With the advance report on GDP for Q2 set to be released this week, economists are working hard to explain why it doesn’t represent the utopian delivery that they swear had already occurred via monetary intervention. There is, in immediate terms, the universal appearance of “residual seasonality” in the past few months as an almost complete revulsion to even the possibility that the US could experience yet another “soft patch.” Without meager redirection from the academics, one might get the sense that the grand recovery narrative, exposed, apparently, to regular soft patches, is more fiction compared to such unstable ground.

Beyond that supposed explanation for Q1, economists at Goldman Sachs have theorized GDP is flawed in other ways. On that we agree, but for very different reasons. They take GDP to be undercounting economic growth by way of being technologically ignorant. As if they are unaware of the broader population’s persistent complaint about the CPI, the economists argue that the major GDP statistics are overcounting “inflation” by not appreciating the advance of technology. It is difficult for deflators to fully capture the full weight of progress with each new product generation, so therefore “inflation” is too low and thus GDP unduly depressed.

Jan Hatzius and Kris Dawsey find that difficulty in gauging technology improvements may be cutting gross domestic product readings by about 0.7 percentage point. The government underestimates how quickly semiconductor, computer and special-purpose IT hardware prices are falling, reducing growth estimates by 0.2 point once the figures are adjusted for inflation, they said. It’s also difficult to measure the value of software and digital content as quality improves and new products come on line, weakening GDP data by another 0.5 point.

This is quite familiar terrain, as it perhaps best epitomizes how economists see the economy, which they so little appreciate as anything other than regression equations, and how the rest of us actually experience it. If you google “Bill Dudley ipad” you get a direct sense of this dichotomy, as it was in 2011 Mr. Dudley’s infamous remarks translated to “let them eat iPads.”

Memo to central bankers:

Best not to cite the price of the new iPad as an example of why inflation isn’t a problem when you head into a working-class neighborhood.

In Queens, New York, on Friday, New York Fed President William Dudley did just that. He got an earful.

After being bombarded with questions about food inflation, Dudley attempted to reassure his audience by putting rising commodity prices into a broader economic context — but that only made matters worse.

“When was the last time, sir, that you went grocery shopping?” one audience member asked.

Dudley tried to explain how the Fed sees things: Yes, food and energy prices may be rising, but at the same time, other prices are declining.

Now, economists are at it again this time going beyond the emphasis that Dudley was prepared to withstand. Not only are consumer prices not the problem that most people believe of them, it is actually far better than they conceive in their “irrational” feelings. To the Goldman duo, the 2.2% GDP growth of this recovery was actually something like 3% as if that makes any true difference; neither actually removes the hole left behind by the Great Recession, instead preferring to split hairs about some positive numbers.

The arrogance is striking even if couched in an academic, statistical (as opposed to actual science tied to observation) endeavor. What this is really about is, again, economists unwilling to accept that monetarism doesn’t work as they consistently promised. Instead, as “residual seasonality”, they turn their efforts away from useful reconciliation and toward trying to find the most inane and, in this case, almost offensive excuses just so that their world view might survive increasing restiveness and dissatisfaction. I suppose it will, in the inevitable end, be of some small comfort inside the clique that those that supplant them will be doing so on emotion rather than their beautiful statistics (which still does not amount to actual science, as observation cares not for the math that so often badly describes it).

In that respect, these economists may be doing somewhat of a service even if in the opposite course of their intentions. Casting aside the directions, at the base of their hypothesis is, yet again, the imprecise nature of economic accounts especially “inflation.” They acknowledge that it is exceedingly difficult to define how much prices are what prices are in the economic sense; you might as well try averaging the numbers in the phone book, unappreciative of technology as that would be. And while they find that useful in undercounting deflators as a means to “find” “missing” GDP, they actually confirm that the whole system of GDP itself as it relates to “inflation” is unreliable in any sense.

