If last month was another perfect payroll month, June was at least its opposite. While the Establishment Survey advanced by more than 200k yet again, the average monthly gains has dipped significantly of late (more on that below). Outside of that, however, it was ugly everywhere. All the upward volatility in the rest of the data points from May were undone in June, leaving the payroll picture largely unchanged for the two months. Since January, there has been a clear deceleration or worsening of the employment environment.

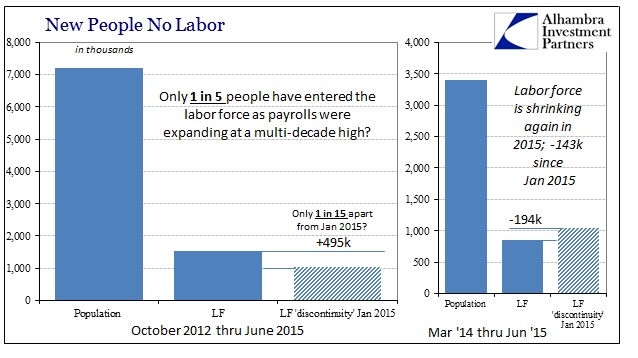

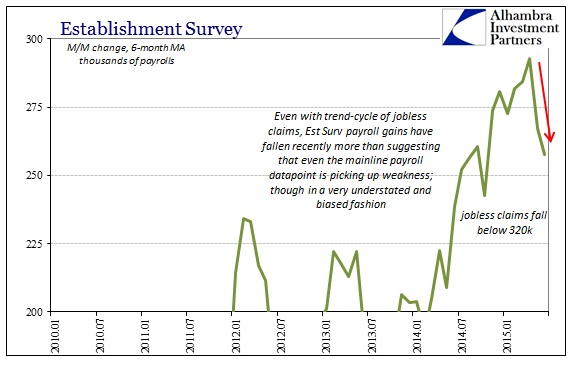

The Establishment Survey has averaged only +210k payrolls per month in those five months, down significantly from the nearly +300k of late last year. The Household Survey has calculated only half those gains, worse in terms of full-time employment, and the labor force has, yet again, shrunk.

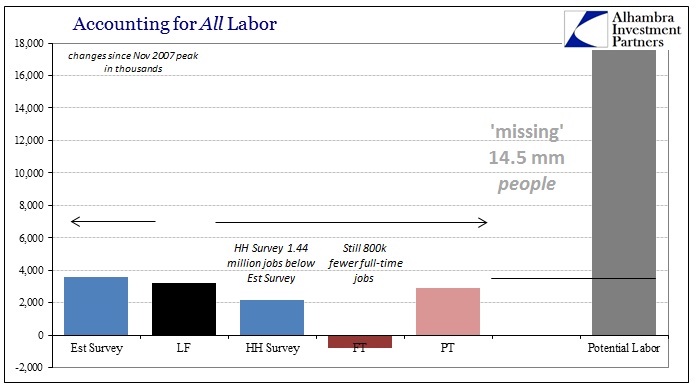

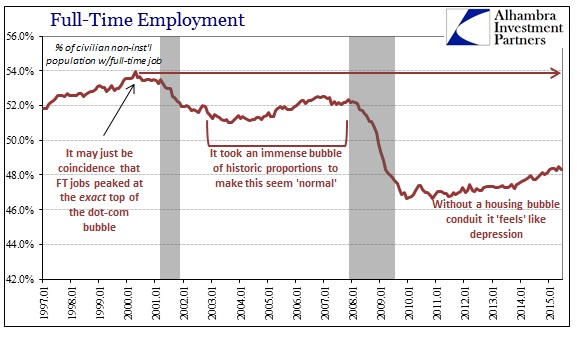

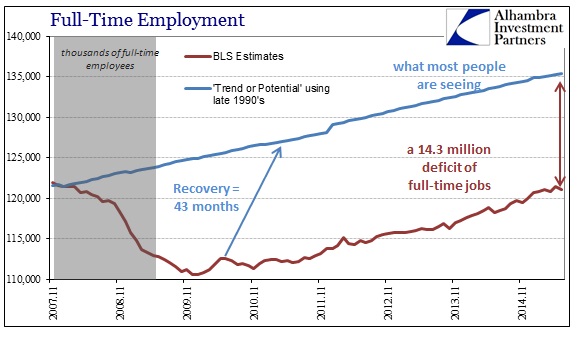

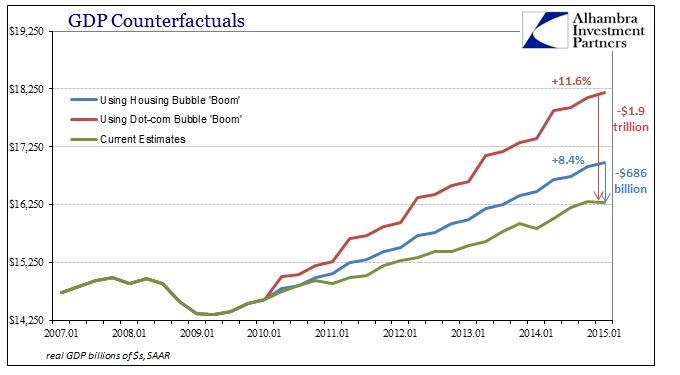

Full-time jobs which were sharply higher in May were sharply lower in June. As a result, the US economy is still 800k below the November 2007 peak. With those officially not included in the labor force jumping by an enormous 640k, the official accounting of labor decay is short by now 14.5 million. Since a true economy in the modern sense is marked by increasing labor specialization, such lingering weakness in the state of labor utilization actually suggests (proves?) not a recovery but both a depression and far, far smaller legitimately comparably economy.

With average weekly new jobless claims holding at a cycle low, that means the trend-cycle component of the Establishment Survey in particular is most likely highly upwardly biased. The fact that average monthly gains have fallen off sharply in the past few months is quite significant, as even with that bias the mainline payroll report is at least picking up something of a cycle depression. That would mean, factoring trend-cycle, that the Establishment Survey is actually agreeing with the rest of the economic data universe if severely understating the degree to which there is harmony about the growing and persisting negativity.

Overall, last month’s “perfect” report simply disappeared which means there was nothing so very good about it if it can’t foretell further and similar gains. As I surmised, it was nothing more than monthly variation, with further trends and averages suggesting the same kind of attrition as has been apparent in the rest of the economy for at least all of 2015. That leaves payrolls as subjected to both the cyclical erosion of whatever “slump” is still being exhibited now into June and also in close corroboration of the structural depression, lack of recovery, that is also displayed far-too-universally. In other words, June was worse than May was ever better because what was thought about May no longer really exists. Like the majority opinion of the recovery and especially its status in 2015, it was all statistical phantoms.