The horror show of European banking system data just keeps getting worse. With Deutsche Bank now constantly in the headlines, it has the look and feel of impending doom, maybe worse than 2008-09. The biggest difference between then and now is that back then the financial markets had already plunged and central banks had yet to start printing money. Now it seems like we’re just whistling not past, but through, the graveyard. One of these zombies will surely reach up from the grave and pull us into the casket with them.

Meanwhile Mario Draghi proclaims “great success” in NIRP and QE, while maintaining that he’ll do whatever it takes to stop the meltdown. This is the fantasy world of contradictory propaganda in which Europe and the world now live.

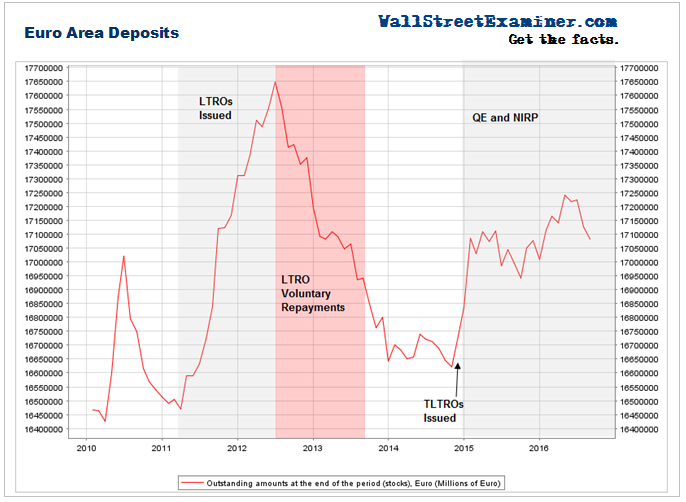

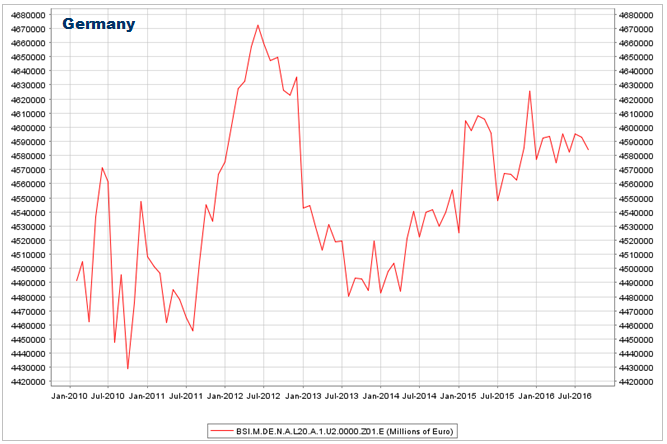

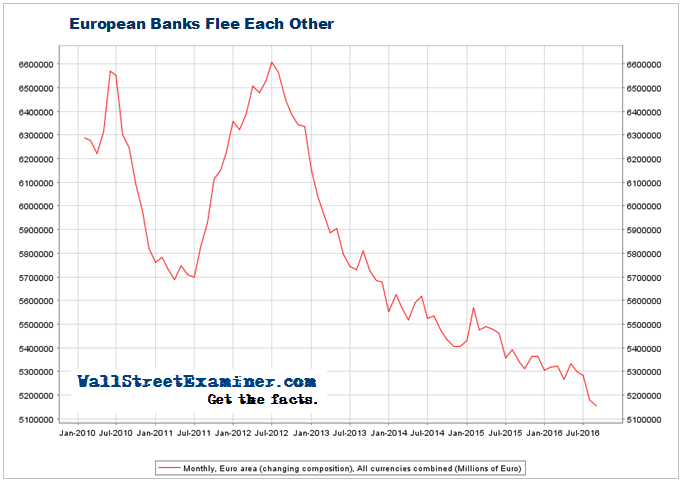

ECB data on bank deposits for the Eurozone shows total bank deposits down sharply again in August, breaking the uptrend in force since the low in 2014. That’s shocking considering that the ECB just boosted its money printing QE programs. Deposits should be rising steadily in concert with the amount of QE, not falling. But cash extinguishment and capital flight are increasing faster than the ECB can print.

