By Ciara Linnane at MarketWatch

Another day, another flurry of gloomy earnings reports.

Thursday was the busiest of the current season so far, and while there were some bright spots, it mostly continued the trend of widespread sales misses and lowered guidance for the rest of the year.

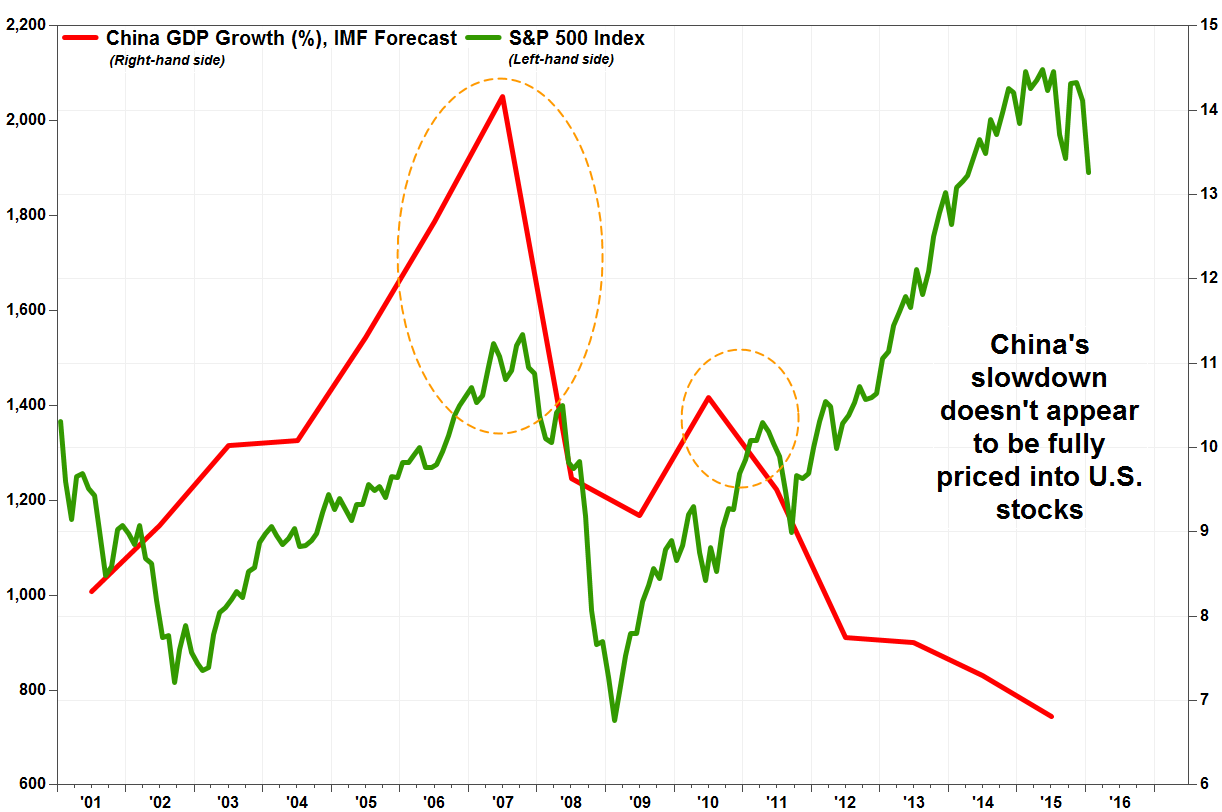

A wide range of companies have missed sales forecasts this week, weighed down by the now familiar list of factors that include the strong dollar, the slowdown in China and the weakness in commodities. There is also growing concern that the Federal Reserve may have pulled the trigger on interest-rate hikes too early.

As per-share earnings are more easily manipulated through such actions as share buybacks, the sales number is a key metric in understanding underlying performance. And the stream of sales misses has analysts using the R word—recession, either confined to the industrial sector or even applied to the broader economy.

Reflecting the gloom, Credit Suisse analysts on Thursday revisited lessons learned from past recessions, in an attempt to address growing concerns about the state of the world.

That’s after the U.S. equity market’s dismal performance in 2016 so far with the S&P 500 SPX, +1.20% down 8% and the Dow Jones Industrial Average DJIA, +1.32% off 8.3%.

The bank’s economists are still expecting growth of just above 2% for the next two years, although they acknowledge risk stemming from credit markets, energy and China. “Given these risks and escalating investor fears, we have taken a deep dive into the implications for U.S. equities if the U.S. falls into recession,” they wrote in a note.

The bad news: history suggests recessionary periods lead to a 33% pullback in equities on average, the analysts found. The good news: that is typically followed by a rebound of 62% on average.

About a third of S&P 500 companies have now reported and the index is on track for a median 3.5% decline in sales, according to FactSet data. That’s the data provider’s blended growth rate, which combines those companies that have reported with the estimates for the rest.

As recently as September, analysts were expecting a more modest 1.1% median decline in sales.

Expectations for the current quarter have also fallen sharply. Analysts were expecting the first quarter to show growth of 4.3% back in September. On Thursday, that number had shrunk to 0.7%.

The S&P 500 is on track for its fourth straight season of negative sales, according to FactSet, the longest such negative streak since the four-quarter stretch from the fourth quarter of 2008 to the third quarter of 2009. The S&P 500 index has fallen 7% in the last 12 months.

