Both Keynesians and monetarists are almost entirely focused on demand, aiming squarely at spending as the means to economic growth. Since 2008, and really 2007, the amount of “stimulus” recorded in that attempt to beckon “aggregate demand” is unlike anything ever seen before. Trillions and trillions of QE-drawn magic have been unleashed as well as government deficits as large as anything in our history (combined) year after year. And for it all there is a shocking lack of “demand” left in their wake.

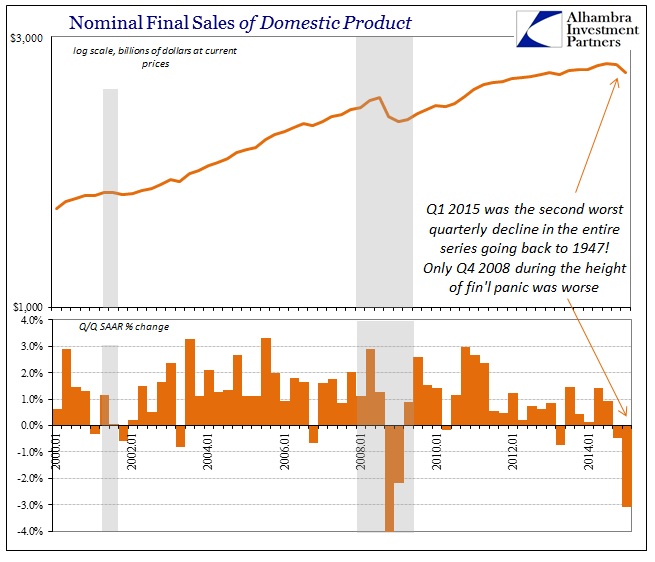

I looked at final sales earlier today as one measure of private demand, but it really is consumers that seem to bearing the brunt of “whatever” adjustment is forcing retrenchment. While services spending (if the huge imputations could be called that) was lackluster, spending on total goods declined Q/Q for the first time since 2011, and was barely positive Y/Y at the lowest (by far) advance of the cycle.

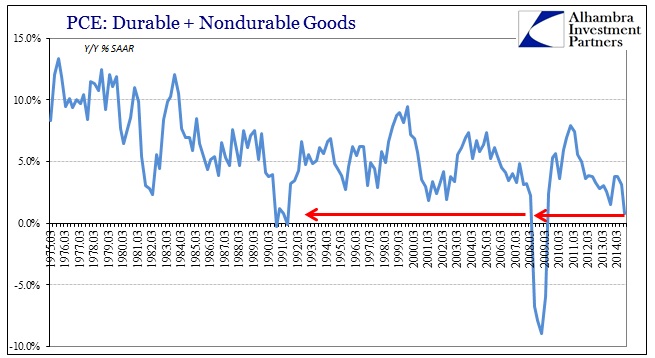

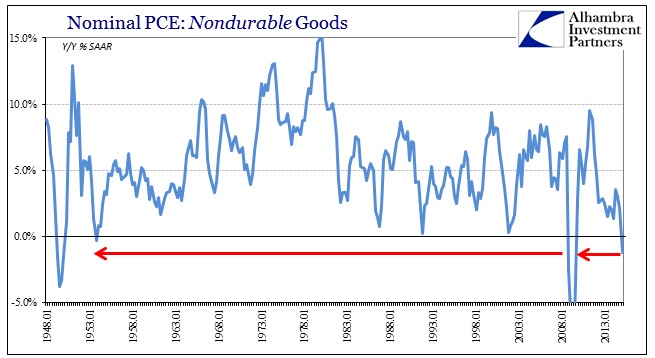

Both durable and nondurable subcomponents were negative Q/Q, as auto spending subtracted from GDP in Q1, but Y/Y spending on durables was much the same weak level as has been the case since 2012. The much larger nondurable segment, however, simply collapsed as there is clearly something very wrong here. I’m sure there will be attempts to dismiss this as gasoline and such, but even if that were the case the “gas savings” should be offset by at least some spending elsewhere (as we have heard ad nauseam since that 5% GDP was first threatened).

To really grasp the scale here, Q1 2015 was the second worst quarter in the entire data series dating back to the 1940’s! Only the collapse during the height of financial panic in Q4 2008 was worse. That means consumer spending on non-durable goods, accounting for a fifth of total PCE (and a much greater proportion ex-BEA imputations of phantom activity), was weaker in Q1 2015 than even Q1 2009. There is no way to explain that and maintain that the state of consumers in America is anything other than defeated, out of options and spending sources.

I think we are starting to see the contours of Japan here, as I described yesterday how QE and its cousins do have “wealth effects”, namely redistribution that benefits only a narrow proportion of the population at the expense of everyone else. The spending figures here in America seem to suggest “at the expense of everyone else” may be reaching its point of full exhaustion. It certainly doesn’t argue for the “best jobs market in decades.”