We continue to see evidence that funds are fleeing the European banks for the relative “safety” of the US. My long running thesis that the US is and will be The Last Ponzi Game Standing is still well supported by the data. The looming problem is that all Ponzi schemes eventually collapse. The only question is the timing, which we deal with in other reports.

The charts below show that the European banking system is in a slow moving disaster. Only smoke, mirrors, and the unwarranted confidence of most Europeans in their banks and the ECB are keeping the system afloat.

The source of all European bank data in the charts that follow is the ECB Statistical Warehouse.

7/1/16 Money printing in the form of the ECB’s asset purchases should cause a euro for euro increase in deposits, but that has not occurred. Sorry to be repeating this, but it’s because a substantial portion of the ECB’s newly printed money flees the Eurozone to avoid the NIRP tax.

Click any chart to view it full size.

The problem worsened in August when bank deposits in Europe contracted for the second straight month in spite of €70 billion per month in QE. Deposits are now down by €161 billion since April and are back to the December 2015 level.

This report is excerpted from the Wall Street Examiner Pro Trader monthly report on the condition of the European banking system. Try the service for 90 days risk free.

Since deposits in Europe’s banks peaked in April, the ECB printed €341 billion in its QE program. Sum that amount added to the banking system with the net deposit decline of €161 billion, a total of €502 billion disappeared! Poof! Magic Mario prints money and then makes it disappear, and then some.

When the ECB buys securities, it debits the dealer’s account at the ECB. That cash then flows into the banks as the dealers trade with other parties. Another means of transmission is when governments spend funds they raised in debt sales funded by the ECB indirect purchases via dealers. Bank deposits should increase euro for euro with the amount of ECB purchases.

Extending the lookback period to the inception of NIRP in September 2014, the ECB balance sheet has grown by €1.33 trillion. Bank deposits have only grown by €430 billion. Therefore, €900 billion of the €1.3 trillion that the ECB has printed and pumped into the banking system has disappeared from the face of the European continent. That, ladies and gentlemen is the magical effect of NIRP. It results in the destruction of money. It is a process that I predicted would happen back then.

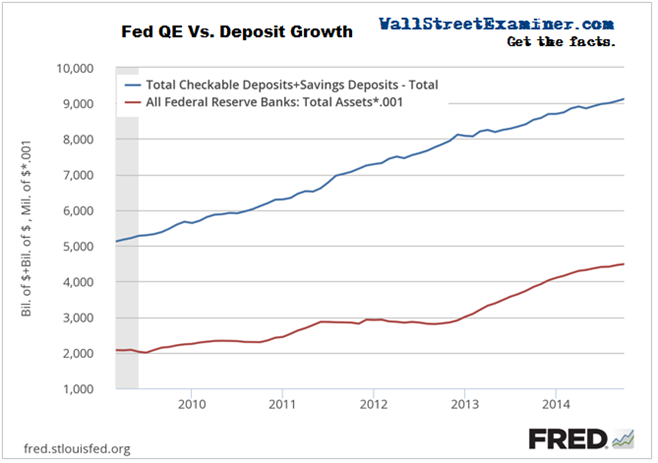

To illustrate the point, let’s compare what has happened in Europe to what happened in the US under QE and ZIRP from March 2009 to the end of 2014 when QE ended.

The ECB reports total combined deposits of all types as a line item. The Fed reports various types of deposits separately and then in various groupings, none of which are an exact match to the ECB’s total deposits figure. I tally a total US deposits figure combining all checkable deposits and savings deposits which is akin to the ECB’s grouping of total deposits. The US figure grew by $4.30 trillion from March 2009 until the end of 2014. During that period, the Fed added $3.66 trillion to its balance sheet (aka printed). In other words, US checking and savings deposits grew by 117% of the amount which the Fed injected into the system.