Per-share earnings are looking at a deeper decline of 5.7%, which is an improvement from a decline of 6.3% on Wednesday. It will be the third straight quarter that earnings decline.

Among the weaker reports Thursday, Altria Group Inc. MO, +1.86% bucked the current positive trend for tobacco companies with below-consensus sales and profitand news it will cut jobs in a cost-cutting program that aims to save $300 million annually. The Marlboro maker said the cuts would come from its selling, general and administrative areas and result in $210 million in employee-separation costs that will be recorded in the first quarter.

Harley-Davidson Inc. HOG, -0.98% cut its shipments outlook for 2016 as profit slumped 43% and its market share slid to 50.2% from 53.3% in 2014.

Private-equity giant Blackstone Group’s BX, +3.65% profit fell 64%. Stanley Black & Decker Inc. SWK, +2.13% sales fell 4.6%, instead of climbing as analysts weer expecting. Johnson Controls Inc. JCI, +0.69% fresh from its Monday merger with Tyco International TYC, +2.14% said sales and profit fell, and sale missed estimates. Caterpillar Inc. CAT, +0.52% swung to a loss and said its full-year sales declinewould be double earlier expectations, citing trouble in the U.S., Brazil and China.

Among the bright spots, Ford Motor Co. F, +0.00% swung to a profit thanks to strong U.S. truck sales, although analysts said pricing and the dollar are headwinds. Alibaba Group Holding Ltd. BABA, +0.15% beat on profit and sales. But Alibaba’s gross merchandise volume, a key metric for the e-commerce giant, slowed to 23% from 28% last quarter, and a big slowdown from 50% growth in 2014.

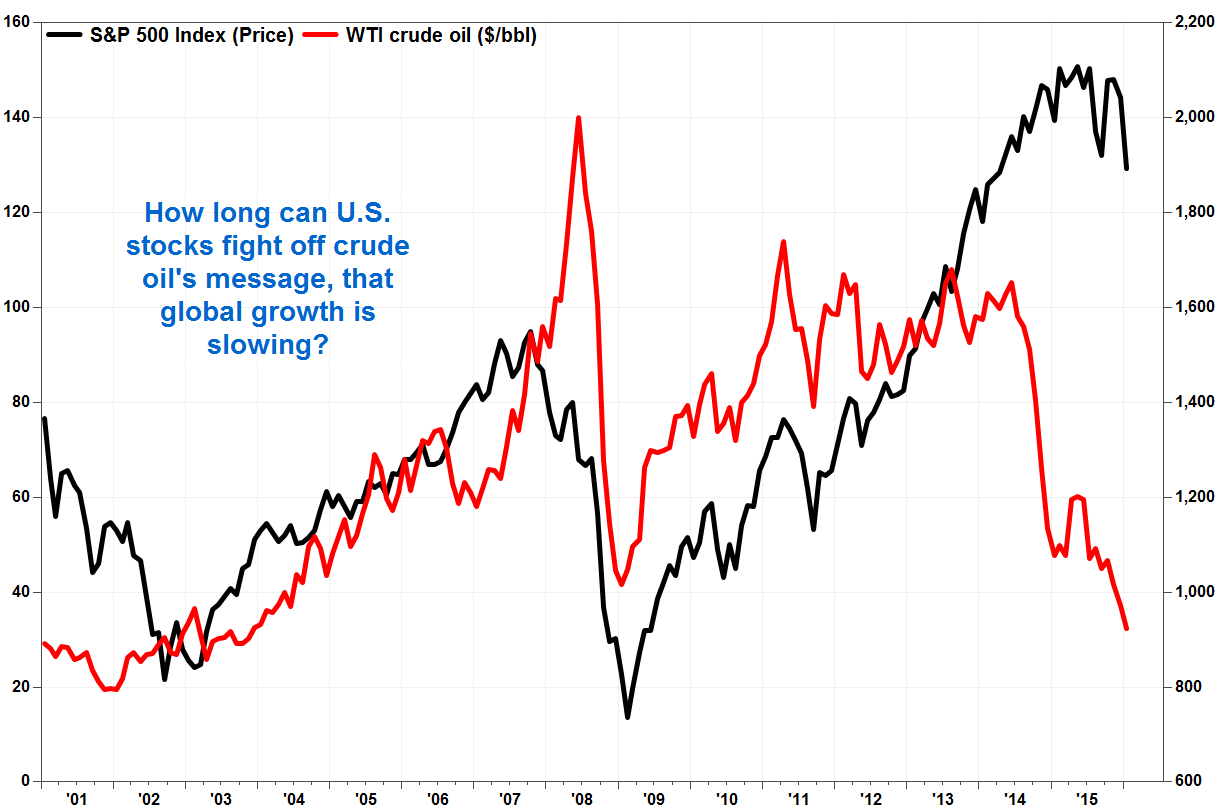

“Oil is a barometer of global economic growth expectations, which have been revised downward several times in recent months,” John Jares, senior portfolio manager at USAA Investments wrote in a market commentary to clients. “Most of the anxiety about this trend focuses on China, which in 2015 experienced its slowest pace of growth in a quarter century and is expected by many to slow even more this year.”

Source: These Earnings Suggest We May Be Headed For Recession – MarketWatch