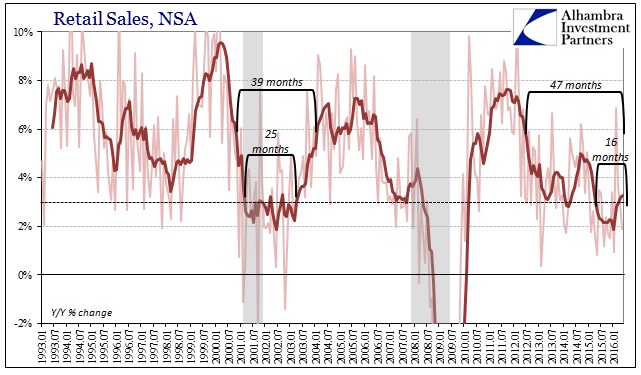

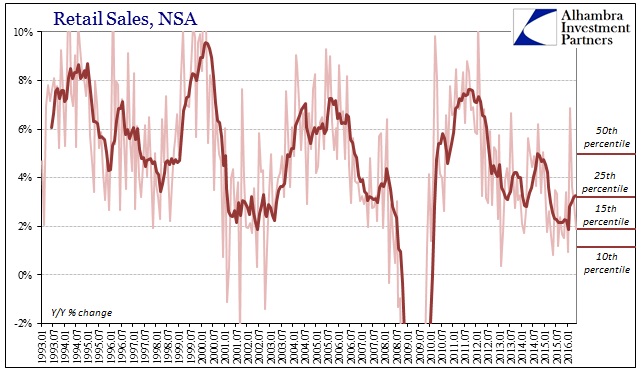

As with other economic accounts, retail sales dropped back in May after the temporary rebound coincident to calendar effects. Overall sales, including autos, grew just 1.9% over May 2015, well below the 3% level that historically defines recessionary conditions. That growth rate was the 39th worst in the entire data series (out of 281 months), placing it in the lower 15th percentile. In short, nothing has changed for a recession-like slump that now extends into its sixteenth month (since retail sales first dropped below 3% in February last year) and a slowdown that next month will mark its fourth anniversary (the 6-month average fell below 6% for the first time in July 2012).

The entire dot-com “cycle” lasted 39 months, including the “jobless recovery” and its effects afterward, compared to this nearly four years of ongoing stagnation. The difference this time to then is that by the start of 2003 at least the economy was on an (artificial) upswing. The current economy, despite being depressed for so long already, is still on the downswing and facing just the beginning of recessionary prospects.

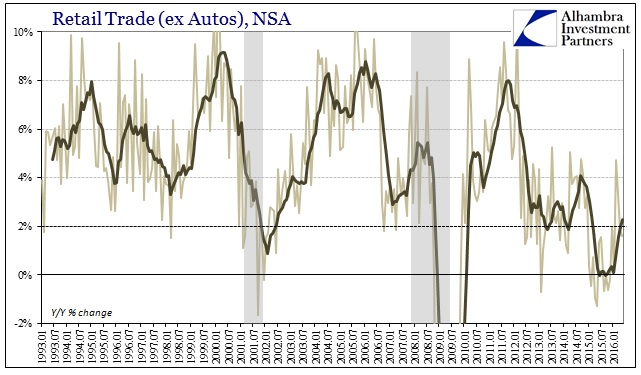

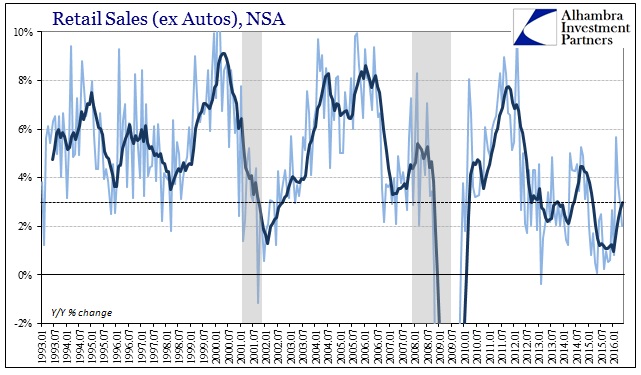

Ex autos, retail sales grew just 2.01% while retail trade (not counting food sales) both with and without autos was up only 1.58% in May Y/Y. This should end any hope that the February (29th day) and March rebound was anything significant or meaningful.

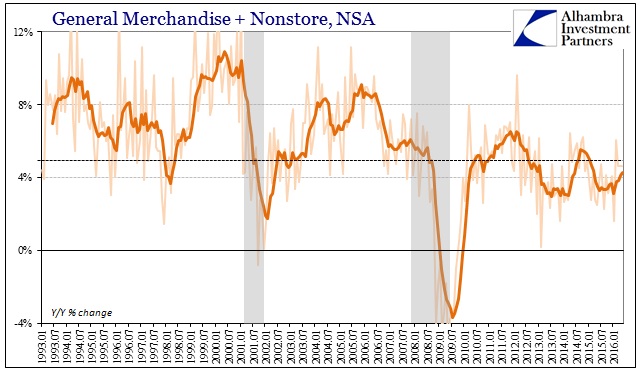

The only positive portion of the retail sales report was in the nonstore sector, as online retailers are benefiting from the stagnation/contraction. Nonstore retail sales jumped 16.0% last month Y/Y after rising more than 9% in each of the prior three. But this activity does not represent anything other than taken market share, as any overall spending increase is denied by another reduction in sales at general merchandise outlets (including a sharp decline at department stores -5.8% SA). Combined, nonstore plus general merchandise sales grew just 4.6%, even with the 16% annual gain, in the same reduced footprint that has been consistent with the slowdown since 2012.

