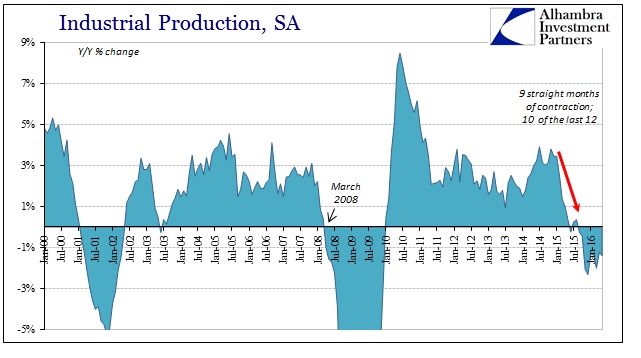

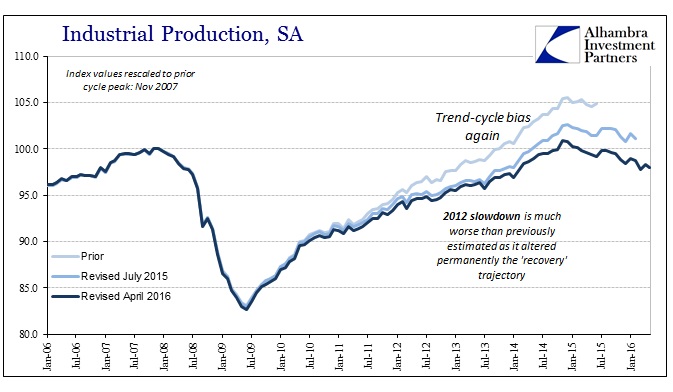

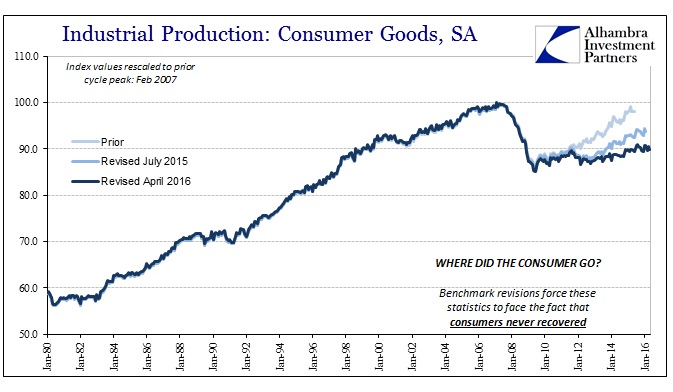

Industrial production fell year-over-year in May 2016 for the ninth consecutive month. At -1.4%, it is the same kind of slow, steady contraction now that we find in so many other places. This is not the typical recession response, instead more consistent with the slowdown turning into serious than just insufficient growth while still at the precipice of potential recession. Production in consumer goods was also down, but that also isn’t necessarily meaningful since, after benchmark revisions, consumer goods activity never recovered.

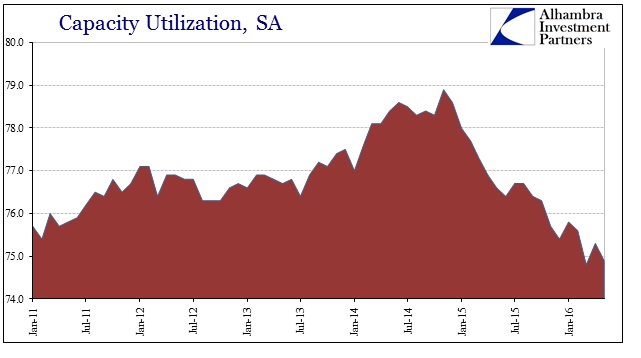

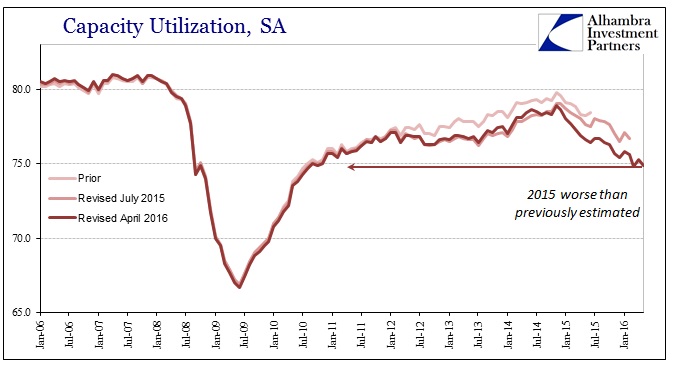

The overall report was thus relatively unsurprising, save autos, continuing more or less the same. Capacity utilization dropped back to 74.9%, essentially matching the new low reached in March. That is equivalent to the industrial inefficiency last seen just prior to the launch of QE2 in the autumn of 2010. Overall, as with all other accounts, this industrial slump has not abated despite the expected (in the mainstream) rebound from the poor start to the year. It is more evidence that further weakness and even contraction is the baseline not the anomaly.

