By Tyler Durden at ZeroHedge

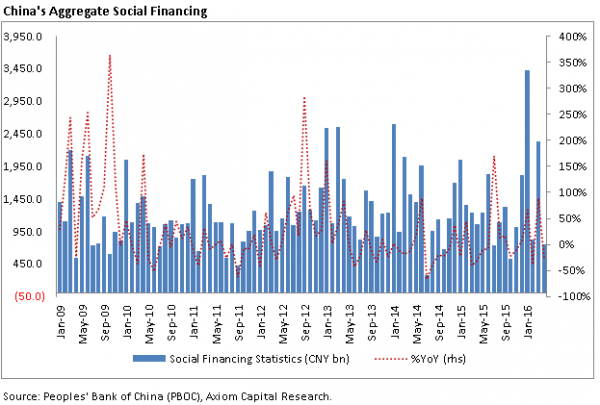

Just over a week ago, we pointed out that China’s great credit growth stimulus from early 2016, when the PBOC injected $1 trillion in new credit in the first quarter of the year, had come to a screeching halt in April, confirmed by the lack of growth in China’s broadest credit aggregate, Total Social Financing, which had just dipped to a negative growth print year-over-year.

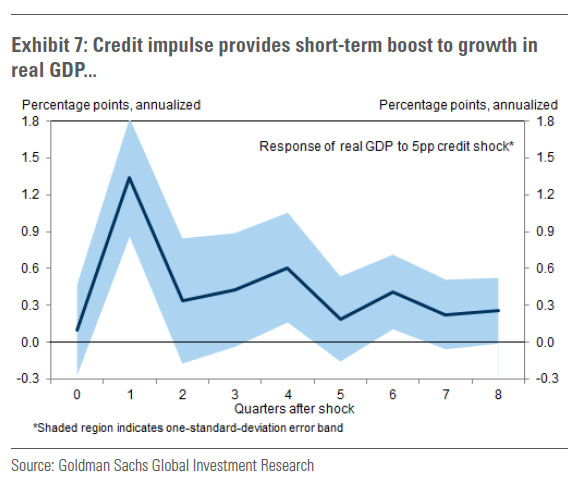

While there were various important implications from this substantial Chinese slowdown, we concluded that the biggest concern for China, and the world, is that “now that China’s credit impulse is gone, it means that the it is only a matter of time before the impetus behind Chinese, and global growth, evaporates as per the timeline presented in the following Goldman chart, which explained the surge in Q1 economic activity, and which now anticipates a steep slowdown in the second and subsequent quarters unless China manages to stoke its unsustainable credit growth once again.”

To be sure, the CNY64 trillion question is how long before the market prices in this imminent slowdown.

According to a just released very bearish note by Morgan Stanley’s chief cross-asset strategist Andrew Sheets, which picks up on the risk factors unleashed by China’s dramatic slowdown the recent pick-up in global growth is temporary, and flags “greater risks that the slowdown arrives even sooner than August.” But most importantly, when looking at when the market will price in the next Chinese slowdown, Sheets says that “our China economic activity indicator (MS-CHEX) is at 3% versus 10% last month, while property sales in top cities have slowed to 15%Y in the first two weeks of May compared to 55%Y in April. If we think China growth softens again over the summer, the question for markets is how far ahead of this prices react.”

His conclusion: “the risks are rising that the time is now.”

* * *

Here is Morgan Stanley’s full note on “Timing China’s Mini-Cycle”

It’s remarkable that in this day and age, when we can encode whole genomes and land spacecraft on comets, we struggle to answer basic questions on how big economies are doing. Although I’m going to focus on China, my fellow Americans shouldn’t be smug: The US enjoys some of the best economic statistics in the world and yet the market seems legitimately confused over whether the US economy is ‘weak’, ‘fine’, or actually starting to see a cyclical pick-up.

But in a contest for size and economic question marks, China may hold the crown. The speed and scale of the country’s growth has been remarkable, making China an essential part of the global economic fabric. The country consumes 45% of the world’s copper, produces 50% of the world’s steel, and is responsible for roughly 12% of global trade. Yet this importance is coupled with a level of uncertainty. Most investors that we meet believe China is extremely important to their outlook, and yet express a low degree of confidence in their ability to predict where it is headed next.

This dilemma is particularly relevant today. In response to slowing economic growth, China eased policy aggressively in the early part of last year. Interest rates were lowered. Fiscal spending picked up. Restrictions in the property market were eased. These steps, with a lag, have resulted in a strengthening of economic numbers since 3Q15. The question is how long this strength lasts, and how far ahead of that “turn” markets will react.

While the good news is that policy easing helped to stabilize growth, the bad news is that Chetan Ahya, our Chief Asia Economist, views this pick-up as temporary, and recently flagged greater risks that the slowdown arrives even sooner than August.

- First, China is no longer doing the spending or easing that was in the pipeline six months ago.

- Second, the current pick-up also appears associated with an even larger increase in net borrowing.

With it now taking 6.5 units of debt to produce 1 unit of GDP, additional gains from the lending channel are limited, in our view. China data already suggest diminishing returns from a flagging stimulus. Our China economic activity indicator (MS-CHEX) is at 3% versus 10% last month, while property sales in top cities have slowed to 15%Y in the first two weeks of May compared to 55%Y in April. If we think China growth softens again over the summer, the question for markets is how far ahead of this prices react. The risks are rising that the time is now.

The Fed’s attempt to inject more risk premium into the front end comes at a most vulnerable moment for EM, boosting the dollar and further limiting prospects of a fragile EM recovery. Fed futures price a full hike through December now, but the risk premium out the curve in the 2yr-5yr sector is still low. Yellen’s two speeches on May 27 and June 6 ahead of the June FOMC become critical in shaping that risk premium. A reiteration of the hawkish minutes will likely lead to front-end steepening and push USD higher and the commodity/EM universe onto the back foot. This is why our US rates strategist Matt Hornbach sees 2s5s steepeners as a good risk hedge.

Against this backdrop it is no surprise that across our research team, we are pessimistic about assets tied to the commodity/EM complex. Our EM & Asia equity strategist, Jonathan Garner, believes that investors should fade the rebound in EM and ‘Old China’ equities. Our EM fixed income strategy team has just gone underweight local rates and sovereign credit, in addition to already being bearish on EMFX. In commodities, our metals team is cautious about prices for 2H (which would also fit standard seasonal patterns) while our energy team believes that fundamentals remain much weaker than oil prices currently suggest. Our European equity strategist, Graham Secker, has turned to the safety of defensives, moving overweight last week. And for US equities, my colleague Adam Parker is increasingly convinced that the rally in low-quality names may be coming to an end, a dynamic that would help our preference for US financials over energy.

Finally, historical seasonal patterns suggest that May-November features a wider range of returns, with a more negative skew and higher vol of vol for many assets. That is yet another reason, if you needed one, to make this a summer you own some volatility into.