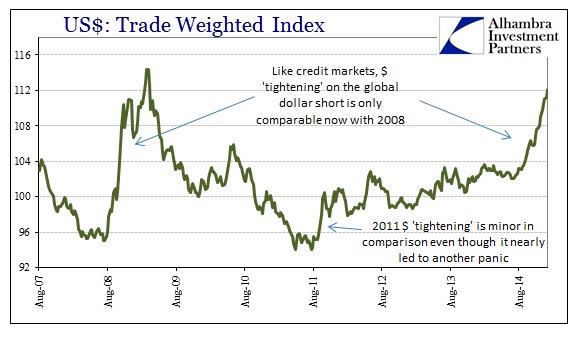

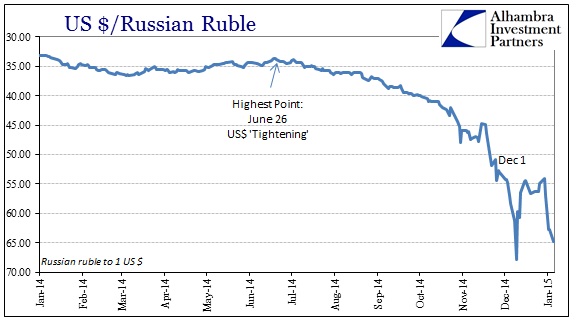

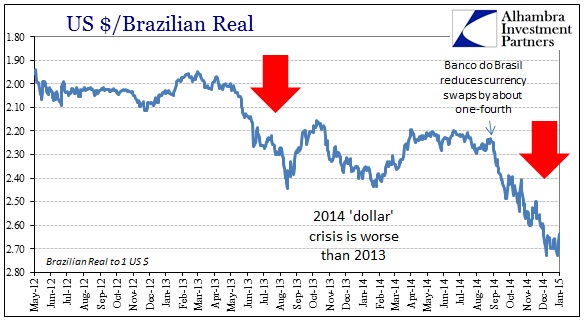

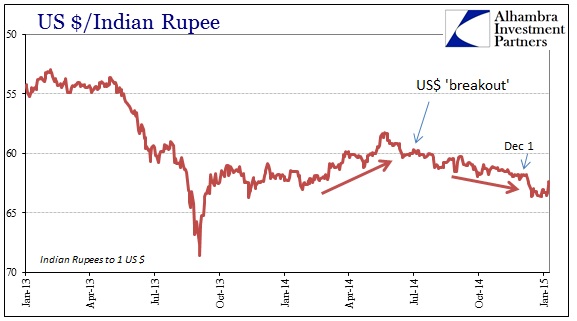

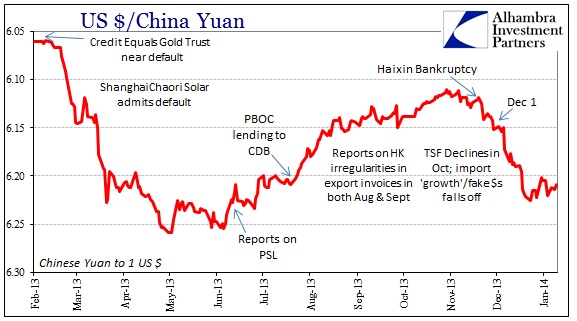

In parallel to US$ credit markets, the “dollar” itself found a new and worsened degree of “tightness” right around December 1. The trend that was already in place, doing so much damage globally prior to about Thanksgiving, took another upward turn at the same time US credit markets may have completely given up on the dominant economic story. In other words, just as US credit may have thrown in the towel on the economy, the global “dollar” position drew much further toward greatly heightened constraint. It doesn’t take any intuitive leap to connect those two.

The most obvious example shortly thereafter was the crash of the Russian ruble, but that was not the only renewed breakout of funding problems.

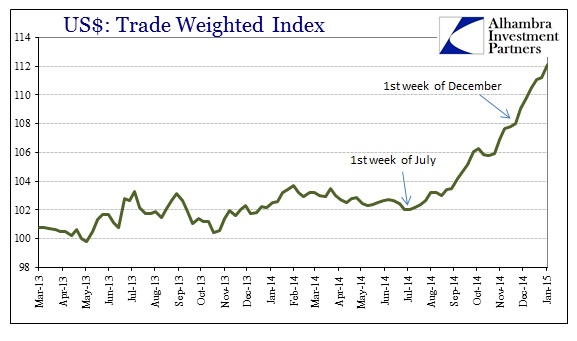

The movement since the end of June/first week in July is now matched only by the period right before the 2008 crash. In other words, this is the most significant “dollar” problem we have seen during this part of the “cycle”, far and beyond even the 2011 version which nearly saw a rerun of Lehman Brothers that December.

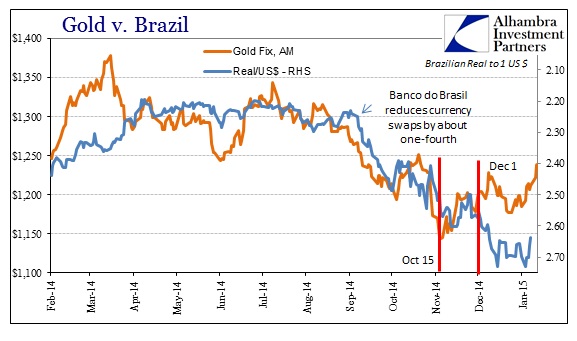

Like the flattening yield curve from around December 1 onward, foreign currencies almost everywhere have been entrapped by the same pessimism. If I am right about the implications being almost exclusively economic rather than financial responsibility for this “tightening”, that would again and further cement the globalized economy as indistinguishable from individual pieces – the US cannot escape of its own and is, in fact, a good part of the problem.

As if to emphasize this trend further, the action in gold seems to indicate a much stronger bid for “safety” starting right in December, especially in comparison to gold trading in correlation with the “dollar” before then (gold as interbank collateral).

Again, if I am correct about the ordering of factors after December 1, this would indicate not financial leading economic, but rather the other way around. That is in many ways a much more dangerous and explosive arrangement particularly given the current degree of central bank involvement. Something changed in late November/December 1 which shifted the risk perceptions of credit and, more importantly, funding globally. From what we see of January so far, that hasn’t been at all alleviated even if the immediacy has withdrawn so far this year.