Contrast that to Europe where bank deposits have now grown by only 32% of the amount of ECB injections in the latest round of QE. This shows the massive drag effect of NIRP. While NIRP has not been passed through to most bank depositors yet, its effect has shown up in sovereign yields. They have dropped below zero, encouraging holders to sell and take a windfall profit, then move the money to the US. It also encourages potential buyers to send their cash to the US rather than accept a penalty for holding the paper.

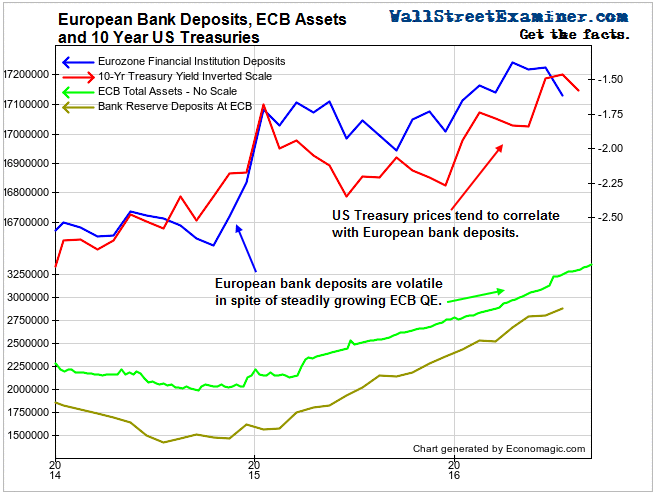

3/2/16 I have constructed the chart below to illustrate what is happening. That chart shows the correlation between the ECB’s asset growth, and the size of its various deposit facilities–what economists call reserves–along with the correlation to total European bank deposits and the direction of US Treasury bond prices.

3/2/16 Note the correlation between European bank deposits and the direction of US Treasury note prices (yield inverse) at the top of the chart. We obviously know that some European deposit holders have been buying Treasuries. I have shown charts similar to this in the past which depict this correlation over the long term. This chart shows what has happened since the ECB started NIRP in June 2014.

The lower half of the chart shows that as the ECB purchases assets (green line) there is a like increase in bank reserve deposits at the ECB. This is basic Accounting 101. The ECB buys the bonds from the banks by crediting their deposit accounts at the ECB with money it materializes by waving its magic money wand through the electronic ether.

Those reserve deposits which didn’t exist prior to that moment instantly become very real, and absolutely immutable. They can move around on the liability side of the ECB’s balance sheet, but they can’t leave it. Banks can get rid of their reserve deposits by buying assets from other banks, dealers, investors, businesses, or governments, but that only leaves another bank with the reserve deposit. Somebody will always be stuck paying the interest on the deposit. That makes those reserve deposits a hot potato that nobody wants, but nobody can escape as cash circulates through the banking system. Gone today, here tomorrow, oops.

The problem for the bagholding banks is that when they try to pass on the negative interest rates to customers, those customers with international connections do the rational thing, because, unlike central bankers, they are not insane. Deposit holders find the best option for their cash outside the European banking system, and the deposit leaves that system for greener pastures, most often in the US. Those deposits move frequently via the purchase of US Treasury securities or even US stocks. When the depositor buys Treasuries or US stocks, his bank exchanges his Euro deposit for US dollars and transfers the US dollars into the US account of the seller of the Treasuries. That could be a dealer, another investor, or the US government itself. The Euro deposits are thus converted to dollars and become US bank deposits.

This is basic interest rate arbitrage, and NIRP exacerbates that to the nth degree. That’s how the ECB can pump 650 billion euros into the European banking system, and deposits in that system manage not to grow at all. Depositors aren’t stupid. They’re getting the hell out of Dodge. The only stupid ones are Mario Draghi and his fellow central banksters at the ECB and more recently the BoJ. This raving lunatic is singlehandedly keeping the US Ponzi Game markets rolling while doing absolutely nothing for Europe.

