As if something out of bad dream, the economy continues to shrink. Actually, the economy has been shrunken this whole time, it is only the full recovery narrative that has shriveled as each drastic data revision blasts apart what little is left of the positivity. We are made to believe that government data providers go out into the economy and actually count what is going, leaving us forever confident that the numbers and the numbers. In reality, these are all stochastic processes that are nothing more than chained monthly modeled variations and thus are subject to all manner of interpretations.

Benchmark revisions act as a check on the accuracy and validity of the “high frequency” models of those variations. Every five years, the Census Bureau conducts a full-scale Economic Census with which to complete a comprehensive review. Because of its exhaustive size and scope, it takes years before the data can be incorporated into each of these economic accounts. The earliest touch of the 2012 Economic Census didn’t start until late 2014, but it really didn’t start to reveal the rampant over-estimation until last year.

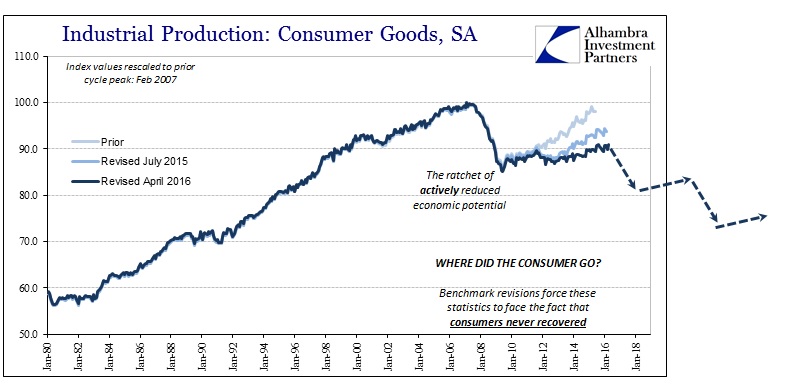

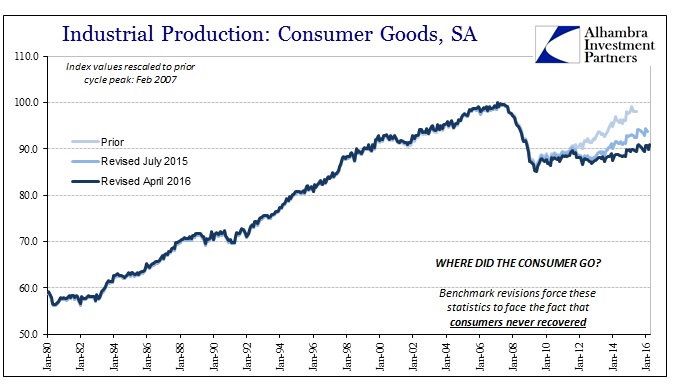

That means that until these past few years, the stochastic estimations of monthly variance were based upon the 2007 Economic Census, with pre-crisis conditions as the most basic assumption of how the data “should” behave. I have referred to these before, the latest being Industrial Production especially of consumer goods. Last year, there were also massive revisions to everything from retail and wholesale sales to durable and capital goods. At the May 2015 benchmark revision for durable goods, I wrote:

Given the benchmark changes in retail sales, none of these changes are a surprise except perhaps the degree to which they were carried out in 2013. What that accomplishes is an after-the-fact agreement that the recovery got much worse after 2012, not better, and it further highlights the now-enormous dichotomy between spending and employment figures. Just as the rebound in 2013 disappeared, there is little to suggest that the 2014 version was anything other than a statistical mirage. Why would companies suddenly start hiring at a multi-decade high suddenly in 2014 when 2013 was really rather atrocious? [emphasis added]

So much of the economic surety during this “rising dollar” period has been based upon 2014, yet it was always shaky to begin with. There was never any income growth to suggest what the payroll reports were reporting. Even in accounts like durable goods, there was only marginal improvement in activity that could at best plausibly suggest an economic rebound was coming. Just as I suspected last year, however, the latest benchmark revision largely erased it; leaving 2014 just as barren as the rest of the 2012 slowdown.

