 2014’s capacity, as they all cut their staffs in this segment, significantly, and started devoting resources elsewhere. Thus systemic capacity is severely curtailed by the fact that QE didn’t deliver what was expected, indeed what was promised in September 2012, in terms of financial profits and one-way collateral flow. Burned badly, dealers aren’t going back.

The lessons of all this are great and enormous, thus cannot be overstated. I also think, given the sudden pliability of even policymakers to admit this as reality in contrast to prior hardline positions (especially Bernanke) that QE had not even a single downside, that these negative effects have been internalized far more broadly then has been broadcast by mainstream assumptions. QE was always a problem, including the micro-problem of repo collateral that was learned very well in April 2011 (coming as a result, of all things, due to a change in FDIC assessments about “reserves”). The trade-off was supposed to be psychological, as the economy “should” have been able to ignore all these “details” and simply take the “direction” provided under rational expectations theory into a sparkling new era of rebirth and unquestioned growth.

Instead, the economy is moving the wrong way, the outlier Establishment Survey notwithstanding, and we are left with all these deficient QE artifacts of reduced capacity and function. Again, monetary neutrality is a total myth. If it wasn’t apparent in the shape of the economy these last two decades, it can at least be seen here in an area where everything is supposed to be totally healed from 2008. That is the one “victory” that the FOMC proclaims above all else, that the financial system has been normalized and put back to prior levels of function and order. However, they only do so because nobody can penetrate this madness and see through to what really happened and happens. Instead, all the rest of the world knows is that there was a huge “dollar” problem in 2013, another in 2014 followed closely by whatever happened on October 15 this year. Closer examination reveals that QE wasn’t just a failure, it was demolition.