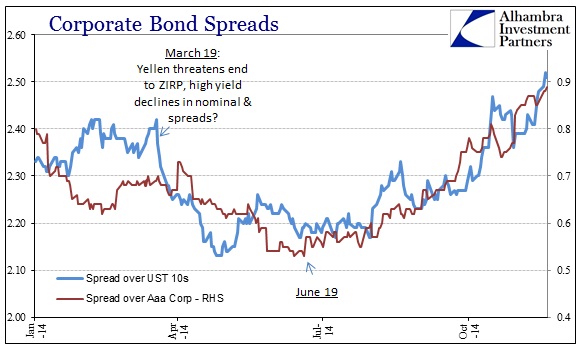

Adding to the repo observations from this morning regarding illiquidity and more importantly gathering risk aversion, the behavior of corporate bonds and spreads matches that overall sketch very closely. The key point is how different the corporate bond space, like the UST curve, has behaved in 2014 in relation to 2013. In past periods just prior to recessions, you see the spread of riskier corporate bonds (here represented by Moodys Baa-rated Index Yield) rise over UST (using the benchmark 10-year in this case).

While the spread rises, nominal yields either fall or at least move somewhat sideways. That simply means that as the Fed doses out “stimulus” as growth weakens, corporate bond rates do not follow UST lower. That gets back, somewhat, to Greenspan’s ultimate “conundrum” where long-term interest rates do not always follow monetary “orders.” In this case, the rising spread is essentially growing caution in corporate credit that actually parallels what we can take from treasury yields at the same moment. In other words, nominal divergence is indicative of risk perceptions (in both directions).

In 2013, despite a serious selloff in credit, risky bond spreads actually continued to decline despite nominally rising rates. At least for that episode, corporate bonds and UST yields were moving in the same direction at the same time at the same rate (generally speaking).

In 2014, that behavior is inverted. Nominal yields have traded mostly sideways (until recent weeks) while spreads have conspicuously decompressed. The timing of these trends matches the liquidity process that played out in repo (with one surely reinforcing the other, and back again).

In addition to the risky corporate spread over UST, there is also the corporate spread of Baa-rated bonds to Aaa-rated, separating risk perceptions within the corporate space. As you would expect given this setup, spreads over Aaa-rated yields have also been rising in recent months contrary to prior conduct, again indicating risk aversion and liquidity (leverage concerns leading to likely margin and collateral calls). The turn in those spreads was the same week that the repo market experienced the greatest amount of fails, in mid-June, just as all this began.

Unlike UST, the inflection in corporate trading and thus risk is far more recent. Where the treasury curve has been growing very bearish back to November 20, 2013, corporate credit had been more attuned, apparently, to the stock market view of the world. Such optimism could not, it seems, continue unabated while systemic liquidity began to tighten. Again, the fact that this tightening in 2014 behaved opposite to 2013 more than suggests a paradigm shift about risk and leverage – and not in the “good” direction.

Fitting this all within the leadup to the October 15 UST event, the rising spreads undoubtedly were pressuring leveraged positions and financial counterparties extending such leverage. That would have been especially pertinent since spreads had been compressing so steadily since June 2012 (and the whispers of QE3 and Draghi et al). In fact, the Baa spread to the 10s had come down from about 2.90% at the height of the 2013 selloff all the way to about 2.15% by mid-July 2014.

Such favorable pricing undoubtedly led to overly and unduly low calculations of volatility and Greek expectations (financial calculations, not the country) that were pressured and then increasingly run over and shattered by the June/July inflection. Though the decompression in spreads is very low by historical standards, it is oversized in representation of the recent paradigm (both that complacency and the basic numerical situation of such a miniscule starting point in nominal yields). Therefore I think it safe to conclude that corporate spreads and trading are very much supportive of the illiquidity paradigm after June 10 (supporting both the systemic function part and growing nervousness about actual central bank efficacy to do anything other than mask true risk).

To that effect, it is also interesting to note that neither nominal yields nor spreads for risky corporates have rebounded (lower) since October 15. That also suggests that liquidity was not just strained pre-October 15 but that it has lingered forward for more than a month. Risk aversion may still be growing and lurking rather than a one-off affair as the electronic scapegoat would suggest.