I’m starting to get the feeling the scorn and ridicule heaped upon Dr. Hussman by the Wall Street shysters is about to be thrown back in their faces. Of course, he isn’t an I told you so type of person. He’s an analytical investor who bases his thinking upon historical facts and valuation methods that have proven accurate over the last 100 years of investing. His two key principles on investing are flashing red. Corporate revenues and profits are falling. The attitude of investors regarding risk is shifting from greed to fear. With valuations at record highs, margin debt at epic levels, and professional investors extremely bullish, even the hint of fear will begin the collapse. It’s already happened twice in the last fifteen years and Hussman called the previous two collapses too.

If I were to choose anything that investors should memorize – that will serve them well over a lifetime of investing – it would be the following two principles:

1) Valuations control long-term returns. The higher the price you pay today for each dollar you expect to receive in the future, the lower the long-term return you should expect from your investment. Don’t take current earnings at face value, because profit margins are not permanent. Historically, the most reliable indicators of market valuation are driven by revenues, not earnings.

2) Risk-seeking and risk-aversion control returns over shorter portions of the market cycle. The difference between an overvalued market that becomes more overvalued, and an overvalued market that crashes, has little to do with the level of valuation and everything to do with the attitude of investors toward risk. When investors are risk-seeking, they are rarely selective about it. Historically, the most reliable way to measure risk attitudes is by the uniformity or divergence of price movements across a wide range of securities.

I should make the point that these principles aren’t new. They capture the same principles I laid out in October 2000, at the beginning of a market collapse that would take the S&P 500 down by half and the Nasdaq 100 down by 83%. They capture the same principles that prompted me to turn constructive in April 2003 after that collapse. They capture the same principles I laid out in July 2007, just before the global financial crisis took the S&P 500 down by 55%.

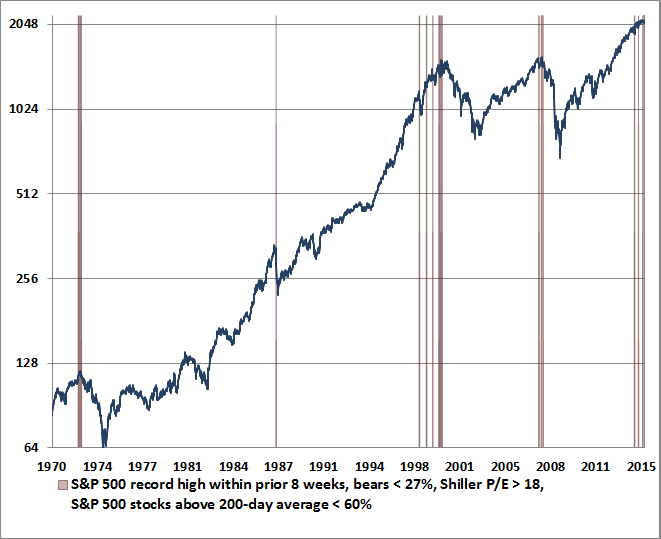

For those who are visually astute, please peruse the chart below. The conclusion is quite simple. When the current conditions have existed over the last 45 years, the stock market crashes. Period.

The chart below imposes one additional condition, showing periods where fewer than 60% of S&P 500 stocks were above their respective 200-day moving averages. This is as clear and simple as the Iron Laws can get. The worst market outcomes in history have always emerged after an overvalued, overbought, overbullish advance has been joined by deterioration in market internals.

Let’s go one step further, and restrict these instances to weeks where the S&P 500 had just set a record weekly closing high. That restriction kicks out 1987. In that instance, the earliest warnings were from weakness in utilities and corporate bonds, but the percentage of stocks above their own 200-day averages didn’t fall below 60% until the market itself was already down nearly 10% from its high; less than two weeks before the crash. Many trend-followers were caught off-guard because the warning period was so brief. If one wasn’t following a broad range of market internals, one needed to respond almost immediately to the emerging weakness in order to avoid the collapse.

The market has fallen for five consecutive days. The Chinese market is already crashing. I wonder how many people are prepared to see their investment portfolio or 401k fall by 50% – again. We’re gonna find out.

The remaining signals (record high on a weekly closing basis, fewer than 27% bears, Shiller P/E greater than 18, fewer than 60% of S&P 500 stocks above their 200-day average), are shown below. What’s interesting about these warnings is how closely they identified the precise market peak of each cycle. Internal divergences have to be fairly extensive for the S&P 500 to register a fresh overvalued, overbullish new high with more than 40% of its component stocks already falling – it’s evidently a rare indication of a last hurrah. The 1972 warning occurred on November 17, 1972, only 7 weeks and less than 4% from the final high before the market lost half its value. The 2000 warning occurred the week of March 24, 2000, marking the exact weekly high of that bull run. The 2007 instance spanned two consecutive weekly closing highs: October 5 and October 12. The final daily high of the S&P 500 was October 9 – right in between. The most recent warning was the week ended July 17, 2015.

Though advisory sentiment figures aren’t available prior to the mid-1960’s, imputed data suggest that additional instances likely include the two consecutive weeks of August 19, 1929 and August 26, 1929. We can infer unfavorable market internals in that instance because we know that cumulative NYSE breadth was declining for months before the 1929 high. The week of the exact market peak would also be included except that stocks closed down that week after registering a final high on September 3, 1929. Another likely instance, based on imputed sentiment data, is the week of November 10, 1961, which was immediately followed by a market swoon into June 1962.

They do ring a bell at the top. The bell is ringing loud and clear. The bell is ringing so hard, it broke. Anyone not heeding the warnings of Dr. Hussman will end up being much poorer. This will not end well.

It’s often said that they don’t ring a bell at the top, and that’s true in many cycles. But it’s interesting that the same “ding” has been heard at the most extreme peaks among them.

Look at the data, and you’ll realize that our present concerns are not hyperbole or exaggeration. We simply have not observed the market conditions we observe today except in a handful of instances in market history, and they have typically ended quite badly (see When You Look Back on This Moment in History and All Their Eggs in Janet’s Basket for a more extended discussion of current conditions). In my view, this is one of the most important moments in a generation to examine all of your risk exposures, the extent to which you believe historical evidence is informative, your tolerance for loss, your comfort or discomfort with missing out on potential rallies even in a wickedly overvalued market, and your true investment horizon. It’s perfectly fine to decide, after that consideration, to maintain a bullish outlook. Earnest people can disagree, and that’s what makes markets. But do review all of your risk exposures here.

Read Hussman’s Full Weekly Letter

Source: SOMETIMES THEY DO RING A BELL AT THE TOP « The Burning Platform