By Tyler Durden at ZeroHedge

With the biggest single-day drop in over 4 years, US High-Yield bond prices have collapsed to their lowest levels since July 2009. Crucially, it’s not just energy companies as the painful illqiuidty has careened across the entire space, not helped by fund liquidations and the biggest outflows since August 2014.

As we warned here, and confirmed here, something has blown-up in high-yield…

With the biggest discounts to NAV since 2011…

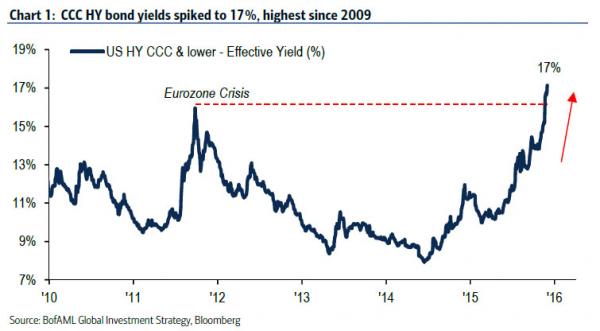

The carnage is across the entire credit complex… with yields on ‘triple hooks’ back to 2009 levels…

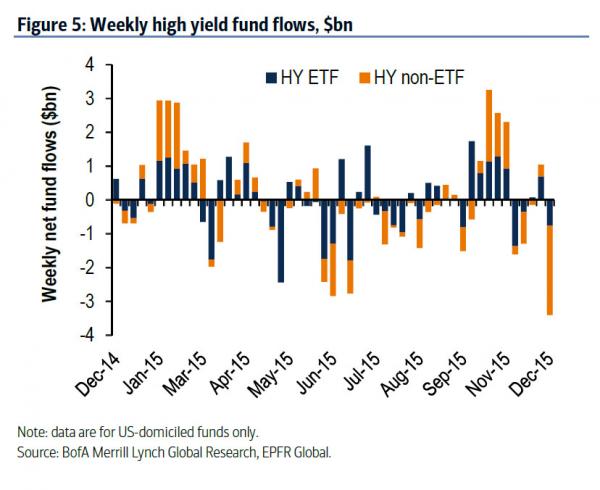

As fund outflows explode…

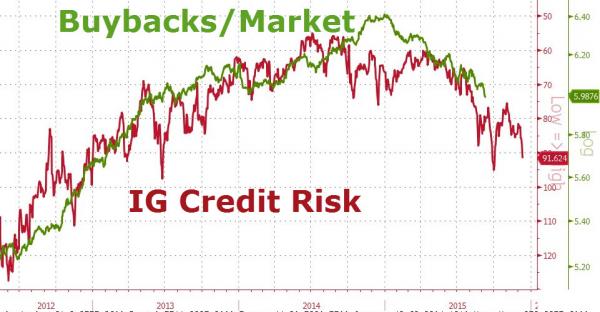

And here’s why equity investors simply can’t ignore it anymore…

It is getting harder to ignore that this isn’t just about crude oil prices and the death of “transitory.”