The Bank of Japan has already been pressured by events to reduce its economic expectations for 2014. At the end of 2013 there was enough cautious optimism that Japanese officials went ahead with their dubious proposal to try to appear fiscally responsible. The tax increase was expected to create a mild contraction in GDP before the economy then accelerated mildly but broadly with inflation. That optimism actually gained strength after the first quarter was estimated far “better” than anticipated, temporarily restraining calls for even more QQE from the Bank of Japan.

The first quarter was actually a case of the inverse interpretation eluding the orthodox mind and his regressions. If the Japanese were so compelled to front-load so much spending and activity over a relatively minor tax increase that could only be viewed, with common sense and intuition free of the statistical prison, dubiously and ominously. A healthy economy would certainly see some of that process, but not enough to create such massive swings. It was the size of the interference that suggested a course far, far off track.

Results in the second quarter had thus been much worse than expected, but still there remained blissful designs for the third. The latest projections for Q3 are hopeful in their scale, suggesting somewhere between 2% and 3% for GDP.

Part of that optimism has been derived from the “success” in generating “positive” price changes inside Japan. Academic economics is absolutely convinced that Japan’s problems stem from stubborn “deflation” that has entrenched itself into the very psychology of the Japanese people. Under that paradigm, a shock of “inflation” should have worked as Japanese agents (people, investors and businesses) are forced by nominal disturbance to re-orient their expectations. That is the foundation of modern monetarism, a mildly stunted psychology.

Yet again, however, the mainstream interpretation is far too infatuated with mathematics and has far too little experience with realistic complexity. That quarter century of “deflation” was not itself the problem, it was a symptom of structural flaws that gained great currency (pun intended) during the halcyon days of the Bank of Japan’s 1980’s “power” and prestige. Not only has the idea of “money supply” itself undergone a radical change in the past thirty years, creating new pathways and channels for psychological impulses and outlets, instability in any form is still instability.

Creating, indeed cajoling and even forcing, positive price directions on any economic system is a radical tool of redistribution. Creating nominal profits from currency debasement is, however, nothing like creating real profits from expanding wealth. There is at least some recognition of the costs of redistribution inside the orthodox construction, but it is always calculated (only qualitatively funny enough) as being less than the intended positive effects. So the Bank of Japan (and its central bank fellow travelers) admits to creating winners and losers, but does so in unabashed intent because the net “stirring of the pot” supposedly forces systemic forward momentum.

Even where losers abound, their station is believed improved over the long run by a healthy economy – supposedly you have to break a few eggs to gain socialized economic advance. That was a specific view espoused time and time again by Ben Bernanke during his justifications for all the QE’s. He “shared the pain” of fixed income retirees as he actively suppressed nominal and real returns to the maximum, but, as he always rejoined, higher rates of returns would only appear and stay when the economy was on the durable growth path (and he was very much right about that, though I’m sure he is not enjoying the current bond market proving that fact in the opposite case).

In Japan, the trick was wages and exports. Redistribution meant greater costs to households and Japanese exporters and businesses, but that would, again, be offset by the positive forces of wage gains and devalued yen cheapening Japan Inc. We know too well just how wrong the orthodox expectations were in terms of exports and Japan Inc, which has been accelerated into Japan Offshore Inc.

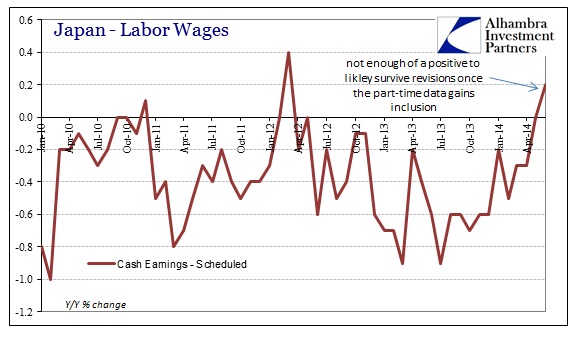

On the wage front, even nominal wages refused to budge – until more recently. In the past few months it appears as if there might stay an actual plus sign in front of scheduled earnings, the main source of income for Japanese households. Last month’s (June) first estimate was positive, as had occurred several times before, but was only revised lower, as expected, to zero. That was a major achievement in itself, breaking a two-year string of declines. Wages in July have also come in slightly positive, though it is unclear yet if it is enough to withstand the quirky downward revisions to come.

But in any event, the trend of nominal wages is in the direction that economists want and expect.

The implications of all this, however, are far less rosy than the sudden plethora of plus signs would seem to suggest (though the latest figures only run through June; given the disaster in spending shown below it might yet be premature to extrapolate about July). Again, redistribution counts more than one facet of consideration, and the state of wages in nominal terms doesn’t always mean what you are told.

Despite that increasing yen flow to households, they are not actually doing any more work. I suppose that conforms to the plan and idea for inflation, as the intentions stray little from the nominal side, but that is the problem. The real world goes far beyond nominal changes, and more often than not in the “wrong” direction due fully to that currency flow reorganization.

The exchange of labor for wages is the predicate position for creating wealth, but the Bank of Japan and all orthodox economics cares little for wealth in the pursuit of generic activity. Had wealth been expanding alongside prices (costs), wages would likely move in tandem and there would at least be some kind of hope for weathering the redistribution storm that has been unleashed over there.

Instead, there is no real reason for wages to rise other than nominal inertia, but that is far too insufficient to equalize where debasement has already had its full force. That is the great problem with all of this, that redistribution in whatever form, be it currency debasement directly, asset inflation or whatever, can only penetrate so far on its own. Unfortunately, the areas and segments of the economy most susceptible to this corruption are usually negative factors. So in the generic sense, orthodox practitioners intend to create a healthy economic trend out of an engineered preponderance of negative factors.

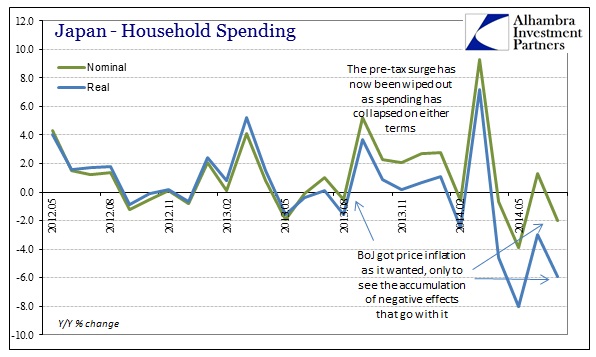

The results are entirely predictable outside of regressions. Household spending collapsed as intuition suggested during that very “hopeful” first quarter, but worse than that it hasn’t stopped.

Adjusting for prices, as best any official inflation measure can, household spending in July was worse than April and almost as bad as May! Even in purely nominal terms, to see spending decline so much without a polar vortex (cheap shot, but deserved) or additional tax changes is a very serious blow not just to future expectations but to credibility. And that is the biggest problem here, in that the Bank of Japan is not an outlier central bank running unique programs directly targeted at only Japan. They are reading the same textbook as all the others and crafting “solutions” based on it, just as the rest are.

If Japan’s results and programs here hold any true difference, it is only that they are further down the same road than the rest of us. As Japanification continues in the US and Europe, we are gaining good observations about what lays ahead until the political will to use that same textbook time and time again is exhausted, or, more likely, removed.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com