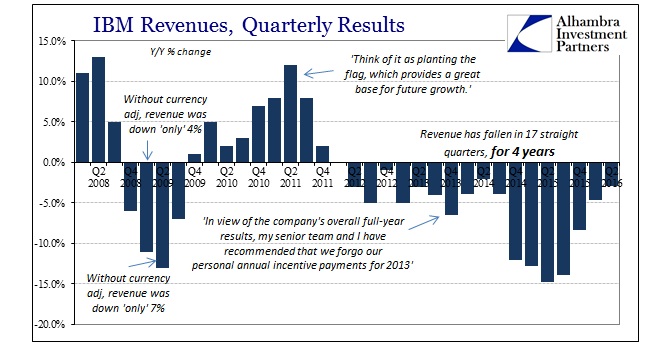

At this point, maybe it’s more like a train or car wreck whose shocking carnage compels you to keep staring at it. I still think there is, however, relevant information in IBM’s ongoing crash though I can’t deny the degree of fascination with it as almost theater. The company yesterday reported its 17th consecutive quarter of shriveling. Like a car accident, the scale of those four plus years is nearly unthinkable. At $20.2 billion in Q2 2016, Big Blue’s topline is just about one fourth less than it was in Q2 2011. And for the first quarter in a long time, management’s presentation made little reference to “constant currency” terms.

There is any number of reasons for this fall, but the timing could not be more coincident to the big events of this era. On July 18, 2011, right in the middle of that auspicious year, the company reported Q2 results that had IBM executives convinced the reported 12% revenue growth was just the start of something big; not related to the cloud, SAAS, or the internet-of-things, which is all they talk about now, but in their core businesses and competencies. At that historic moment, they saw a very good probability of the world returning to its pre-crisis condition.

That was not just the judgment of IBM, as it was endemic throughout the mainstream; the Fed had ended QE2 just weeks before, satisfied with the results (when are they not?); the ECB had just raised rates for a second time because they were more concerned about “normalization” occurring too quickly lest it lead to runaway inflation. Everything seemed to indicate, on the surface anyway, an actual and full recovery.

Only four days after the earnings report, however, stocks in the US and elsewhere started crashing. That would lead to considerable uncertainty, then systemic illiquidity (despite the Fed’s balance sheet expansion), and then outright fear all over again. It all provoked considerable “unexpected” and sustained responses from central banks all over the world, as if, somehow, the global monetary condition had never quite healed from the panic and crisis that began all the way back in August 2007.

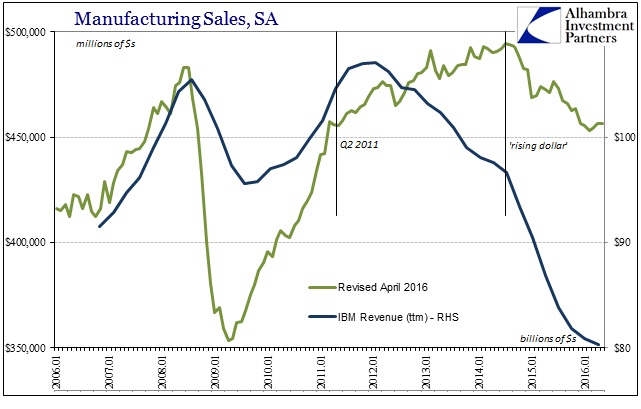

For IBM, it was all downhill from that point forward. Though many have downgraded IBM’s status to more an irrelevant dinosaur from a long ago age, their core business was still at that point global capex and productive investment in technology infrastructure. That basis is, essentially, forward looking in macroeconomic terms. And it is also heavily related to, and dependent upon, financial conditions.

With that in mind, I think there is still a good case to be made for IBM’s plight as not only important but really as a warning. The scale of their unfolding disaster might be idiosyncratic, but at least the timing of it relates all-too-well to the wider economic trajectory. IBM is but a shell of its former self, made so by the systemic monetary change in 2011 as the last gasp of recovery potential. The same can be said of the economy, the global economy at exactly those same points in time.

If IBM does still matter, and I think it does for much more than strictly morbid curiosity, it is still in Q2 warning us about the world economy and global money.