As insane US central bankers may be, I suspect that they are just lucid enough to understand the benefits of NIRPitrage to the US Ponzi. That’s why I doubt that we will ever see NIRP in the US, and why the Fed may just follow through on its threat to gradually raise the sham Fed Funds rate (n0body really trades Fed Funds). The bigger the gap between positive rates in the US and negative rates in Europe becomes, the more capital will be encouraged to flee Europe and float US bond prices higher.

As we’ve seen recently, and as I previously forecast, it has also been enough to foment intermittent rallies in US stocks. This ridiculous pattern can go on for a long, long time. While buy and hold is dead, these policies result in tremendous trading opportunities on both long and short sides of the market for those who are paying attention.

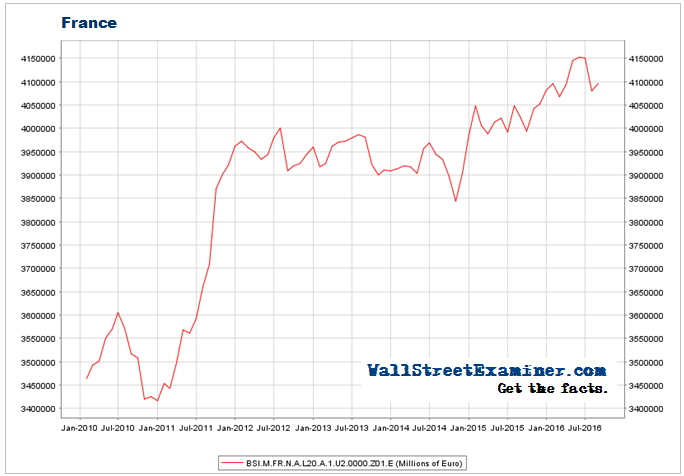

Getting on to the particulars of the state of national banking systems, the French banks had apparently become Europe’s internal safe haven as Deutsche Bank melted down. But that suddenly changed in July as deposits there cratered. There was a dead cat bounce in August.

There has been minimal deposit growth in Germany as the ECB’s printed money has assiduously avoided staying in the German banks. Deposits in August were no higher than they were in early 2015. Deutsche Bank and other troubled German banks have been bleeding deposits this year as fast as the ECB can print and inject money into the German banks.

There has been minimal deposit growth in Germany as the ECB’s printed money has assiduously avoided staying in the German banks. Deposits in August were no higher than they were in early 2015. Deutsche Bank and other troubled German banks have been bleeding deposits this year as fast as the ECB can print and inject money into the German banks.

6/10/16 While some of the ECB cash has perversely flowed to US shores, some of it has been used to extinguish debt, and thus deposits, in European banks.