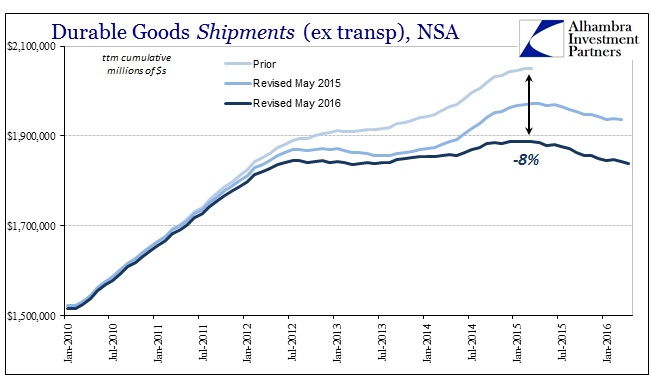

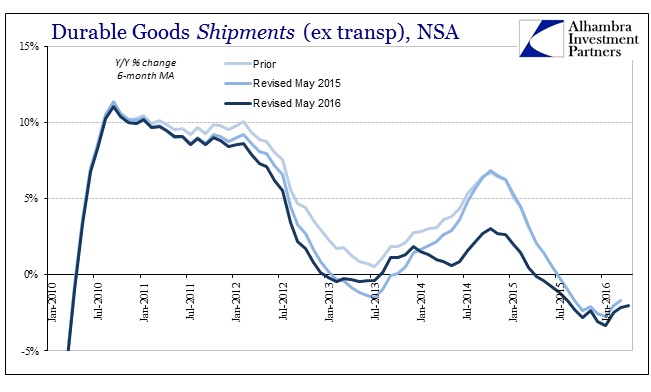

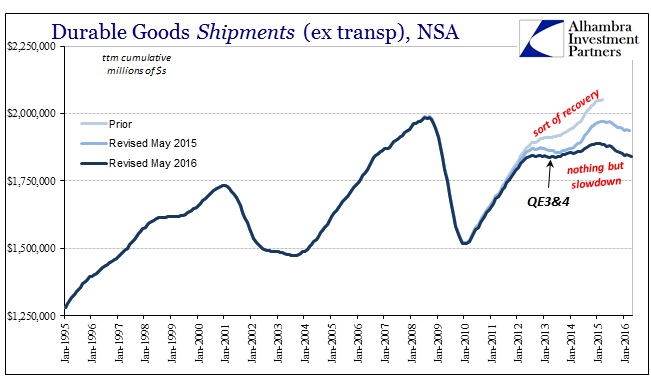

The numbers are simply staggering, though not unexpected given the preview provided in the benchmark revisions of Industrial Production for consumer goods. As you can plainly see above, there is so little left of 2014’s “bump” that it doesn’t qualify for anything other than confirmation that the 2012 slowdown was indeed a permanent alteration in trajectory; a black hole of economic gravity from which there never was any possible escape. There is nothing of Yellen’s economy left in it.

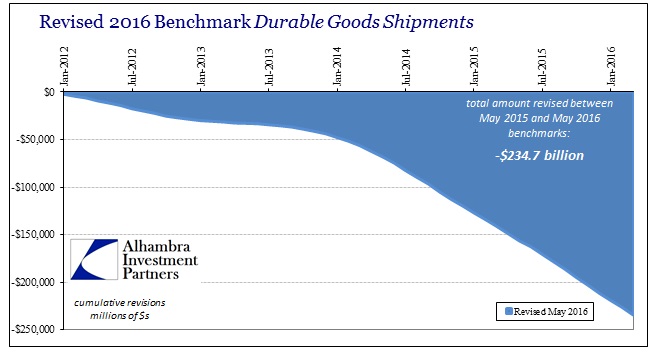

In just the latest benchmark change from last year’s update, durable goods shipments have been shorn of another almost quarter trillion in activity dating back to the start of 2012 – with almost all of that disappearance contained within the past two years.

