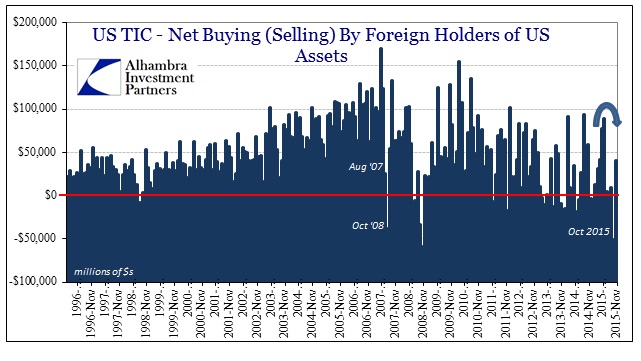

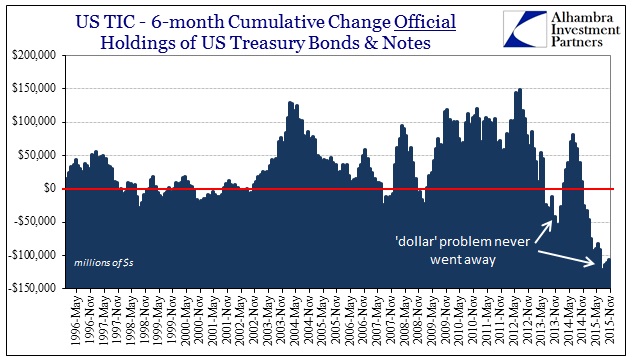

The November update for TIC figures shows relatively few surprises given what was witnessed November into December then January. The heavy downdraft of October was somewhat reversed, and even the official sector was probably less strained (outside of China) than at any time in 2015. But these are reactive symptoms to the greater problem of “dollar” availability, so the most important numbers in terms of forward indicators of TIC are not necessarily UST’s or dollar-denominated assets.

There is certainly some lagged effects here, as the massive “selling UST’s” in October was surely trailing the events of August and September; particularly central banks trying to catch up to the illiquidity as best they can (under orthodox constraints, including anachronistic philosophy). So where there was net selling of $50 billion for October, including -$17 billion in the official sector, November rebounded to net buying of $41 billion with only a net $152 million in official sales.

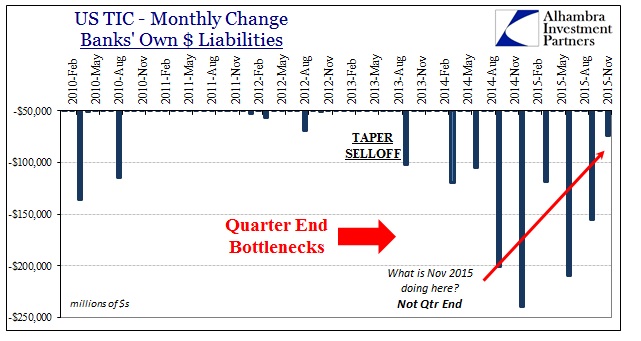

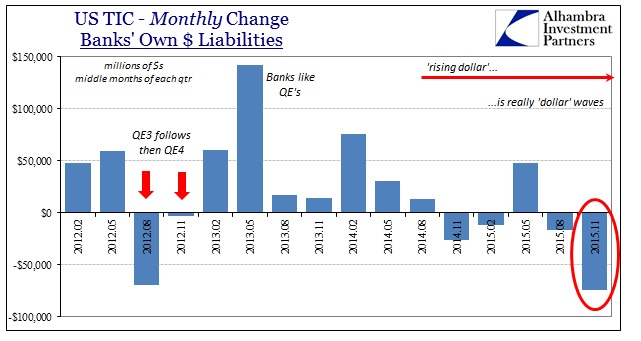

These are, again, only effects of the general eurodollar environment which is generated almost exclusively by eurodollar banks. The TIC figures provide a loose proxy for that very notion, estimating reported changes (flows) in bank liabilities denominated in dollars. Since the 2013 taper drama, these bank liabilities have shown a quarterly tendency to collapse in the last month of each quarter and then rebuild only somewhat during the next. That may account for what looks like a ratchet or waves of “dollar” effects globally.

When looking at it just in terms of quarter-ends, that much is apparent. However, as is highlighted immediately above, November 2015 shows up where only December 2015 should. There was a massive outflow or diminishment in reported dollar liabilities in November; far out of line with everything we have come to expect of this quarterly pattern since QE3. In fact, isolating only the middle month of each quarter makes this very plain.

Since bank resources contribute the bulk of the eurodollar baseline, it seems to account for the major problems that followed thereafter – including the renewed CNY “devaluation” and the further desperation of the PBOC. Given what we know of eurodollar banking via their earnings pronouncements, FICC and all that, this is not completely unsurprising (Morgan Stanley, Deutsche Bank, Credit Suisse, etc., cutting back severely toward the end of last year) though I still find it quite extreme.