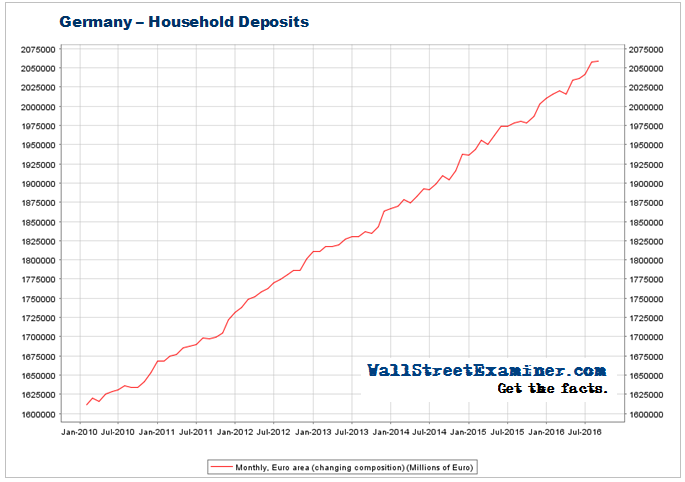

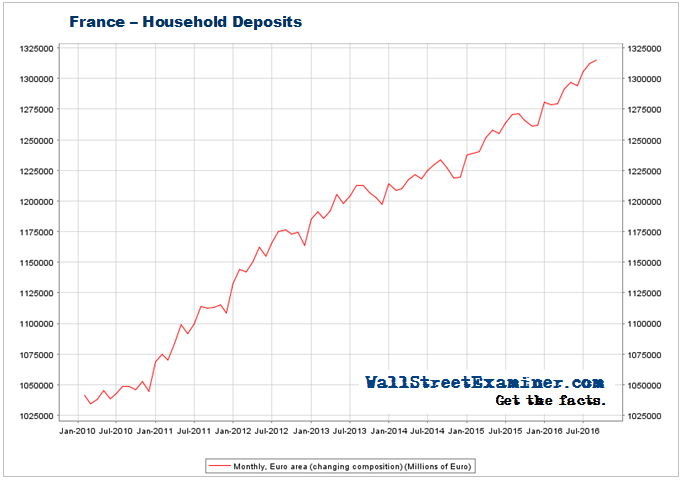

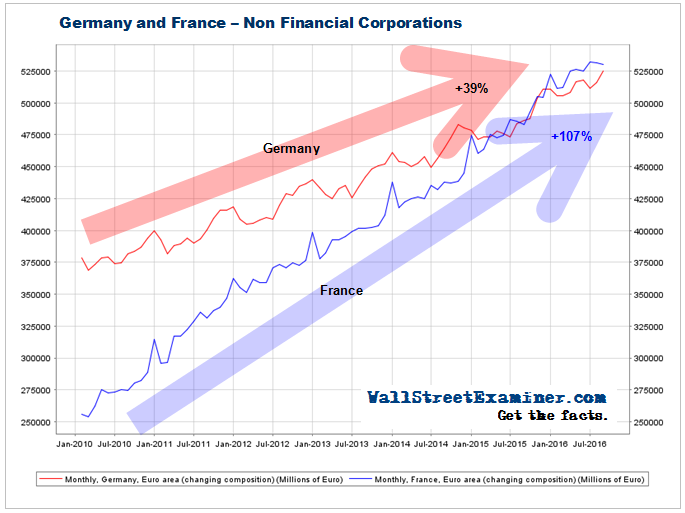

Households have been growing deposits in Germany and in France. Non financial corporate deposits have been trending higher (Charts below). These increases were all an effect of negative rates. Deposit costs are lower than the cost of holding government paper. Businesses and wealthy families choose not to hold highly negative yielding government bonds. This will ultimately prove disastrous when the banks collapse and depositors are forced to bear the losses. Deutsche Bank’s recent troubles are just the tip of the iceberg, the first domino.

German (and some other European) households, however, continue pouring money into German bank accounts. The question is whether households will be bailed out or will be the bagholders, if and when the crunch can no longer be papered over.

French people, and to some degree other European households, also appear to have unlimited faith in French banks. While financial corporations and institutions flee the system, either the public has been successfully hoodwinked, or it has no other options.

Non-financial businesses have also been pouring cash into French and German banks. In the course of every day business activity, what choice do they have? I guess that another question is why corporate business deposits in France have grown so much faster than in Germany.

Some data is just mysterious, but in this case the suggestion is that while businesses may be unable to move deposits out of the European banking system entirely, they have less confidence in German banks than French banks. Shockingly, French banks now hold more business deposits than do German banks. Back in 2010, German banks held roughly 50% more in business deposits than did French banks.

