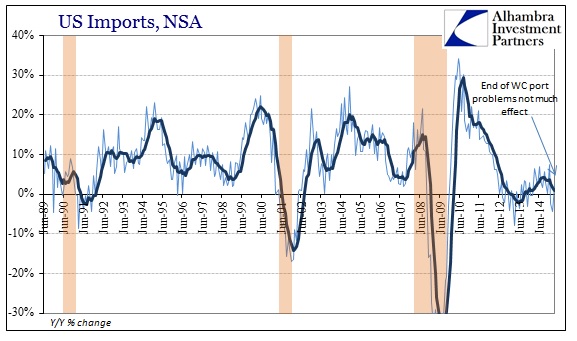

The port strike on the West Coast of the US was finally resolved and goods began to flow more freely starting in February. That meant March’s import figures would be absolved of this aberration and we could begin to piece together the state of domestic “demand” without the blockage. Given that January and February figures were atrocious, it would stand to reason that March would be at least something of a turnaround.

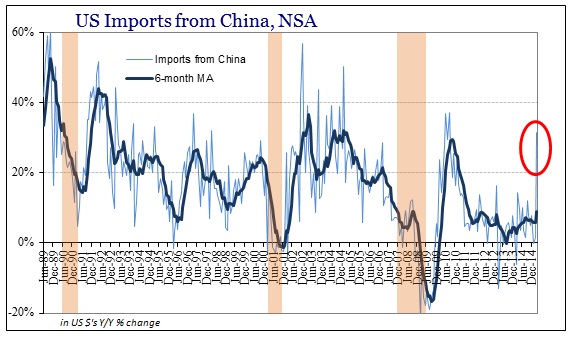

And it was, if only limited to what looks to be an anomaly in the Chinese estimates. Imports from China surged by 32% in March over March 2014. There really is nothing much like it anywhere else so it is difficult to tell whether that was the final release of goods that have been building up for some months along those stricken ports, or whether there are statistical artifacts even left over from last year’s enormously volatile numbers.

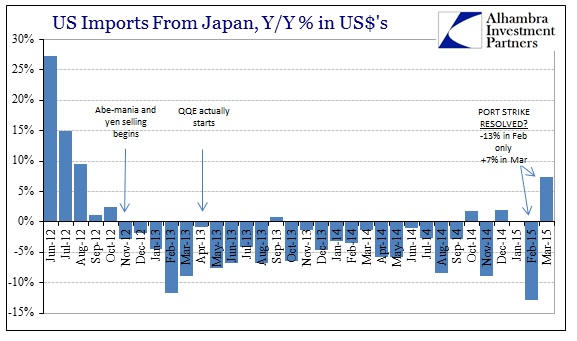

Japanese imports, by contrast, were far more consistent offering a similar comparison of west coast terminus. After falling by 13% in February, March imports from Japan (in dollars) were up only 7.3%. In other words, the port strike did not mask a surge in Japanese imports as has been expected, only the degree to which they remain on the decline.

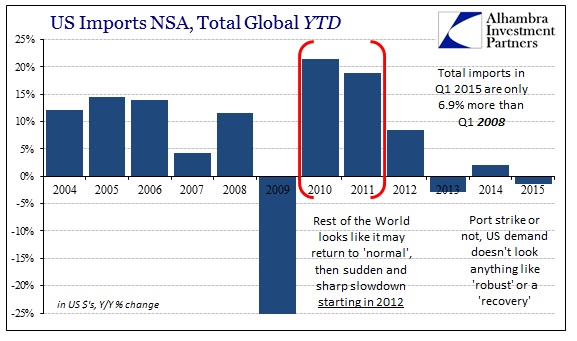

Imports from Japan cumulative in the first quarter were down 1.4% from Q1 2014 (which wasn’t exactly a robust period of US “demand”). Aside from China, there doesn’t appear to be much of an imprint due to the port strike. Total US imports were up just 2.1% Y/Y in March, after having declined 4.4% in February and 2.5% in January. Taking the quarter as a whole, total US imports were down 1.4% from Q1 2014.