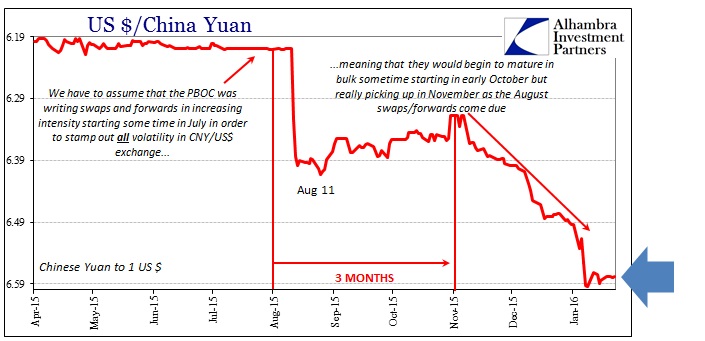

There is a good chance that this defilement continued on which leaves those systems especially vulnerable at this juncture all the more so – Russia, Brazil and especially China. We know full well that China and the PBOC have been under intense strain in January, so this data largely confirms suspicions as to why the “dollar shortage.” We can infer its continuation particularly through the PBOC not just in what it attempted via HIBOR (or was made to suffer?) but the growing evidence that the eurodollar has become so untenable once more that the Chinese central bank has returned to pegging the dollar again.

Since January 11, when the CNY exchange hit 6.60, it has moved essentially sideways in a seeming replay of the middle of last March (subscription required). That would be an undeniable signal of even more desperation, especially since the “tools” required to achieve that are the same that put China in such a desperate place to begin with – swaps, forwards and all the manner of wholesale items that can only come back to haunt Chinese money markets about three months hence (if not before then).

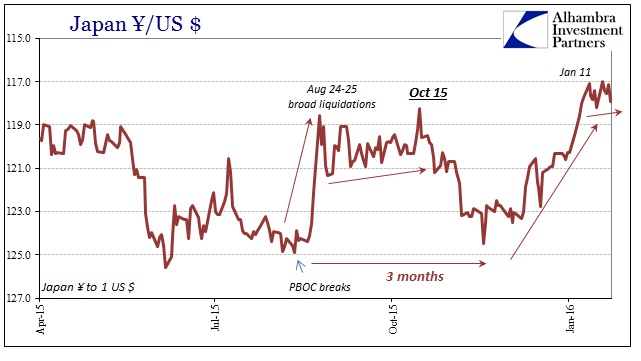

That point is corroborate by the Japanese yen, of all things, which further suggests as I suspected of Japanese banks acting a Chinese/Asian “dollar” conduit. The yen which was moving opposite CNY, as you would figure under these circumstances, suddenly stopped its ascent right on January 11 – an almost perfect reflection of the resurrected artificial CNY.

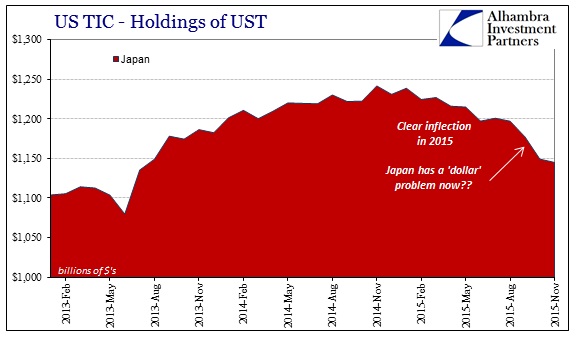

And, of course, November TIC provided more evidence for the Japanese connection, as the reported UST balance from Japan fell yet a bit more for no other apparent reason.

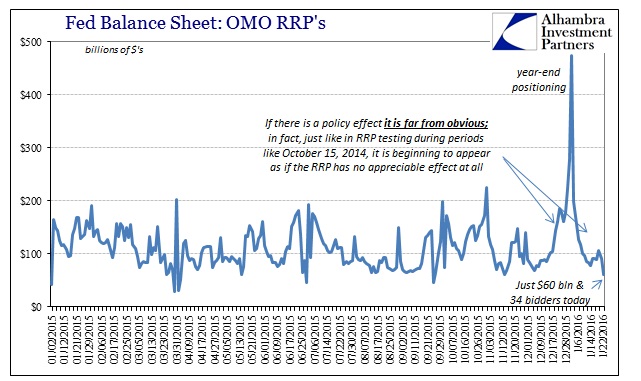

There are further elements to this PBOC/eurodollar angle, with serious implications, including domestic money markets, eurodollar futures, RHINO and treasury bills as I work through here (subscription required). It should be pointed out (continually with emphasis) that through all of the turmoil recently the Federal Reserve is AWOL; the RRP bids this afternoon were just $60.3 billion, averaging just $86.9 billion this week and $105 billion on the month. So much for the $2 trillion in available liquidity bluster, the Chinese appear necessarily short of all kinds of “dollars” including collateral which the RRP was designed to address.