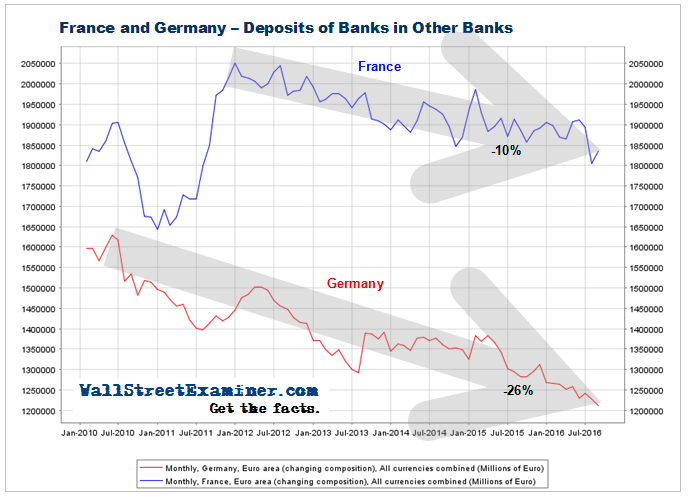

3/19/16 But look what is happening to the deposits of the banks themselves in other banks. Just as I predicted they would, banks have been extinguishing deposits ever since negative interest rates were instituted. And where has that trend been strongest? In Europe’s largest economy and banking system, Germany. They dropped to a new low in December even before the ECB went to an even more negative deposit rate. Then they dropped again in January. Banks will elect to use their cash deposits to pay off loans. Where will they get the cash? Why, from the ECB of course, as it buys securities from them.

In August, other banks continued to flee German banks while French banks saw a dead cat bounce within the downtrend. The downtrend in Germany has been unrelenting. Conversely, France had been stable since late 2014, but then it broke down in July.

6/10/16 If any picture illustrates the problem in Europe, it’s that flight of bank cash from Europe’s largest banking system. Confidence in the system is falling apart. It’s probably the real reason that the ECB keeps boosting QE, buying more and more assets from the banks. The resulting deposits are at the ECB, not Deutsche Bank.

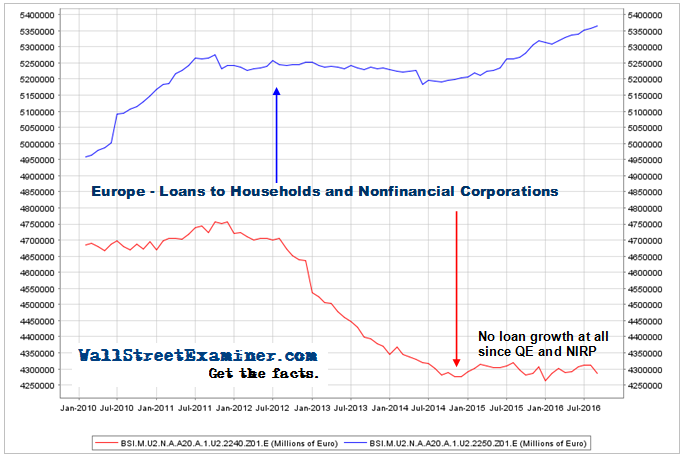

6/10/16 Loans to households have grown at an annual rate of around 2% since October. Accrued credit card interest alone could account for most of that increase. There’s no evidence of real growth in consumer lending.

Loans to nonfinancial businesses in the European banking system stabilized in late 2014, after 3 years of decline. They edged to a new low in December 2015 before a dead cat bounce which has kept them just above the lows this year. Loans have not grown at all in spite of massive, and massively misguided, attempts at stimulus by the ECB. Yet somehow, Mario “Borat” Draghi pronounces, “Great success!”

The remainder of this report reviews the most troubled European national banking systems. To view, try 90 day risk free trial to the Wall Street Examiner Pro Trader monthly report on the condition of the European banking system along with reports on the Fed, the US banking system, liquidity flows in the US Treasury market, and monthly reports on real time Federal Government revenues.

This report is excerpted from the Wall Street Examiner Pro Trader monthly report on the condition of the European banking system. Try the service for 90 days risk free.