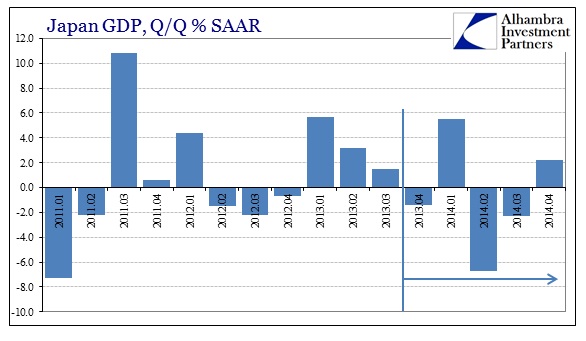

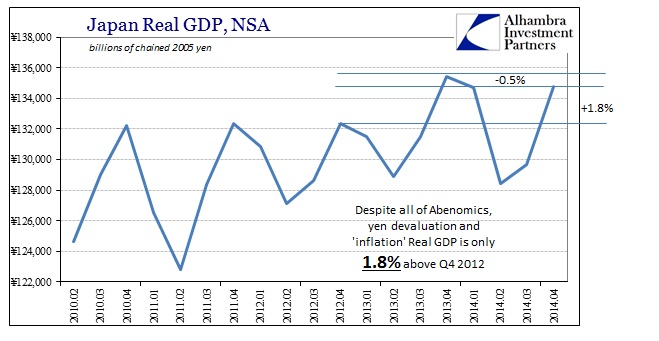

Japan’s GDP grew by 2.2% in Q4 but that was far less than the 3.7% expected by economists. As a whole, consumer spending and business investment remained quite weak, “unexpectedly” so, confounding interpretations that Japan was heading in the right direction after its brief, sharp slump.

Japan’s economy pulled out of recession more slowly than expected last quarter, with soft spending by businesses and consumers underscoring the challenges facing Prime Minister Shinzo Abe as he tries to steer the nation to a robust recovery…

“I was surprised by how weak household spending was,” said Shotaro Kuga, an economist at Daiwa Institute of Research, said of the fourth quarter results. “The economy is recovering—it’s just the pace of the recovery is less than forecast.”

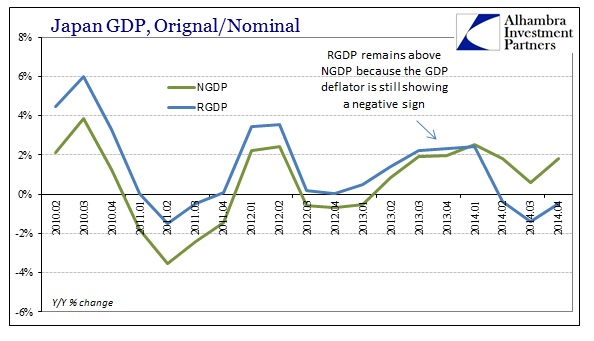

In other words, there is supposed to be a recovery in Japan just one that does not include consumers or business investment? If that construal seems more than a little curious that is because the only means by which GDP figured out as a positive number were inventory and exports. As if to almost perfectly illustrate why GDP is a flawed statistic in “non-normal” times, the biggest contributor to GDP was exports – the very sector that is perhaps best demonstrating the destruction of the core Japanese economy somehow added 1.9% of that 2.2% growth.

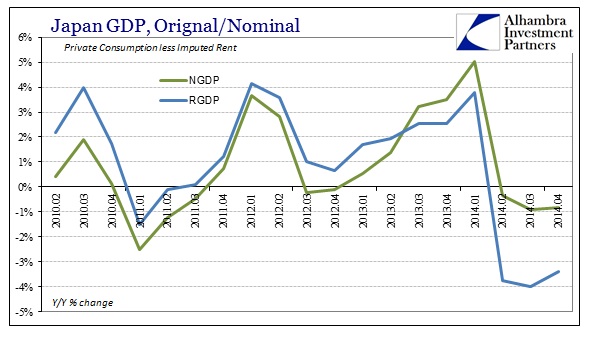

In raw terms, exports were estimated to have grown by 11.4% after adjusting for “inflation.” That doesn’t make any sense given the history of the yen in Q4. For comparison purposes, the export deflator was just 4.56% (Y/Y), while the import deflator was only 3.07%. In other words, GDP benefited strongly from the yen’s devaluation while the actual economy, the one in which the Japanese have to live with, decidedly did not.