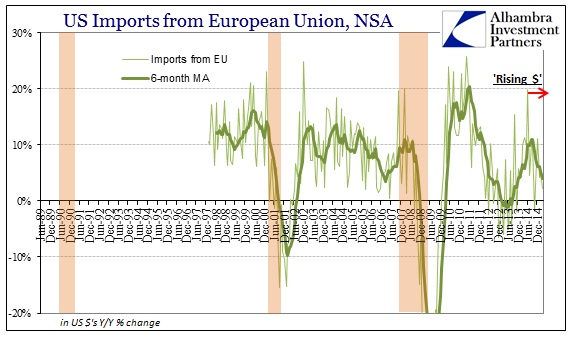

This lack of “demand” for global goods flies in the face of all expectations about the “dollar” and how that is supposed to, as I noted yesterday, transmit US strength globally. Instead, it is clear that US strength is as absent as the expected “dollar” effects. A perfect example of that are imports from the European Union. Nowhere has the “dollar” price been moved more than against the euro, and yet for all the supposed cheapening (relatively) of European goods for US consumers imports from Europe have steadily and starkly decelerated almost to a standstill.

The peak in imports from Europe was right at June 2014 and where the “dollar” began to surge. Imports from Europe, obviously unaffected by west coast worker strife, only gained 2.2% in March, the second lowest growth rate since the middle of 2013. The other side, however, is revealing of much worse tendencies in the global economic climate. Exports to Europe fell 1.5% in March. While that may be consistent with the orthodox idea about currency relativity, there is more likely the global slowdown shorting the US export benefits.

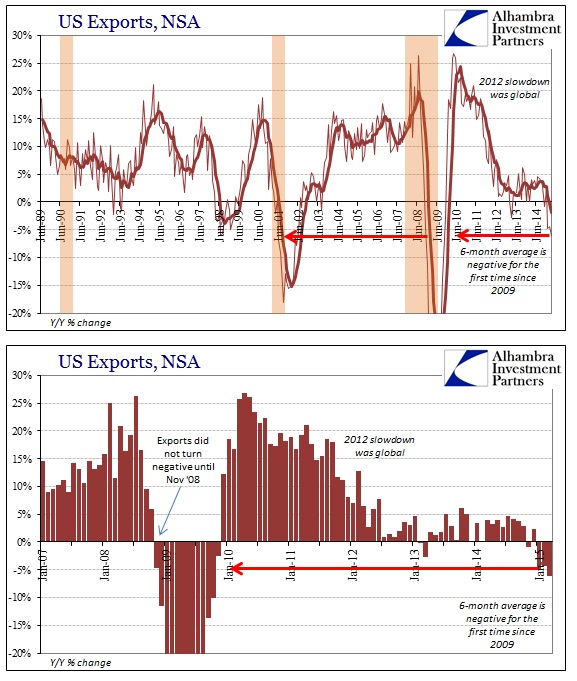

US exports to the rest of the world fell for the third consecutive month, and the fourth time in the past five. Worse yet, the decline in March was 6%, which is actually worse than November 2008, and right about the middle of what we saw in the dot-com recession. For the full quarter, exports fell 5.1% which is worse YTD than every year of the century except 2009 and 2002. This would suggest a seriously challenging, if not contracting, global trade environment.

The tendency is and will be to focus on the “dollar” as if that was some exculpatory factor unrelated to the global economy. Regardless of whether it “makes” US exports more expensive relative to competition, the fact is that such highly negative export “growth” only occurs during the worst global slumps – which is precisely what the “dollar” has been suggesting going back to June 2014. Again, in a world where every central bank has been highly and intrusively attentive to stoking “demand” there is a shocking lack of it anywhere, here or there.