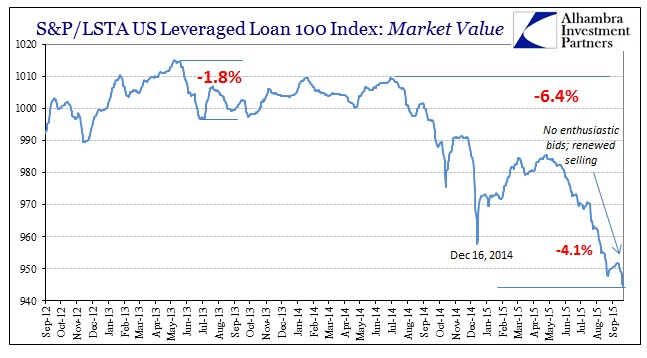

I think it worth noting one more reason Yellen was out front yesterday. Not only is liquidity suffering still globally but that is having an immensely negative effect on asset prices, especially at the bubble points. The S&P/LSTA Leveraged Loan 100 had not been updated since last Friday, which suggested (to me) continued pricing difficulties in leveraged loans. The combination of declining prices with further and greater uncertainty about those prices is highly, highly combustible. Thus Yellen’s feeble attempt at reassurance; it wasn’t quite as bad as “contained” but at this point I doubt you’ll ever hear the phrase “leveraged loans” escape her lips.

Now that S&P has updated the index through yesterday, we can appreciate it being as bad as expected: new low in terms of market value, significantly less than even the August 26 terminus for the global liquidation wave. Again, that isn’t unexpected given other institutional junk prices but especially the continually unsettled nature of the “dollar” and liquidity.

There is a break point looming, though impossible to quantitatively infer where that might be; qualitatively, I would expect it where “transitory” is not only disavowed but more widely accepted as laughable. All we know is that there is very little illuminating the full weight of it. It’s quite understandable that Yellen and the FOMC are feeling the pressure, though they should garner no sympathy since it all falls upon their unnecessarily rigid, soft central planning.