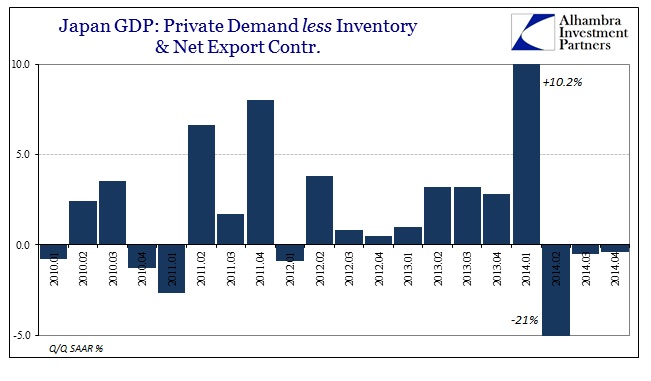

Adjusting for inventory and these net export figures, private “demand” in Japan was not any different from Q3 – both shrank at about half a percent. By and large the reasons for the lack of private economy recovery remains the reluctance (and inability) of Japanese households to participate in all the redistribution.

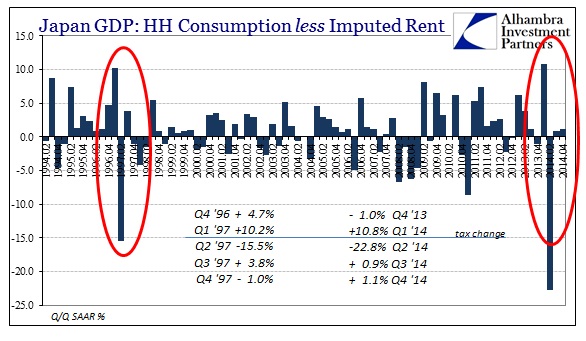

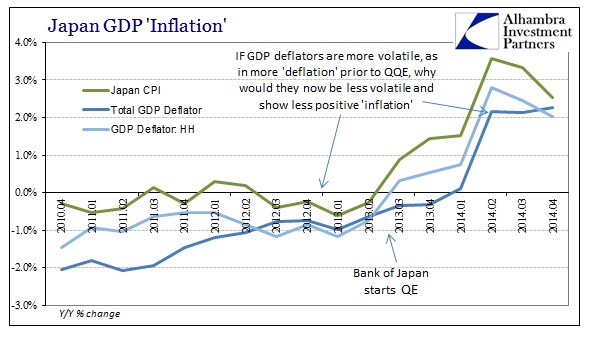

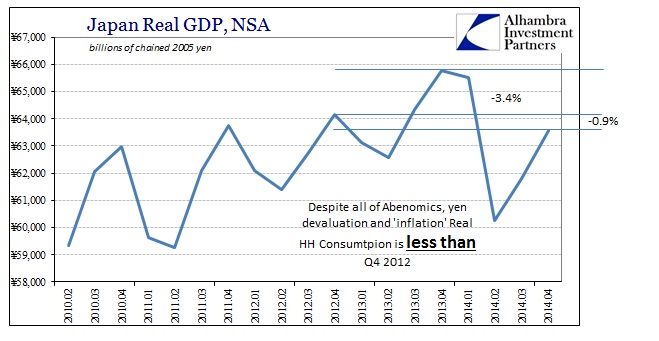

Despite a 23% drop in Household Consumption in Q2, household activity has only rebounded by the smallest amount since then. That is not the track of re-attainment that was expected as “inflation” was supposed to “force” people to spend. Instead, the repression of higher prices has acted like continued repression. For GDP purposes, so far the estimate again benefits from a reduced measure of all that, as deflators undercount what the CPI displays (showing the downward bias of deflators wherever they are calculated).

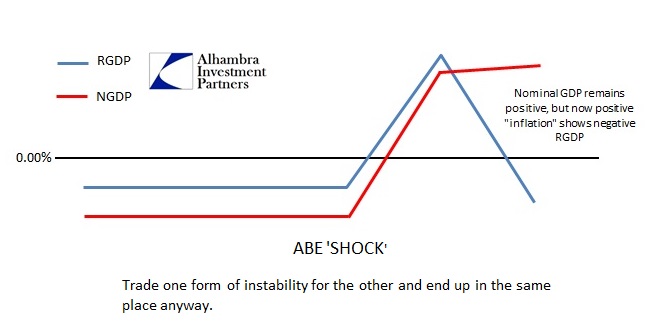

On a longer view, GDP remained negative in Q4 as Y/Y, even adjusted by deflators for “inflation”, as it contracted in comparison to Q4 2013. In that respect, Japan’s GDP still conforms with the template I described back at the outset of QQE in the middle of 2013.

In aggregation, none of this data would suggest that it was the tax increase to “blame” for persistence of lackluster. It should be increasingly clear that instability born of redistribution is keeping even GDP from suggesting an economy remotely close to what was promised all the way back in April 2013. The 2-year time horizon for “inflation” that the Bank of Japan estimated then was supposed to lead not just to hitting that mark (which they haven’t) but a full and complete recovery in the economy. Since even economists are questioning whether or not there is a recovery yet, given the true state of private economics buried under GDP mechanics, it isn’t controversial to say that Abenomics is way, way behind; if not completely failed.

With the state of central banking as it is, outside of China anyway, I suppose that means there will “have” to be more QQE.