What good is a target or even an emphatic commitment to it if you have already proven you can’t achieve it?

So far the only “market” that really counts isn’t buying the new promises, either. We’ll see if that is just a knee-jerk reaction or if it re-ignites the contrary “dollar” trend that had so plagued Abenomics going back to last summer.

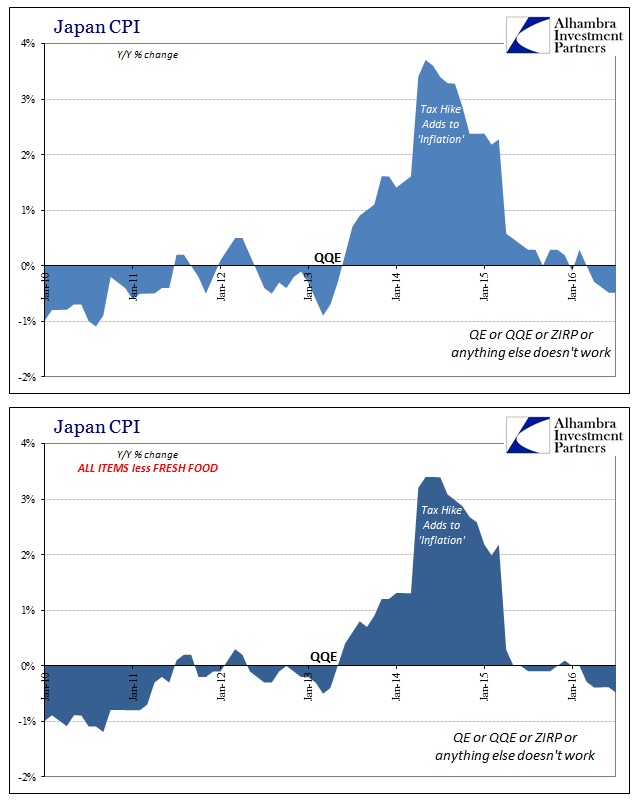

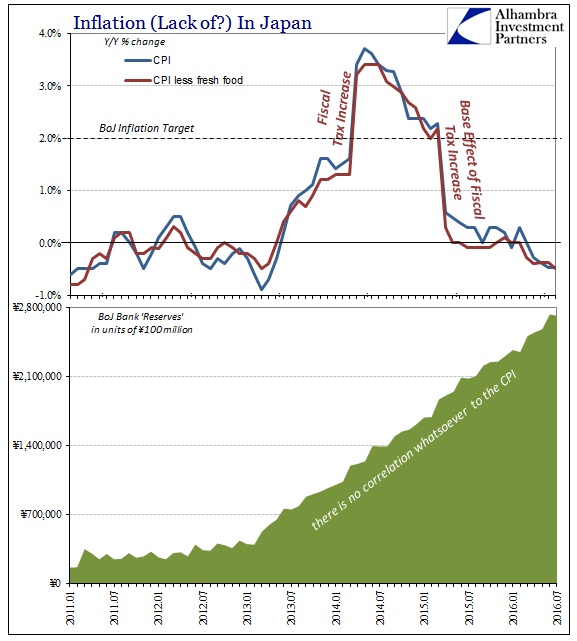

As of Bank of Japan’s end of period balance for July, the combination of QQE and whatever odds and ends of minor “extraordinary” policies implemented along the way leaves the Japanese banking system with ¥271.37 trillion in bank reserves. That is an increase of ¥218.76 trillion (418%) since the start of QQE. The CPI in July was recently updated to show a second straight month of -0.48% “inflation.” Excluding fresh food, the CPI fell to the same -0.48%, joining the total index in proving yet again there is no money in monetary policy.

It is, in fact, proof and it doesn’t need any regression to fulfill the requirement (though you can easily use one, as I have done in the past, if you, like an economist, actually need the math to arrive at such an obvious conclusion).