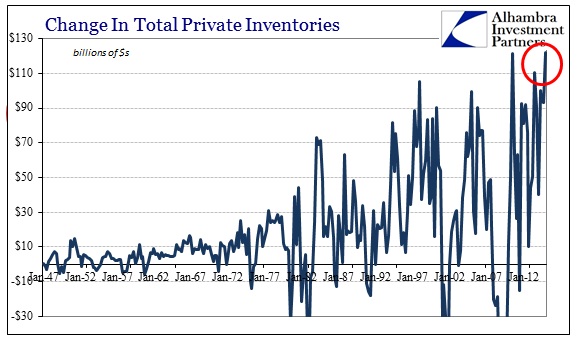

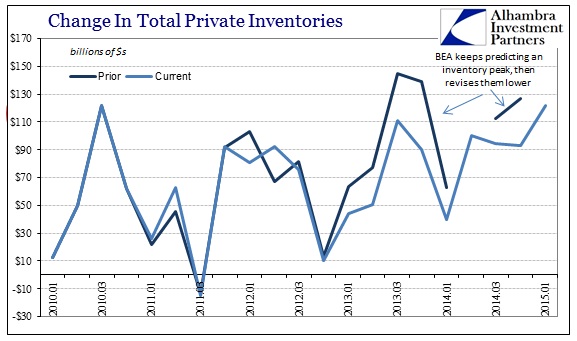

The problem for future growth is obvious in that alone, but there is the inventory problem that has transferred to the GDP figures from monthly data points elsewhere. GDP inventory is tricky, not just for the total second derivative nature of it but also because of the volatile revisions that take place just between the updates for the same quarter. As it stands now, the amount of inventory added was the highest ever recorded, besting, barely, Q2 2010. The same has been said, however, of several of the past few quarters, so it is at this point wholly unclear just how bad the inventory mal-adjustment has been.

If there are similar revisions, downward, then Q1 GDP overall will not remain a positive figure. What is truly concerning regardless of the ultimate quarterly level is that inventory has been building for several years now without a major correction. I think that is the same interpretation as you get from analyzing the wholesale and retail inventory figures, especially in relation to the sharp declines in sales activity. The overhang here is enormous on its own scale, but that much worse as consumers are more and more appearing to have gone back “in the bunker.”

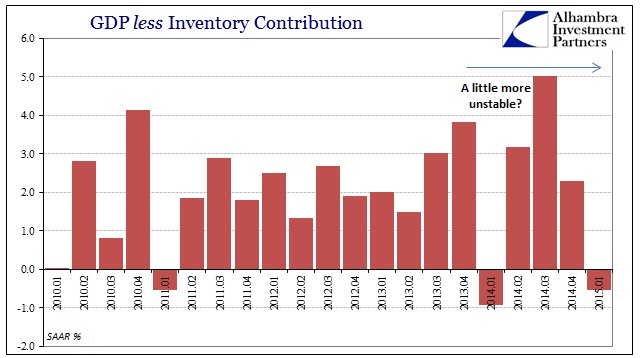

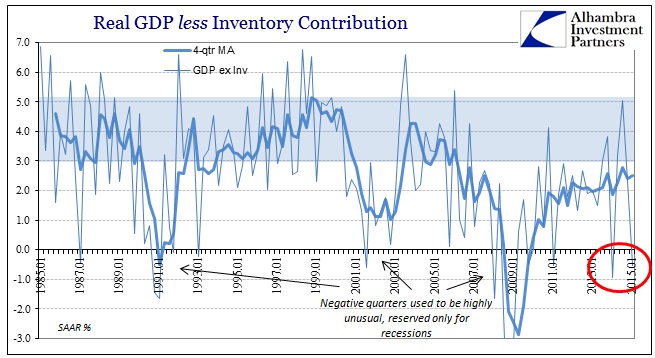

That has left GDP outside of inventory highly unstable, again confirming the view from Final Sales estimates.

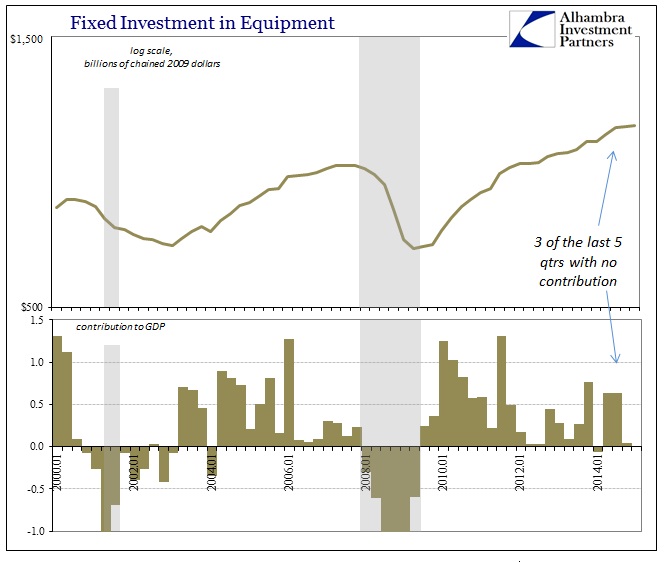

Apart from inventories, US businesses don’t appear to be in a rush to invest anywhere else (aside from financial re-containment). Going back to Q1 of last year, capex in equipment has clearly tailed off or at least matched the overall instability of the wider economy. And that is all before US companies are reacting to the “dollar”, having announced future rollbacks to beneficial, productive investment as revenues and earnings turn negative for the first time since 2009.

The short version of this GDP report was that there was absolutely nothing good about it. At least last year in Q1 economists could hold Obamacare’s introduction to the data series as something to suggest “aberration” or that it was all weather (or now that there is a bias against Q1 GDP), but this time negative focus is squarely upon consumers and the primary expression of “demand.” For all the major policy initiatives, historic in their form and scope, they seem to have had no effect on demand apart from arguably depressing it.