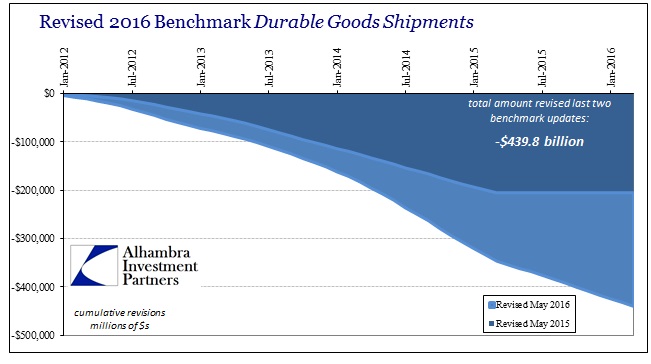

Combined with last year’s downward revisions, the difference between the durable goods estimates that tried to buoy Yellen and what we find now is beyond description – amounting to a cumulative $346 billion just through March 2015. The downward revisions after that point total another $93 billion (April 2015 through March 2016), meaning that since 2012 there were almost half a trillion dollars less in durable goods shipments than originally estimated; again, with most of that reduction for the past two years.

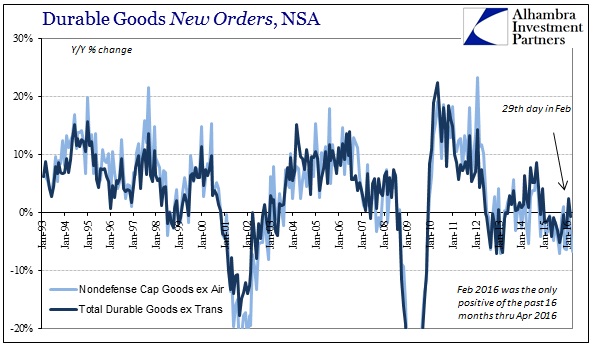

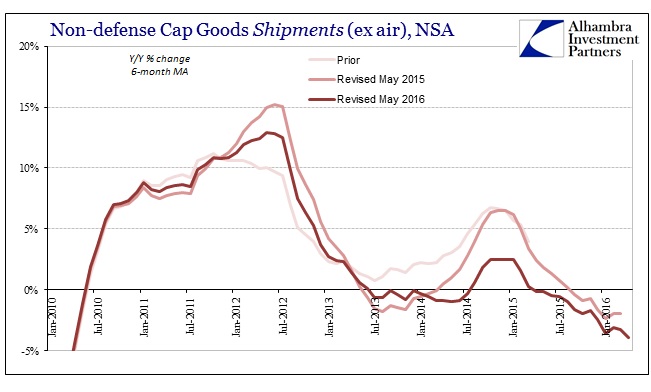

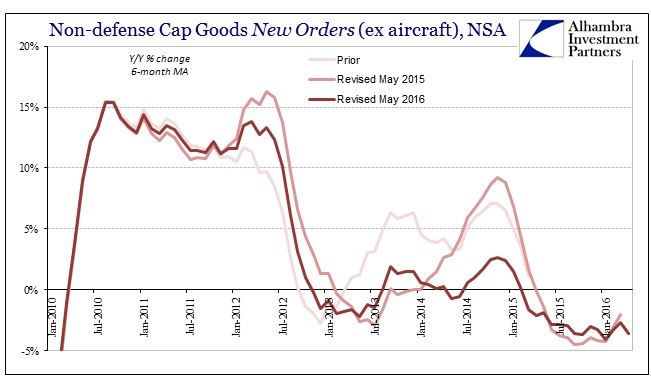

The effect of these revisions on growth rates is to surrender all thoughts of acceleration out of the 2012/13 slump.