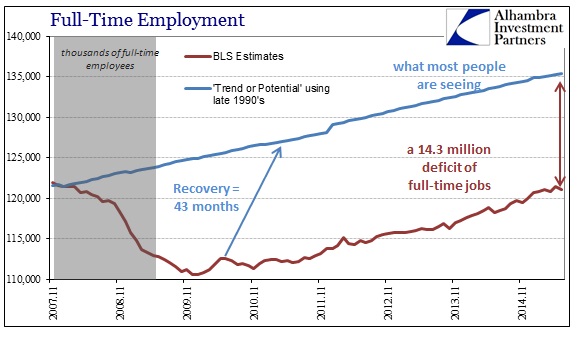

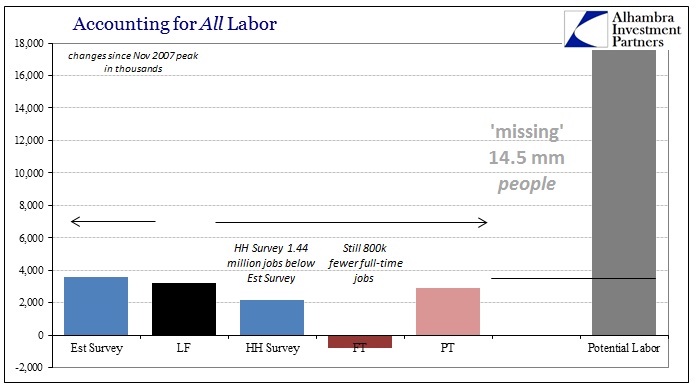

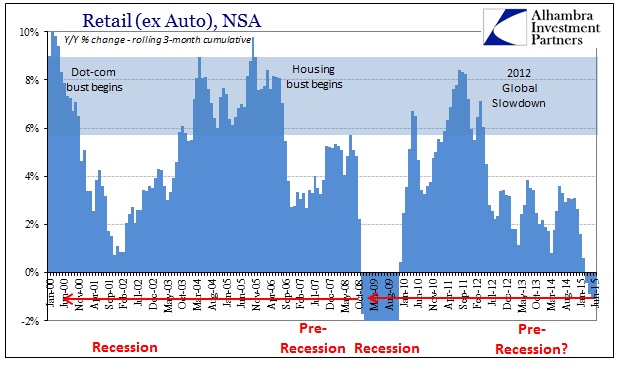

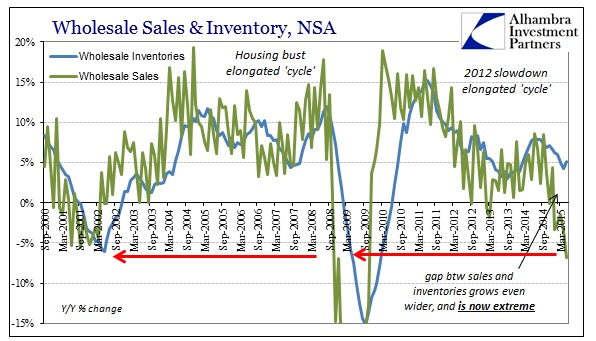

As I noted last week, the level of pollution aside labor utilization more than suggests not just lack of recovery but a permanently shrunken economy following monetary directives:

We can debate the ultimate cause of all this, but that too is intuitively easy to absorb as it correlates exactly (perfectly exact in the case of labor participation; the peak was April 2000 which was also the peak in the dot-com bubble) with serial asset bubbles. What should be much less contentious is what has resulted. It is accepted that the recovery has been lacking, but there is more than enough evidence amassed that it has never actually arrived. The US economy has been durably altered, shrunk by weight of continued socialist redistribution efforts through largely monetary intervention.

All the rest of these positive numbers about GDP and related assumptions (like the Establishment Survey) are just noise further masking the depression. That itself isn’t surprising since the statistics were created under assumptions that monetarism works and works well (trend-cycle). A more informed and faithful interpretation of inflation would cure that problem.

The fact that economists are so far apart from the rest of the population further emphasizes the disconnect. While that has manifested mostly in drastically different views on the current economy, it also comes as directly from true inflation – namely the erosions of standards by which all is actually judged. Goldman’s economists accept asset bubbles as a monetary tool (not to mention a business strategy, if more so in the past) which is perhaps the most stunning implementation of inflation in our history. Asset bubbles were once viewed as unbelievably dangerous and ultimately completely foolish to accept and even argue in favor of them; that alienation might well be incorporated into the GDP debate as such common sense has been displaced by all the garbage in/garbage out models that attempt to find, to even silly tactics, “missing” GDP.

If there is anything truly missing from GDP, it is how artificial growth is superimposed upon organic activity and then counted as sustainably meaningful. In other words, the real problem here is how real inflation is left out as it occurs; how asset bubbles are destructive in the long run and that the long run has long since arrived! If there is misapprehension about inflation, it is all the missing (from the math and models, not our shared perceptions) asset inflation that corrupted the economy to its now withered state.

That is what this is all ultimately about, namely that the economy does not live up to economists’ perceptions because of true inflation. That exhibits in different ways, from Dudley’s ill-conceived Marie Antoinette update to food and fuel prices to the very nature of economic function itself. If getting economists to accept that main statistics are highly flawed if only at first in their assertions of how they think it leads to a more conforming view for them, then so be it. This all has to start somewhere, and it certainly won’t be, by the end, in how technology has made consumers far better off in this cycle. Unstable growth is the most obvious observation about all of that.

Missing GDP? Missing economy: