By Jeffrey P. Snider at Alhambra Partners

The interest in the plight of the Japanese and “their” economy is not just one of morbid curiosity, but of high relevance and perhaps even a glimpse of the future. It is both a cautionary tale about the command economy and, at the same time, a warning about such apathy derived from the failure to demand something different, or even a choice.

In a more intermediate sense, the latest fascination with QE, the tenth application in a decade of broken promises and proclamations, offers perhaps the purest distillation of its unadulterated impacts. If there is one animating feature in Japan right now outside of QE, it is very well hidden. Be careful what you wish for.

The idea was to create inflation expectations through both direct “reserves” and especially currency debasement. Official inflation statistics show a rather early arrival of the planned target, so in that narrowest of perspectives it has accomplished its goal. But nobody expected it would stop dead right there. The idea, actually the ideology, fully and faithfully committed that inflation would be a potent catalyst to establishing a real economy – something unseen on the Japanese island in now a quarter of a century of continuous soft central planning.

Inflation itself is nearly meaningless as it really should be related and compared to wages and earnings. The QE philosophy accepts the negative consequences of inflation in the expectation of rising wages caused by a burst of related inflationary activity. While March wage data did see a rebound in “special cash earnings” from the disastrous first two months of 2014, there is yet even scant evidence of the awaited breakout in employment pay.

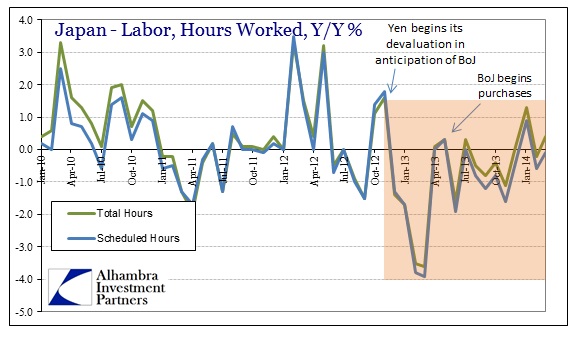

Companies are still behaving as if nothing had changed since 2011. That includes not just regular wages but also hours worked.

Marginally, that means any activity created by these inflationary recesses is not taking place within the Japanese national boundary. These are not closed economic systems as posited by monetary theory.

So the importance of Japanese QE is that it is a nearly pure example of its efficacy and effects. It would be one thing if QE was a neutral proposition, that if it didn’t really work it would leave little or no imprint – in other words there was no harm in trying something so radical. But even monetarists, though they deny that monetary policy has any long-term impact (though it so clearly does) on an economy, fully accept non-neutrality in the short run.

And that is the importance of the Japanese experimentation, and very much germane to any other central bank planners that wish to follow (or already have). You cannot conclude that there was no harm/no foul in taking to QE as the Bank of Japan has done. In the chart immediately above we see what can only be called impoverishment. While Japanese companies at the margins maintain the same flow of wages, prices have obviously changed and the “cost of living” moved against anyone that works (those with access to the asset side of inflation are not so blighted). The vast majority of the Japanese people are far worse off today than if QE had never been initiated.

All that is left is the now-familiar refrain of “it will change as we expected any day now” or “the real recovery is right around the corner”; sentiments that are as common across geography as the lack of economic or monetary choice. And they amount to very small comfort as there is absolutely no empirical evidence anywhere to suggest such optimism. QE is not some new fad; it has been tried numerous times in numerous places with the same deleterious results.

That is the second count on that score, of desperate impoverishment. If the only “offsetting” factor is faster price increases, sincere sympathy is the least of Japan’s future needs.

What the Japanese experience and experimentation shows is that the heaviest of monetarism is not some tonic or magic elixir, it is unalloyed poison.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com