For the most part, the descriptions of factory orders released this morning tend toward the seasonally-adjusted monthly variation. That is unsurprising given how much continued focus there is in just the narrowest of timeframes, leaving that as the basis for enlarging extrapolations. For June, factory orders were up 1.84% after dropping a revised 1.09% in May. That sounds hopeful and is largely taken as such at face value:

New orders for U.S. factory goods rebounded strongly in June on robust demand for transportation equipment and other goods, a hopeful sign for the struggling manufacturing sector.

In past months, that would be the only commentary offered but more recently the depth of the ongoing “slump” has injected more cold reality. By contrast:

Orders to U.S. factories increased in June, and a key category that reflects business investment plans posted a modest rise. But the gains weren’t robust enough to suggest that the sluggish manufacturing sector is mounting a significant turnaround.

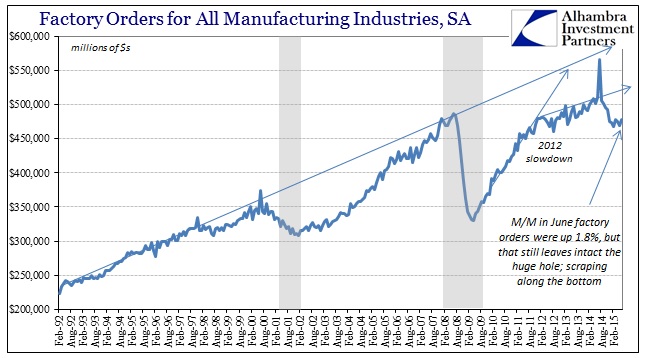

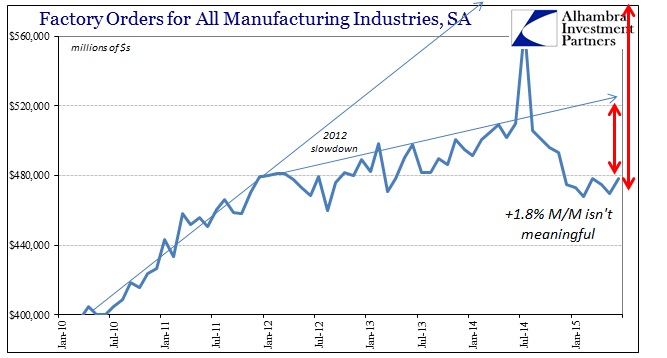

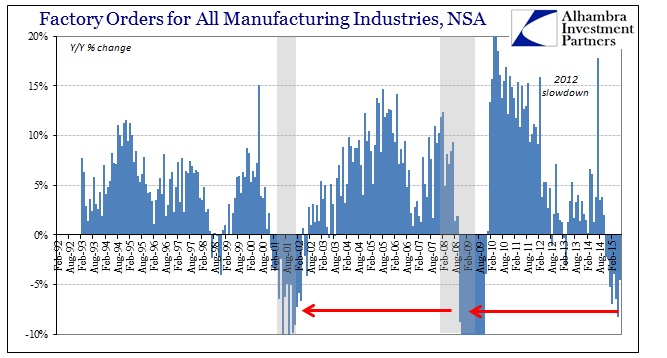

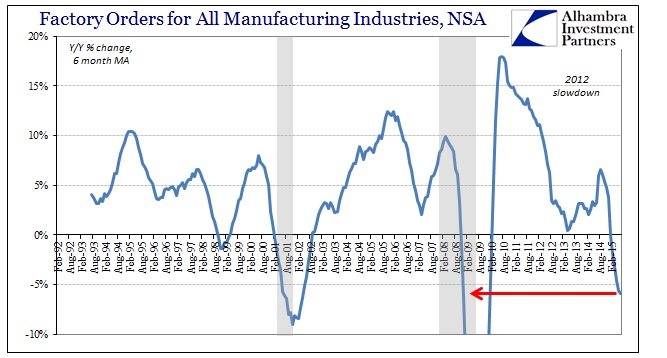

What happened was far closer to the latter than the former, as year-over-year factory orders “improved” from a revised -8.3% in May to just -4.5% in June. When viewing the whole context, the 1.8% monthly gain in the seasonally-adjusted series is obviously not really significant, as the “hole” in the economy from earlier in the year remains.

Worse, an oversized proportion of the monthly gain was due to volatile transportation orders, meaning that the variation is even less sturdy than it appears. Aircraft orders jumped 65.4%, pushing overall transportation to a monthly 9.3% gain. That would suggest, as July-August 2014, next month will end up with a large offsetting decline.

The economy still is overburdened by both misaligned inventory, a contracting sales environment and a “currency” problem that is starting to suggest an additional negative phase beyond what already happened, “unexpectedly”, in the first half – outdistancing by months now weather, port strikes and the best payroll expansion in decades. Without meaningful gains in any of these measures to start to actually erase that economic hole or imbalance, it would only suggest further declines still ahead. The longer this “slump” lingers the greater that eventual and continued reversion.