There is one part missing from the narrative sketched out in home resales being subjected to monetary imbalance. It is a compelling explanation for what we find as the most striking aspect of existing home sales, namely the curious lack of depth among sellers. It’s as if despite rising prices there is a seller strike where a significant part of what should be that market just will not participate.

As I outlined a few days ago, the likely explanation is serious stratification. In other words, prices are rising much faster in the more expensive segments leaving those in either starter homes or still the lower tiers unable to make the usual jump that accompanies economic mobility. Because they aren’t buying up, they aren’t selling despite rising prices which are supposed to signal at least stable demand.

That’s the part that demands further examination. There is another subset of housing that is supposed to act in that circumstance – new homes. If there was not enough supply via resales as the NAR suggests, thwarting a more consistent and healthy home market, then home builders should have been the answer. As noted Monday, this is not an imbalance that just showed up, it has been a factor for at least several years (and in all likelihood throughout the QE-inspired mini-bubble that favored “investors” over potential resident owners). Where are the home builders?

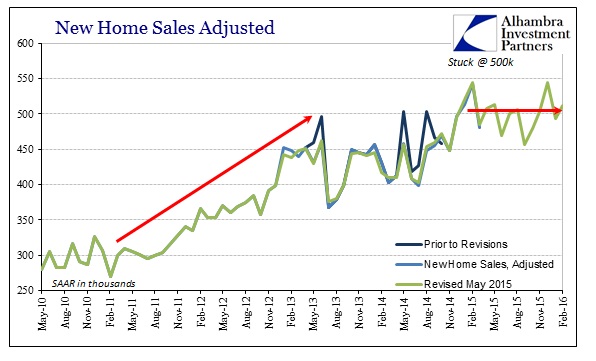

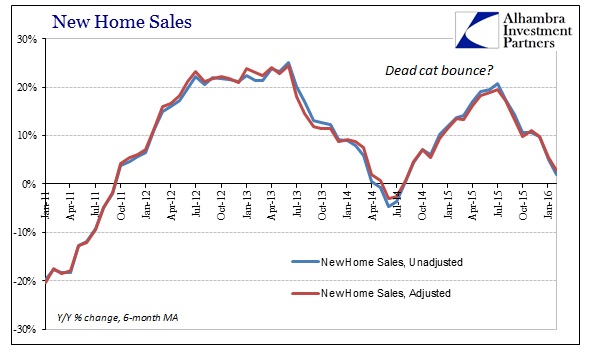

If there is demand for even starter homes well above the visible and attainable supply, that is exactly the market imbalance that should favor new construction. Instead, outside of what increasingly looks to be a one-off rise in new home sales in 2014, home sales have been rather stagnant. All the way back for June 2013, the Commerce Department has been estimating new home sales at around 500k almost as if that were an anchor or fixation. There have been revisions here and there redrawing the exact trajectory, but for the most part ever since then new home sales have been stuck around that level – especially since the start of 2015 (as if that were coincidence).

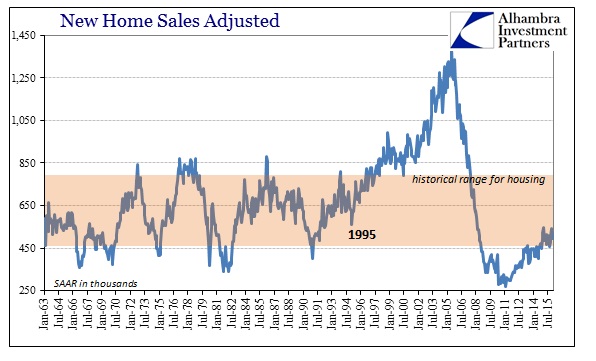

Given the issues here and the potential signals for imbalance, 500k wouldn’t even be that much of a supply factor. That level has been at the extreme lower edge of the historical range once signaling recession-type conditions.

Since home builders react to actual demand rather than the published unemployment rate, that can only mean two potential deficiencies; either there is some demand that would be consistent with what is suggested via resales, those looking for starter or lower tier homes, only they can’t obtain mortgages; or there just isn’t demand at the lower end in anything resembling the more frenzied luxury markets (bifurcation). In reality, the past three years might be explained as a combination of the two, where there was once some demand around 2013 and into 2014 but banks were at that time reeling from taper and cutting all things mortgage. By the time finance stabilized though at a lower volume (maybe accounting for the mini-rebound in the current estimates of 2014) it was just in time for the “rising dollar” and the economic consequences captured by all economic accounts except the unemployment rate.

To my analysis, that would seem to offer the most complete explanation for what seems to be happening in the whole of the real estate market. The gap from resales suggests that home builders should be nearing a frenzy, constructing at a pace more toward the upper end of the historical range rather than continuing along the bottom (if still better than the worst of the housing crash); only there isn’t any rush to build and sell new dwellings (apart from rentals). It is both the bifurcation that erupts anywhere monetary policy manages some intervention, as well as consistent with what we actually see in the economy outside Janet Yellen’s imagination.

It is very much like what seems to be taking place in autos except with unusual constraint this time; perhaps the housing bust had an effect after all? In other words, economic conditions are deficient such that the only way, at the increasing margins, people are buying automobiles is that of subprime (insufficient income and prospects); in housing, that is also the case but subprime is mostly dead (even if some are experimenting with a resurrection), meaning that there are instead no sales or at best minimal volume. Autos reach record levels, houses curiously do not even though both are drawing from largely the same pool. In both cases, it doesn’t suggest anything about positive economic prospects let alone the “best jobs market in decades.” In terms of housing, if there is a “hole” in the overall supply, new homes to resales, it seems a reflection of true demand conditions (willingness and ability).