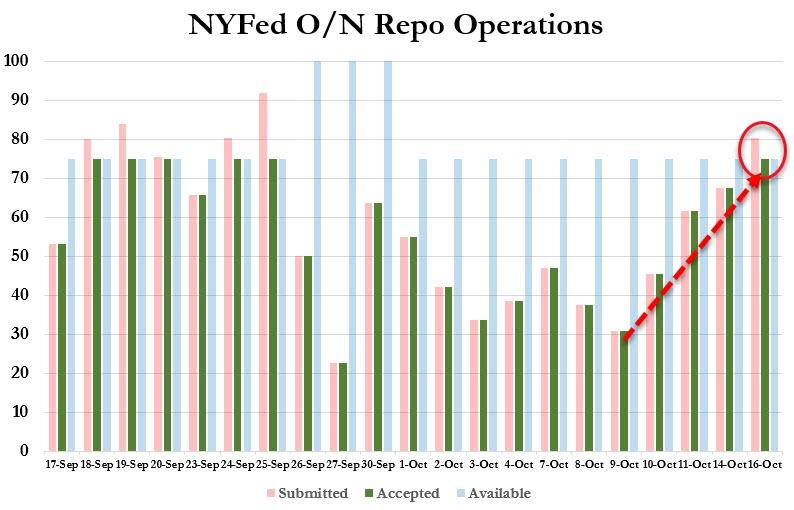

Alas, as of this morning when the Fed’s latest repo operation was once again oversubscribed, it appears that the repo turmoil is not only not going away, but is in fact (to paraphrase Joe Biden) getting worse, because even with both term and overnight repos in play and with the market now expecting the Fed to start injecting copious liquidity tomorrow with the first Bill POMO, banks are still cash starved. To wit: in its latest overnight operation, the Fed indicated that $80.35BN in collateral ($74.7BN in TSYs, $5.65BN in MBS) had been submitted into an operation that maxed out at $75BN, with a weighted average rate on both TSY and MBS rising to 1.823% and 1.828% respectively.