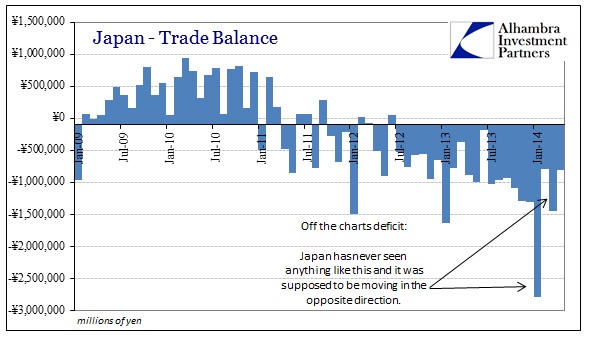

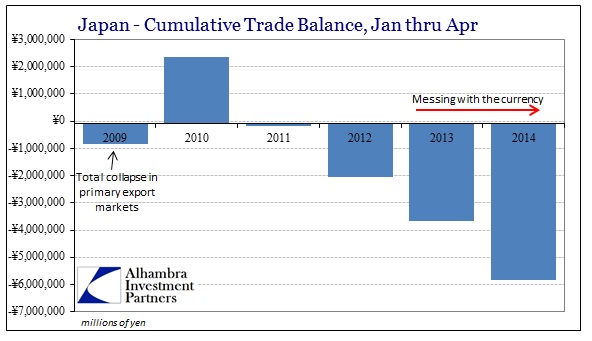

The running narrative all over the developed world is temporary factors. In the US it is weather-related, while Europe is seized by not enough euphoria (more on that later), and Japan by the tax increase attempt at fiscal responsibility. In the Japanese case, as it relates to the ever-important trade balance, the record debilitation in the first quarter under an incomprehensible surge in imports was explained as a demand factor. As Japanese consumers and businesses splurged ahead of the tax change, it was assumed that “demand” brought forward importation.

If that was the case, and it is far more palatable to the optimistic view, than we should have seen a dramatic decline in importation in April to net out such a temporary skew. Like the netted weather difference in US factors, that simply has not happened. Importation growth did taper in April, but the net merchandise deficit was about even with April 2013. If the short-term burst narrative was valid, the trade imbalance in April 2014 should have been far, far more favorable.

The fact that it was not reinforces the counter notion that it is not temporary tax change behavior that destroyed the Japanese trade advantage (after the tsunami in 2011 severely damaged it). Rather, it is becoming increasingly clear that Abenomics has heralded a structural change in the exact opposite manner as estimated, planned and advertised.

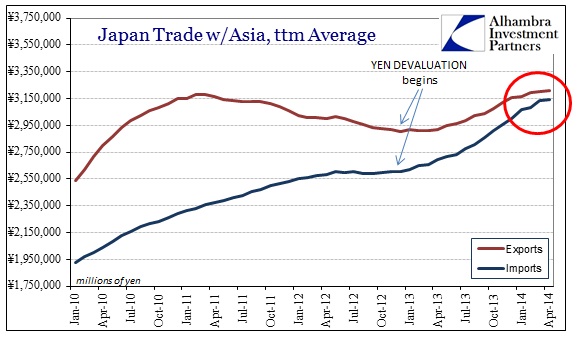

The idea of currency devaluation as a “stimulus” is as old as currency, but the modern financialized affair is distinctly different than even when floating currencies were championed by Milton Friedman’s excitement over central bank control and assumed precision. Again, the assumption of a closed system is the primary fatal flaw. In the case of Japan, we see this most clearly in its trade data with Asia, a geography Japan Inc. dominated not so long ago.

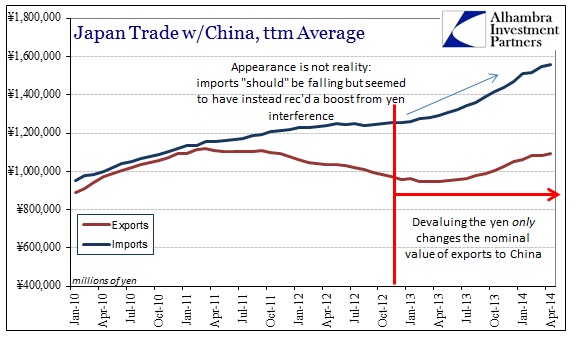

Cleary the tsunami left a major imprint on exports, but it is the period after the devaluation began that is most striking. And it is coming largely through China.

Exports have been given a nominal boost but that only changes the perceptions of revenue via diminished currency translations, not actual trade volume. However, it is the import side that is conclusively damning. Imports from China had actually slowed and even flattened out in 2012. Orthodox theory holds as unshakable that devaluation will reduce imports, but here we have the exact opposite in pristine fashion. Given the change from early 2012 (flat) into 2013 (rising quickly) it doesn’t leave many other options to explain the sudden and exactly coincident transformation.

So where Japanese exports have been given a nominal boost in only raw currency, imports have actually surged. And while energy is an important factor in the need for importation, it cannot explain but a small proportion of this change (especially from China). The introduction of currency instability, intentionally, has unleashed the outsourcing effect. Given that the only replacement is finance (as it has been in the US for decades) it leaves Japan in a far worse condition.

It is not only China, either. Trade with the Middle Kingdom is the best evidence of this effect, but you can see it elsewhere.

Imports from Europe (the Japanese use the classification “Western Europe”) have also been rising faster than exports to Europe. While energy is likely a higher proportion here, it is still exceedingly far from a comprehensive explanation for these “unexpected” results.

On the export side, which was supposed to provide the greatest economic boost inside Japan, businesses found only nominal changes in revenue rather than actual increases in trade volume. Now those nominal growth rates are winding down back to nothing as the yen destabilization itself becomes past tense. That is the primary reason for the increased calls for even more currency debasement.

There is a world of difference in how an economy produces growth, as economic activity is so far from homogenous in its downstream impacts. The Bank of Japan wanted a boost to generic aggregate demand, and may have gotten what it wanted, but that is not the same as producing a healthy economic rebound. You can certainly and even easily create activity by tearing your system apart from the inside, but what is left after that wave of artificiality and inorganic intrusion is done?

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com