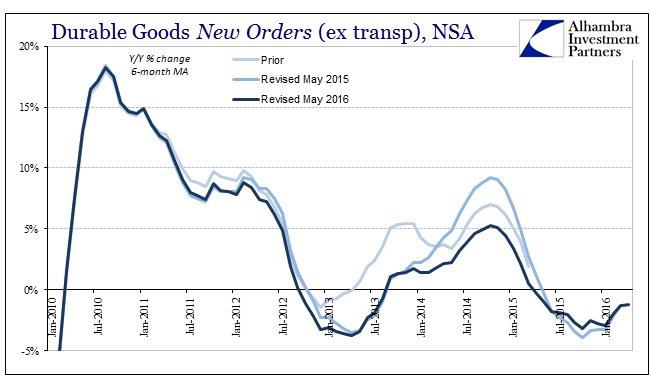

What remains is a small, insignificant improvement in growth rates varied across the components of the durable goods reports; the revision to new orders was somewhat less striking, while revisions to capital goods were actually even more of a (negative) change.

What appeared to be acceleration was only a statistical shadow very likely of trend-cycle over-estimation. The various stochastic processes took what was perhaps a slightly better environment in 2014 and turned it toward the long-sought recovery. That should never have occurred as trend-cycle should have been rethought long before the 2012 Census; there has been every reason to suspect this economy now is not like any prior cycle, or even perhaps a cycle at all. From that view, what little positive difference there may have been between 2012-13 and 2014 would have been seen for what it was, a continuation in the uneven nature of the unsurprisingly durable slowdown.

Instead, with trend-cycle pegged to the 2007 Census the chained monthly variations were looking for a more conforming recovery cycle, which apparently caused them to greatly overstate that small shift. As again with IP in consumer goods, we find durable goods (ex transportation) that once appeared to indicate a slow but consistent recovery turning more positive in 2014 instead being revised to an altogether unrecognizable form.

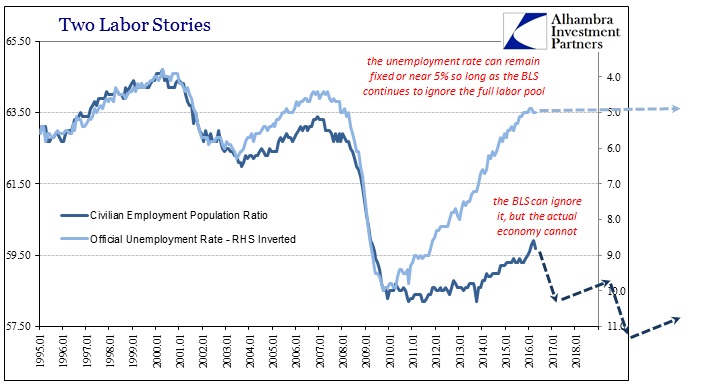

That means that the recovery didn’t disappear, it was never there to begin with, rather it is the narrative that has or at least a great deal of data formerly supporting it (however loosely). Since this is mostly related to consumer spending and really lack of income (but not limited to it, since capital goods are included in these revisions) it casts even more suspicion on whatever stochastic regressions exist within the payroll figures that have so far somehow resisted any benchmark revisions at all. Instead, durable goods with this current benchmark adds further weight to the common sense proposition that there is something very wrong in an economy that “loses” 14 or 15 million people from the labor force.

The unemployment rate for a time seemed to suggest (to the mainstream, anyway) that the participation problem would only be a matter of degree for an actual cycle, but these more complete overhauls show that was always backward. A seriously shrunken labor force would never suggest the speed of any cycle, rather it can only indicate something much worse than cycle in the first place. Economists have tried to ignore the fact of the denominator in the unemployment rate, but more comprehensive data sources show yet again that the economy itself was never going to be able to do so.

If this is all correct, and there is only more data pointing in that direction with each successive updated benchmark, then it leaves us with a very uncomfortable question: now what? Unfortunately, as these statistics are finding out, there is no precedence for this kind of slowdown, stagnation, or elongation of weakness. It means all options should be considered. We could see a slowdown that just keeps on slowing and contracting for however many more years, or worse an actual recession that like the Great Recession only leaves the economy still more withered after it.