When speaking about the costs of having undertaken numerous QE’s in the US, there is not only the economic inefficiency and asset price psychology to account in the tapering and ultimately exit (hopefully a permanent one this time, though I increasingly doubt it). There is little doubt that repo market problems, that have become far too persistent to be comfortable, are added to that list, if not very close to the top of it. But for that analysis to be correct, we have to; 1. establish that there is a problem; 2. that QE was causative; and 3. that the implications are not neutral.

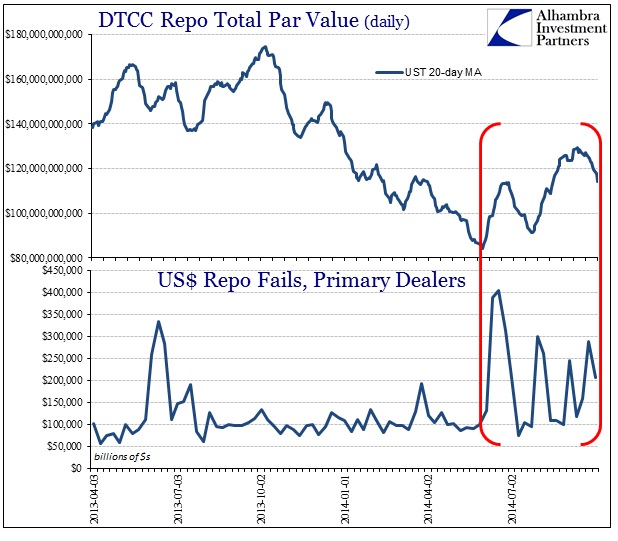

The first part is by far the easiest, given that since June there has been a rolling surge in repo fails that is pretty much seems a regular feature now. Further, it is even more obvious that there is a relationship between this problem of fails and the volume in the repo markets – even though in general volume in the past few months is far below even last year.

For “some” reason, repo markets don’t seem to be able to handle the minor increase in volume off what was a multi-year low point. In terms of monetary policy and the determination toward gaining some kind of control now that the federal funds rate, the traditional monetary trigger and target, is all but irrelevant, that means almost four full months of repo rates sticking in the negative. The surge in fails suggest just how negative effective repo rates were in far too many instances, betraying everything about monetary control right down to the inept and unfortunately inert reverse repo program.

Having established that there is at least a repo-specific problem of function, the connection to QE is nearly as obvious. First, intuitively speaking, the fact that the Open Market Desk “buys” UST’s and MBS’s out from the “open” market (a misnomer if there ever was one given that only the primary dealers are involved in this close relationship). By definition, then, FRBNY removes collateral from the stream. That included, up until March 2013, draining a significant portion of on-the-runs directly and, up until Operation Twist, t-bills.

While that doesn’t necessarily lead directly to the fails problem as I have described it, the reality is that the connection is quite easy to see in practice:

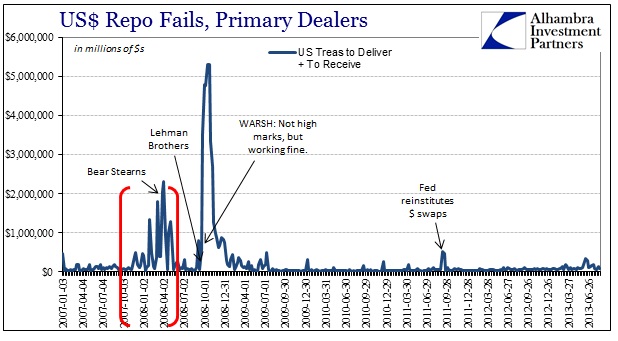

There is a clear and distinct upward bias in the rate of fails tracing back to sometime during the QE2 operation. Now, it is entirely possible that that initial rise was due to dollar disruption resulting from the euro crisis and the third great breakdown in eurodollar flow (the first starting in August 2007; the second at Lehman), but my sense tells me that the baseline was QE-related and that the sharp and discrete episodes of volatile spikes in dysfunction were that. Further in time, however, there can be little argument that repo function, as presented by fails, started to not only rise at the baseline but incur more frequent disruptions almost immediately after QE4’s inauguration.

That leads to the final point, the implications of fails. At first glance, especially lately, there doesn’t seem to be much to be made of all this. Everything appears fine and orderly in the most prominent asset “markets” despite what looks like to be a persistent liquidity problem. However, repo fails of this type are usually consistent with wider disruption, particularly in wholesale dollar systems. The most obvious was late 2007 and early 2008, presaging the entire Bear Stearns saga (that was more than just Bear).

As is clear in chart above, however, the level of disruption then was an order of magnitude larger. But that is not the main point I am trying to make – bigger financial problems then would certainly be expected to show bigger repo disruption. Rather, it is not the size of the fails, particularly now under a 3% fail penalty regime, but the persistence. The period in 2007 prior to the wholesale disruption is like a flatline that suddenly comes to life; almost like a seismograph picking up a sudden geological disturbance. That pattern is evident in late 2007/early 2008, and is also apparent in 2014.

While I don’t believe that means there is another meltdown underway, unappreciated as it may be then and now, rather that there are still negative implications to having systemic liquidity disruption. Again, the link to the dollar:

This period of persisting repo duress coincides with a single-minded “rise” in the dollar, the sharpest and most unrelenting going back years, which has already been very disruptive to “markets” overly dependent on such finance. Given the evident linkages between wholesale funding, repo, and dollar conditions globally as it relates to rolling forward easily the global dollar short, this “coincidence” is not surprising.

That would tend to suggest more worrisome inferences if allowed to continue on, as it unfortunately was in 2008, for longer. That being said, there are a number of reasons to believe that this prolonged tapering (which “had” to be that way given that the Fed fully believes in gradualism, especially from heavy “emergency” programs) has caused maybe permanent damage to systemic liquidity capacity – a topic that has also been in mind of late.

The continued negativity in repo “markets” tends to corroborate that assessment, particularly as QE is very nearly done in its third and fourth applications. Hopefully this will have bearing if and when (inevitably?) the FOMC begins discussing the fifth.