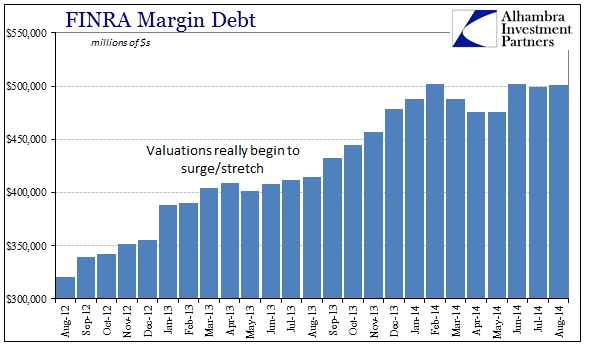

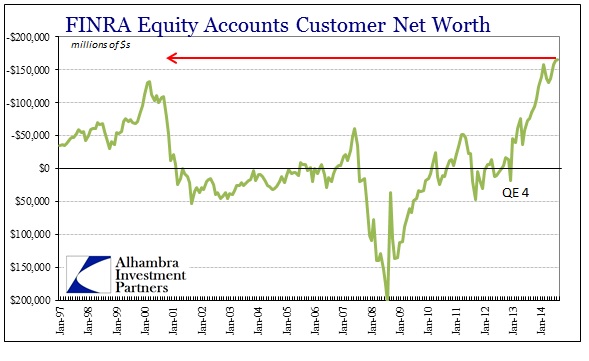

Continuing on with the valuation theme, there are a couple of additional “market” indicators that are also at or above dot-com levels. While not strictly a valuation technique, the level of margin debt and really customer net worth gives us an insight into one aspect of multiple expansion. Margin debt for FINRA accounts (which includes both NYSE and what used to be NASD members) has been somewhat flat since earlier in 2014.

However, the balance of net worth has proceded further negative, doing so at a pace that far exceeds anything ever seen before.

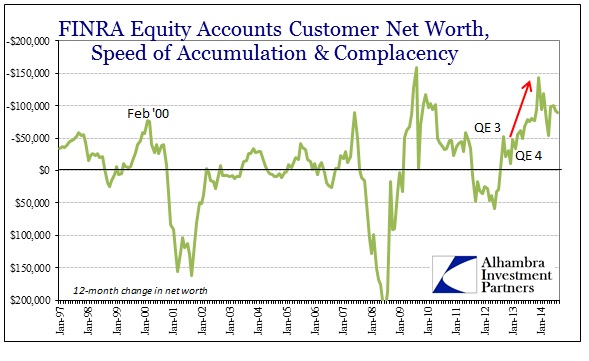

There is a clear imprint of QE, especially QE4, on the changes in equity account behavior. I don’t believe that QE has any direct effect on stocks or stock prices at all, instead in this instance being simply a psychological projection (which is what the Fed intended). Since there is far less resistance to such methodology here, it makes sense that the greatest impact might be felt in equities than rather anything in the real economy.

As I said yesterday, the psychological comfort provided by QE is something along the lines of “next year.” Apparently the third and fourth incidences of monetary manipulation significantly increased the plausibility of that formulation for many. In other words, despite the continued failure of recovery and the return of growth, and in fact the occurrence of a clear slowdown (below), these additional policy measures were enough for stock investors (at least as represented by complacency here) to set aside doubts of the here and now to embrace instead what might be as assumed to be effective at some point.

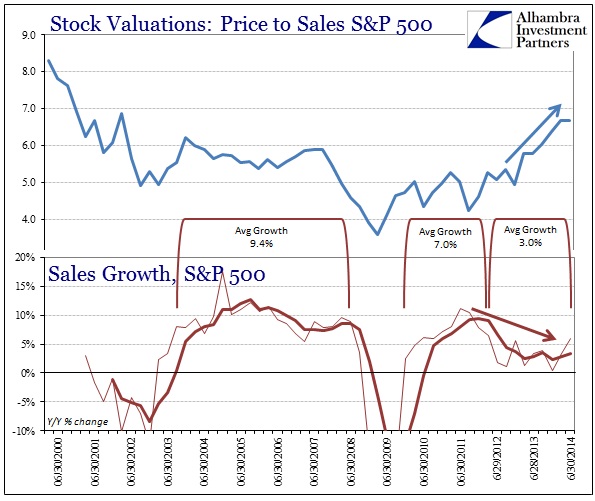

That brings into the examination another measure of market imbalance, namely stock prices to sales levels. The market, here represented by the S&P 500, has moved into an extreme not seen since the downside of the dot-com bubble. The ratio had been relatively flat at a level actually below the up-cycle during the housing bubble until, conspicuously, the end of 2012.

As mentioned above, that presented a sort of conflict along the lines I have described. As prices moved significantly higher, due in some part to the stock margin levels as suggested by exactly concurrent timing, the economy entered a slowdown. That recommends this idea of “next year” as the primary catalyst as it certainly could not have been based on contemporary conditions that still continue to be very disappointing and far below what would constitute an actual upswing.

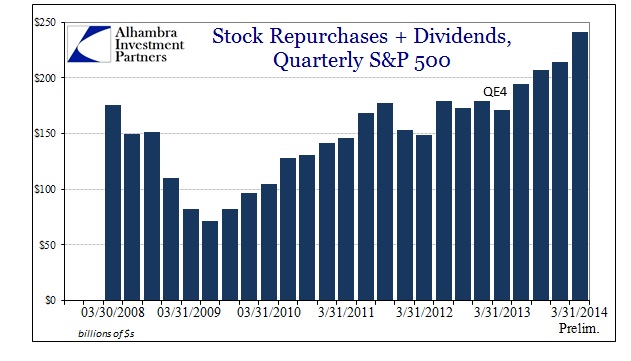

As we know very well, however, the effect of QE psychology was not limited to stock accounts in the course of asset inflation via proxy. Debt levels have exploded, especially for lower quality businesses. In the context of stock prices, that has meant this balance sheet shifting of equity for debt – borrowing “cheaply” (it’s all “free money” according to Krugman) to repurchase shares and pay dividends.

That meant that companies were executing a strategy also contrary to current conditions, though I also doubt they cared (and care) much about the “next year” economic assumptions as stock investors do. Instead, the repurchase trend, especially after QE4, is undoubtedly focused solely on current prices.

Again, more color and context to gauge the risk environment that is replete with massive imbalances, incongruities and some very big inconsistencies. The biggest is the contradiction shown here, since the decline in revenue only further pressures margins, as company executives are then forced to over-manage costs to maintain EPS growth while further dwindling cash and internal resources on buybacks (which explode with higher prices, not at lower prices as the “textbooks” proclaim of repurchases as a “value” maneuver). That makes the “next year” assumption that much less plausible, since companies now act as a system of repressing natural and organic growth instincts in favor of this asset inflation garbage.

What a wonderful modern monetary age; full of stagnation mystery indeed.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com