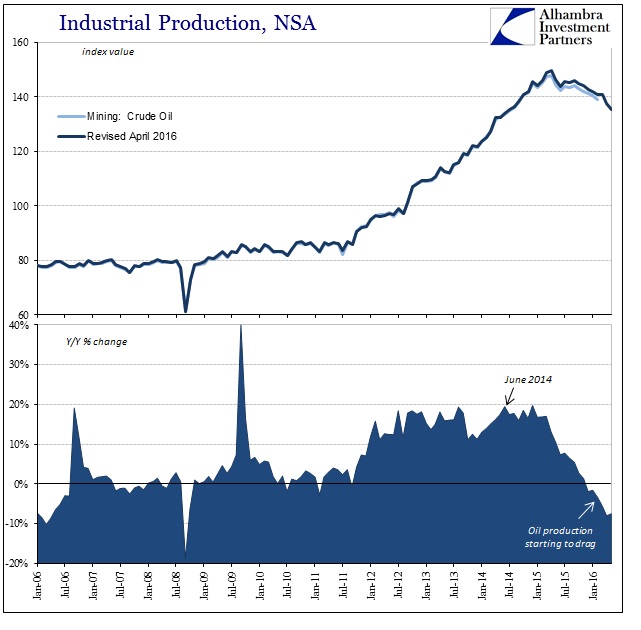

The mining sector, specifically oil and gas, is still only a minor drag on overall production levels. Year-over-year, IP in this segment fell 7.5%, bringing the 6-month average down to only 4.6%. Individual monthly revisions have tended to be upward, meaning that in the initial estimates the contraction in production for the energy sector is somewhat overstated. Still, with IP contracting here for each of the past six months it is clear that the former boost to the economy from artificial oil prices is gone, very likely turned into an as-yet unknown drag.

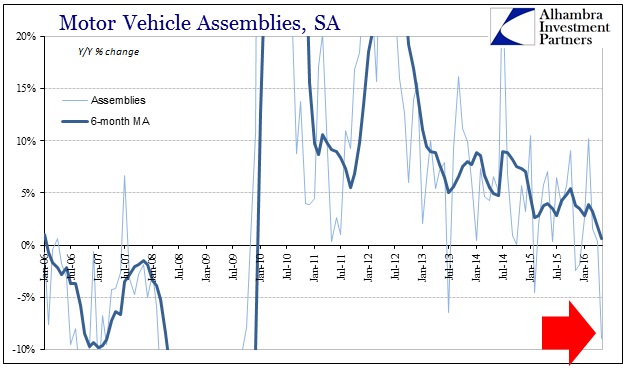

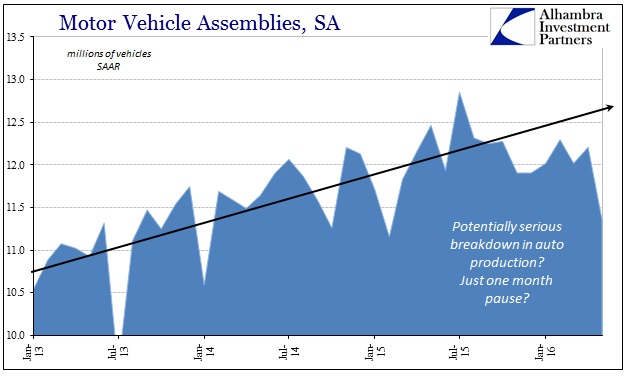

Of greater concern at this point has to be the auto sector. Motor vehicle assemblies, the Fed’s proxy for domestic auto production, fell considerably in April. The Fed estimates that total production was 11.35 million units (SAAR), down sharply from 12.2 million in April and nearly 9% below May 2015.

That was the sharpest decline of this “recovery”, though it isn’t clear yet whether that is meaningful. This data series is notoriously noisy and volatile, so the magnitude of the production contraction will not really be established until future months are estimated. Even if the decline is erased by June production, however, it is increasingly clear that overall auto production has eased from its prior torrid pace – all dating back to last summer and the advance of “global turmoil.” From yesterday’s, retail sales report we find topline auto sales have also softened prominently in 2016, while auto inventories remain at recessionary imbalance.

From that perspective, it is unsurprising to find auto production decline and do so perhaps sharply. What we don’t know is whether this is another small adjustment or if automakers are finally relenting to the slowdown’s shifting (to contraction) economic climate. At the very least, there aren’t any indications of “strong” consumer spending here – only further indications of a worsening economy. As I wrote yesterday:

As autos only further accumulate in inventory, if there is either or both a financial and consumer reluctance now to purchase new autos then we should expect even more slowing across the industrial sector both here and abroad. Autos have been the one bright spot in the global consumer economy so far, meaning the reduction in sales combined with the tremendous inventory overhang takes on disproportionate consequence at the economic margins.

We may be starting to find just that in production, though it will need more than one month to confirm. At the very least, it is so far consistent with both sales and inventory, and thus a highly negative prospect for the economy’s near term in an overall industrial environment already seeing steady and expanding contraction.