It adds more evidence to the retail industry’s radical change as it relates to the macro economy rather than simply the takeover of smartphones and shifting consumer habits. In other words, retailers like Amazon are benefiting from the wretched economic climate at the direct expense of JC Penney or Macy’s because consumers can no longer afford to dismiss any online cost savings. The traditional allure of shopping in the physical world cannot hold up where consumers can’t afford the “luxury” of bricks and mortar.

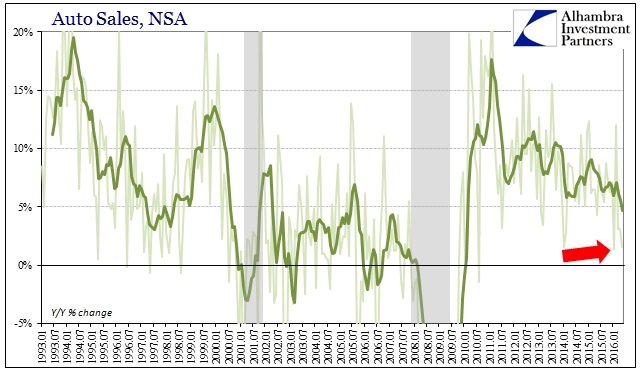

That point might be further reinforced in auto sales, where suddenly consumer appetites for cars have dropped off considerably in 2016. Auto sales were up just 1.6%, barely more than the 1.3% at the worst in January. May’s gain in vehicle sales was the third lowest of this “cycle”, with the 6-month average now below 5% for the first time since early 2010.

We have to consider not just incomes and consumer “confidence” when it comes to auto sales since there are serious financial factors. The financial disruption associated with the “global turmoil” earlier in the year could be having negative effects (and feedbacks) on especially the appetite for subprime leasing. Other than a 12% gain in February, auto sales have been noticeably weaker to start 2016 compared to any other year in the “recovery” period – including the much-discussed Polar Vortex winter of 2014 that saw only two months with auto sales gaining less than 3%.

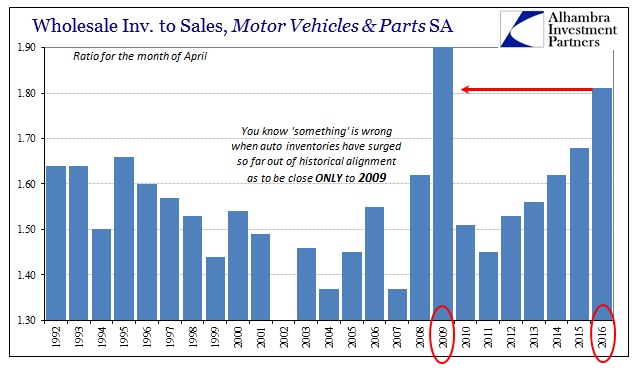

As autos only further accumulate in inventory, if there is either or both a financial and consumer reluctance now to purchase new autos then we should expect even more slowing across the industrial sector both here and abroad. Autos have been the one bright spot in the global consumer economy so far, meaning the reduction in sales combined with the tremendous inventory overhang takes on disproportionate consequence at the economic margins.

There were still, however, lingering seasonal effects in the figures. Despite everything reported above, the seasonally-adjusted month-over-month numbers were especially encouraging if only to the mainstream’s heavily reduced qualifications and descriptions.

U.S. retail sales rose strongly in May as Americans bought automobiles and a range of other goods, even as they paid more for gasoline, suggesting that economic growth was gaining steam despite a sharp slowdown in job creation…

The Commerce Department said retail sales increased 0.5 percent last month after surging by an unrevised 1.3 percent in April. The second straight month of gains boosted sales 2.5 percent from a year ago. Excluding automobiles, gasoline, building materials and food services, retail sales rose a solid 0.4 percent last month after an upwardly revised 1.0 percent increase in April. [emphasis added]

The article makes no mention of any relevant context, instead relying on the words “strongly”, “boosted”, and “surging” to make up for the omission. Left unsaid is how 2.5% (seasonally adjusted) annual gains are actually atrocious and indicative of significant and widespread economic problems; retail sales in every other normal expansion grow at an average 6%. As noted above, unadjusted sales in May did not even manage 2%, leaving the additional 0.6% to seasonality. With auto sales rising also less than 2%, it makes for a stunning contrast to “Americans bought automobiles” especially since growth in retail sales of autos were averaging close to 10% in late 2014.

Where else did all this inventory come from? With manufacturing in recession that even the mainstream admits, it’s not as if the inventory imbalance is due to rampant overproduction, with Ford, GM, and Korean manufacturers running their plants on triple and quadruple shifts. The problem is, again, the binary approach of orthodox economics and the media that parrots it without fail or question (or even notation of the untold proliferations of these obvious contradictions). Because recession isn’t about to be declared, they can only describe an economy that must be in expansion; with Janet Yellen hinting strongly at “full employment”, 2.5% growth in retail sales “must” be similarly “strong.”

The alternative actually consistent with the data violates these dogmatic strictures; the US economy experienced yet another slowing at the start of yet another year that only leaves it that much worse off. That suggests once more that the only aberrations are those such as February 2016 on the high side. It might hint at the only monetary policy “inflation” worth pursuing; perhaps the Fed should look into, like February, simply adding another day to each month in 2016. At least then the economy would hold the outward appearance of “strong” rather than being forced to further reduce and devalue the word.